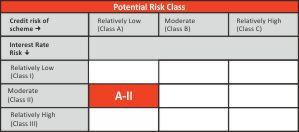

| CATEGORY OF SCHEME | Ultra Short Duration |

| INVESTMENT OBJECTIVE | The investment objective of the Scheme is to generate regular income and capital appreciation through investment in a portfolio of short term debt & money market instruments such that the Macaulay duration of the portfolio is between 3 - 6 months. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved. |

| Inception Date (Date of Allotment): | 05-May-2021 |

| Benchmark: | CRISIL Ultra Short Duration Debt A-I Index |

| Minimum Application Amount: | Rs.5,000/- and in multiples of Rs. 1/- thereafter |

| Load Structure: | Entry Load: Nil Exit Load: Nil |

| Total Expense Ratio (TER): | Including Additional Expenses and Goods and Service

Tax on Management Fees |

| Fund Manager | Mr. Vikrant Mehta (Since 05-May-2021) Total Experience: 28 years |

| AUM (in Rs. Cr): | 132.75 |

| AAUM (in Rs. Cr): | 125.21 |

| Average Maturity: | 141 Days |

| Macaulay Duration: | 137 Days |

| Modified Duration: | 130 Days |

| Yield to Maturity: | 6.86% |

Regular Plan

(in Rs.) |

Direct Plan

(in Rs.) |

|

| Growth | 1,083.0851 |

1,102.3424 |

| Daily IDCW | 1,001.0000 |

1,001.0000 |

| Weekly IDCW | 1,001.1212 |

1,001.1420 |

| Fortnightly IDCW | 1,001.7444 |

1,001.8617 |

| Monthly IDCW | 1,001.7436 |

1,001.8616 |

| Annual IDCW | 1,083.1033 |

1,103.2202 |

| Name of Instrument | Ratings |

Market Value (Rs. Lakhs) |

% to NAV |

| Debt Instrument | |||

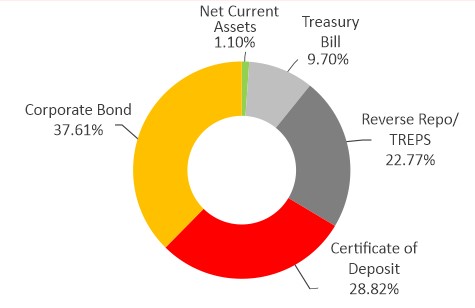

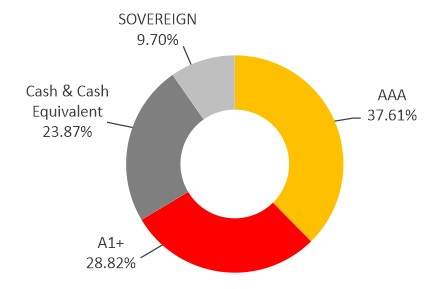

| Certificate of Deposit | |||

| Axis Bank Limited | CRISIL A1+ |

1380.70 |

10.40 |

| Canara Bank | CRISIL A1+ |

1247.50 |

9.40 |

| Bank of Baroda | FITCH A1+ |

1197.38 |

9.02 |

| Corporate Bond | |||

| Hindustan Petroleum Corporation Limited | CRISIL AAA |

1138.27 |

8.57 |

| Bharat Petroleum Corporation Limited | CRISIL AAA |

1104.96 |

8.32 |

| National Bank For Agriculture and Rural Development | ICRA AAA |

1034.51 |

7.79 |

| REC Limited | CRISIL AAA |

714.85 |

5.39 |

| Power Grid Corporation of India Limited | CRISIL AAA |

600.74 |

4.53 |

| Small Industries Dev Bank of India | CRISIL AAA |

250.08 |

1.88 |

| National Housing Bank | CRISIL AAA |

149.40 |

1.13 |

| Treasury Bill | |||

| 91 Days Tbill (MD 20/07/2023) | SOVEREIGN |

792.90 |

5.97 |

| 91 Days Tbill (MD 03/08/2023) | SOVEREIGN |

494.27 |

3.72 |

| Reverse Repo/TREPS | |||

| Clearing Corporation of India Ltd | NA |

3023.00 |

22.77 |

| Net Current Assets | NA |

146.18 |

1.10 |

| Total Net Assets | 100.00 |

Value of Investment of 10,000 |

||||||

| Period | Fund Returns (%) |

Benchmark Returns (%) |

Additional Benchmark Returns (%) |

Fund () |

Benchmark () |

Additional Benchmark () |

Regular - Growth |

||||||

Last 1 Year |

5.45% |

6.69% |

6.26% |

10,545 |

10,669 |

10,626 |

Since Inception |

3.93% |

5.12% |

4.47% |

10,831 |

11,090 |

10,948 |

Direct - Growth |

||||||

Last 1 Year |

6.35% |

6.69% |

6.26% |

10,635 |

10,669 |

10,626 |

Since Inception |

4.82% |

5.12% |

4.47% |

11,023 |

11,090 |

10,948 |

Past performance may or may not be sustained in future. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: CRISIL Ultra Short Duration Debt A-I Index Additional Benchmark: CRISIL 1 Year T-Bill Index. Fund Manager: Mr. Vikrant Mehta is managing the scheme since its inception 5th May 2021. Returns less than 1 year period are simple annualized and greater than 1 year are compounded annualized. Inception date of the scheme (05-May-2021). Face Value per unit: Rs. 1000

Record Date |

Plan(s) Option(s) |

Individuals/ HUF (IDCW) (Rs per unit) |

Others (IDCW) (Rs per unit) |

Cum-IDCW NAV (Rs per unit) |

27-Mar-23 |

Regular Plan - Monthly IDCW Option | 4.9592 |

4.9592 |

1005.9592 |

27-Mar-23 |

Direct Plan - Monthly IDCW Option | 5.5920 |

5.5920 |

1006.592 |

25-Apr-23 |

Regular Plan - Monthly IDCW Option | 6.4635 |

6.4635 |

1007.4635 |

25-Apr-23 |

Direct Plan - Monthly IDCW Option | 7.1365 |

7.1365 |

1008.1365 |

25-May-23 |

Regular Plan - Monthly IDCW Option | 5.1036 |

5.1036 |

1006.1036 |

25-May-23 |

Direct Plan - Monthly IDCW Option | 5.8011 |

5.8011 |

1006.8011 |

Pursuant to payment of IDCW, the NAV of the IDCW Option(s) of the Scheme/Plan(s) falls to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. For complete list of IDCW, visit www.itiamc.com.

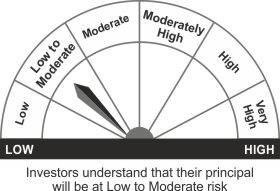

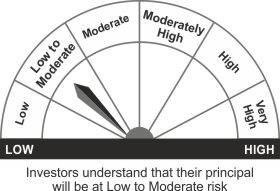

THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

- Regular income over short term

- Investments in debt and money market instruments, such that the Macaulay duration of the portfolio is between 3 months - 6 months.

^Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Face Value per Unit: Rs. 1000 unless otherwise specified Data is as of May 31, 2023 unless otherwise specified.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully