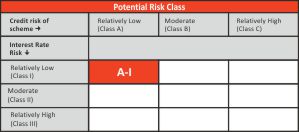

| CATEGORY OF SCHEME | Liquid Fund |

| INVESTMENT OBJECTIVE | The investment objective of the Scheme is to provide reasonable returns, commensurate with low risk while providing a high level of liquidity, through a portfolio of money market and debt securities. However, there can be no assurance that the investment objective of the scheme will be realised. |

| Inception Date (Date of Allotment): | 24-Apr-19 |

| Benchmark: | CRISIL Liquid Debt A-I Index |

| Minimum Application Amount: | Rs.5,000/- and in multiples of Rs. 1/- thereafter |

| Load Structure: | Entry Load: Nil Exit Load: Investor exit upon |

| subscription Up to Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Day 7 onwards |

Exit Load % 0.0070% 0.0065% 0.0060% 0.0055% 0.0050% 0.0045% 0.0000% |

| Total Expense Ratio (TER): | Including Additional Expenses and Goods and Service

Tax on Management Fees |

| Fund Manager | Mr. Vikrant Mehta (Since 18-Jan-21) Total Experience: 28 years |

| AUM (in Rs. Cr): | 50.90 |

| AAUM (in Rs. Cr): | 48.08 |

| Average Maturity: | 38 Days |

| Macaulay Duration: | 38 Days |

| Modified Duration: | 38 Days |

| Yield to Maturity: | 6.62% |

Regular Plan

(in Rs.) |

Direct Plan

(in Rs.) |

|

Growth |

1,184.2822 |

1,190.4192 |

Daily IDCW |

1,001.0000 |

1,001.0000 |

Weekly IDCW |

1,001.1750 |

1,001.1800 |

Fortnightly IDCW |

1,001.8601 |

NA |

Monthly IDCW |

1,001.8603 |

1,001.8818 |

Annual IDCW |

1,187.5758 |

1,191.3234 |

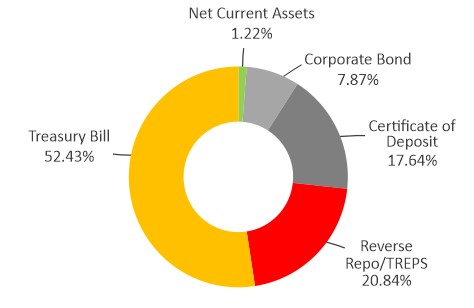

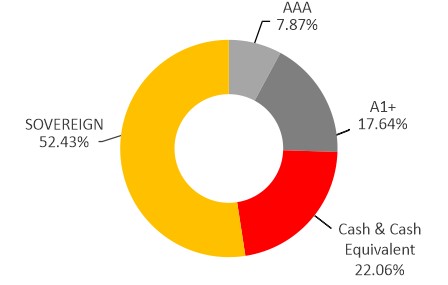

| Name of Instrument | Ratings |

Market Value (Rs. Lakhs) |

% to NAV |

| Debt Instrument | |||

| Certificate of Deposit | |||

| Canara Bank | CRISIL A1+ |

449.10 |

8.82 |

| Bank of Baroda | FITCH A1+ |

449.02 |

8.82 |

| Corporate Bond | |||

| Power Grid Corporation of India Limited | CRISIL AAA |

400.49 |

7.87 |

| Treasury Bill | |||

| 91 Days Tbill (MD 03/08/2023) | SOVEREIGN |

1977.09 |

38.84 |

| 91 Days Tbill (MD 10/08/2023) | SOVEREIGN |

493.64 |

9.70 |

| 91 Days Tbill (MD 20/07/2023) | SOVEREIGN |

198.23 |

3.89 |

| Reverse Repo/TREPS | |||

| Clearing Corporation of India Ltd | NA |

1061.00 |

20.84 |

| Net Current Assets | NA |

61.87 |

1.22 |

| Total Net Assets | 100.00 |

Value of Investment of 10,000 |

||||||

| Period | Fund Returns (%) |

Benchmark Returns (%) |

Additional Benchmark Returns (%) |

Fund () |

Benchmark () |

Additional Benchmark () |

Regular - Growth |

||||||

Last 7 days |

6.34% |

6.53% |

5.90% |

10,012 |

10,013 |

10,011 |

Last 15 days |

6.60% |

6.97% |

8.70% |

10,027 |

10,029 |

10,036 |

Last 30 days |

6.65% |

7.04% |

7.39% |

10,055 |

10,058 |

10,061 |

Last 1 Year |

5.90% |

6.35% |

6.26% |

10,590 |

10,635 |

10,626 |

Last 3 Year |

4.00% |

4.47% |

4.20% |

11,250 |

11,403 |

11,313 |

Since Inception |

4.21% |

4.85% |

5.22% |

11,843 |

12,147 |

12,324 |

Direct - Growth |

||||||

Last 7 days |

6.50% |

6.53% |

5.90% |

10,012 |

10,013 |

10,011 |

Last 15 days |

6.76% |

6.97% |

8.70% |

10,028 |

10,029 |

10,036 |

Last 30 days |

6.81% |

7.04% |

7.39% |

10,056 |

10,058 |

10,061 |

Last 1 Year |

6.07% |

6.35% |

6.26% |

10,607 |

10,635 |

10,626 |

Last 3 Year |

4.14% |

4.47% |

4.20% |

11,295 |

11,403 |

11,313 |

Since Inception |

4.34% |

4.85% |

5.22% |

11,904 |

12,147 |

12,324 |

Past performance may or may not be sustained in future. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: CRISIL Liquid Debt A-I Index Additional Benchmark: CRISIL 1 Year T-Bill Index. Fund Manager: Mr. Vikrant Mehta from (Managing since January 18, 2021). Returns less than 1 year period are simple annualized and greater than 1 year are compounded annualized. Inception date of the scheme (24-Apr-19). Face Value per unit: Rs. 1000

Record Date |

Plan(s) Option(s) |

Individuals/ HUF (IDCW) (Rs per unit) |

Others (IDCW) (Rs per unit) |

Cum-IDCW NAV (Rs per unit) |

27-Mar-23 |

Regular Plan - Monthly IDCW Option |

4.7823 |

4.7823 |

1005.7823 |

27-Mar-23 |

Direct Plan - Monthly IDCW Option |

4.8958 |

4.8958 |

1005.8958 |

25-Apr-23 |

Regular Plan - Monthly IDCW Option |

5.2846 |

5.2846 |

1006.2846 |

25-Apr-23 |

Direct Plan - Monthly IDCW Option |

5.4159 |

5.4159 |

1006.4159 |

25-May-23 |

Regular Plan - Monthly IDCW Option |

5.5181 |

5.5181 |

1006.5181 |

25-May-23 |

Direct Plan - Monthly IDCW Option |

5.6355 |

5.6355 |

1006.6355 |

Pursuant to payment of IDCW, the NAV of the IDCW Option(s) of the Scheme/Plan(s) falls to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. For complete list of IDCW, visit www.itiamc.com.

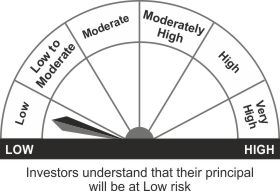

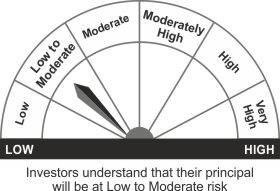

THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

- Regular income over short term.

- Investment in money market and debt instruments.

^Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Face Value per Unit: Rs. 1000 unless otherwise specified; CD - Certificate of Deposit; CP - Commercial Papers;

Data is as of May 31, 2023 unless otherwise specified.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully