Equity Market Update

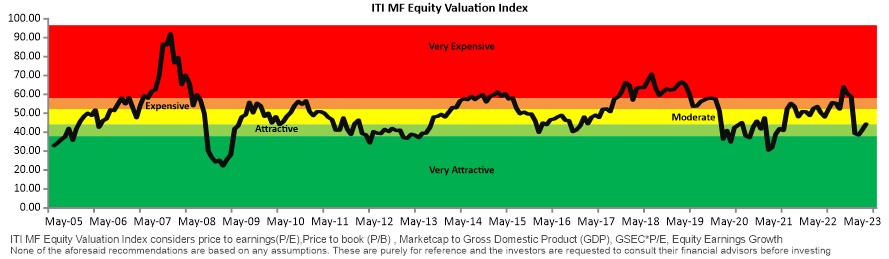

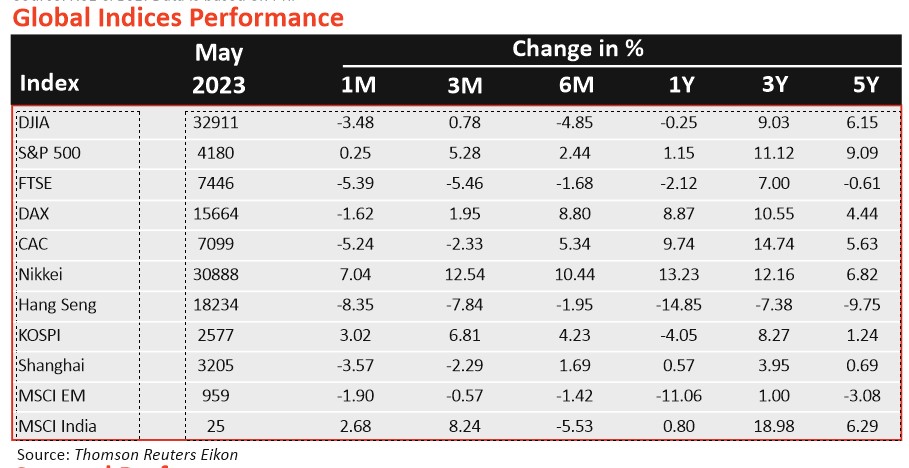

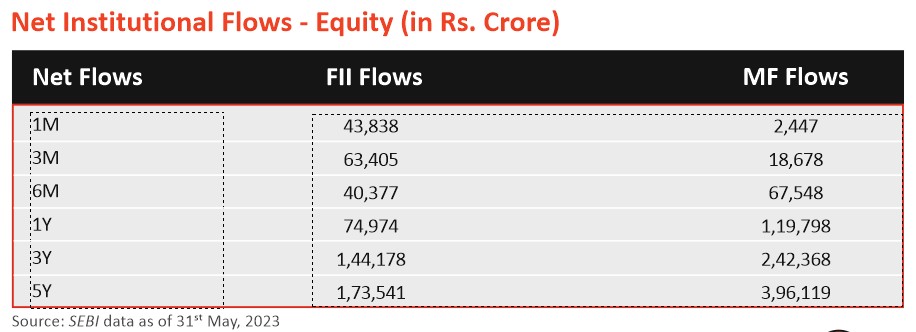

- Markets sustained the rally in May 2023 on the back of strong FII buying (Rs 43,838 crores) even as DIIs turned (net) sellers to the tune of Rs 3,306 crores. While there was no formidable rallying point, lower-than-expected inflation, a pause on rate hikes, absorption of full year’s earnings and encouraging performance of certain sectors, continue to showcase India as a bright spot in emerging markets.

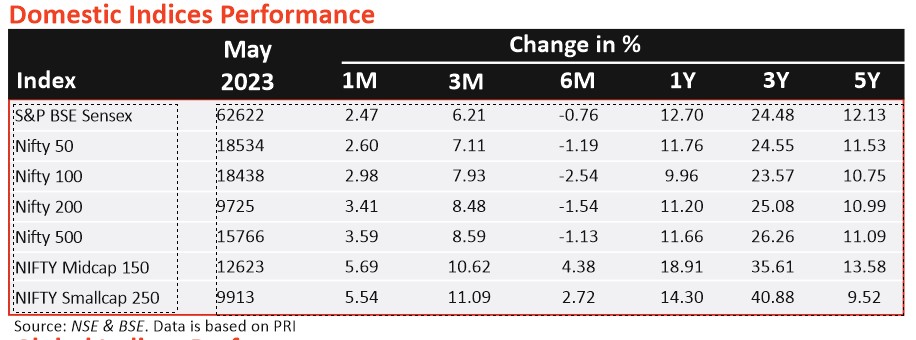

- The frontline indices, S&P BSE Sensex and Nifty 50 closed higher by 2.47% and 2.60% respectively, while S&P BSE Mid-Cap and S&P BSE Small-Cap surged 6.31% and 5.56% respectively.

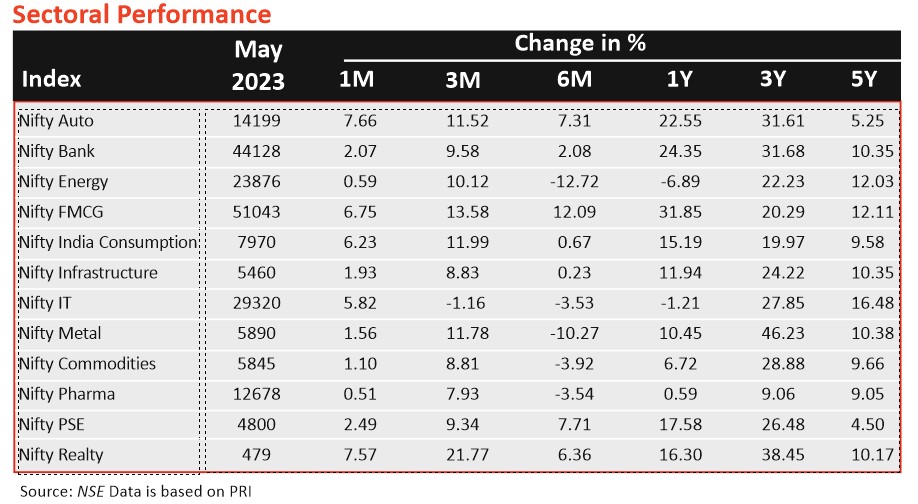

- On the BSE sectorial front, S&P BSE Auto ( 7.94%), S&P BSE Realty ( 7.67%) and S&P BSE CD ( 6.47%) were the top gainers. S&P BSE Metal ( 2.94%) and S&P BSE Oil & Gas ( 1.64%), S&P BSE Utilities ( 0.59%) were the biggest losers.