Dear Investors & Partners,

The domestic market continued its uptrend for the third consecutive month. The Nifty gained 2.6% MoM to

18,534 in May'23. The Nifty is up 2.4% in CY23YTD. The benchmark is now 1.9% away from its all-time high of 18,888 recorded in Dec'22. The Nifty Midcap 100 (+6.2% MoM) and the Nifty Smallcap 100 (+5.1%) outperformed the Nifty-50 during the month. All major sectors end higher in May'23: Automobiles (+8%), Real Estate (+8%), Consumer (+7%), Technology (+6%), and Telecom (+4%) were the top gainers, while PSU Banks (-3%) was the only laggard. Over the last 12 months, the MSCI India index (+7%) has outperformed the MSCI EM index (-11%). Over the last 10 years, it has outperformed the MSCI EM index by 173%.

The month of May witnessed an interesting mix of news for participants at the stock markets across the globe with the U.S. agreeing on an in-principle deal to increase its debt ceiling, Germany slipping into recession, high volatility seen in gold and crude oil prices, while positive data emerging in India with the Indian industrial output (IIP) higher on a monthly basis and sudden spikes in inflation well-curtailed.

FIIs remained net buyers for the third straight month at USD5b in May'23 (highest since Sep'22); YTD inflows stood at USD4.4b. DIIs turned net seller in May'23 at USD 0.4b, with YTD inflows at USD10b.

- We remain enthused by India's resilient economic performance despite global headwinds and a volatile macro environment. Several high frequency data points highlight the underlying strength of the Indian economy, lending additional fundamental credence to our optimism.

- Real GDP accelerated to 6.1% YoY growth in Q4FY23, taking growth for FY23 to 7.2% (above the RBI's 7% and IMF's 6.8% estimates).The rebound in Q4 was spurred by a turnaround in net exports, as exports of goods and services grew 11.9% YoY while imports decelerated to 4.9% YoY growth.

- May composite PMI output index remained stable at 61.6, matching the near 13-year high set in April. May services PMI at 61.2, cooling marginally from historic peak of 62 in April to post the second strongest rate in nearly 13 years. Sequential momentum in demand and output remains one of the strongest over the period. May manufacturing PMI improved to 58.7 (vs. 57.2 in April), as remarkable demand conditions brought in both domestic and export orders. Factory orders increased at the fastest pace since January 2021, which caused firms to scale up output proportionally.

- Key high frequency indicators show favourable improvement: Revenue spending (6% YoY), Auto sales (19% YoY), Personal Credit (19% YoY), Cement production (12% YoY)

- Earnings season strong: Amid a challenging global macro backdrop, India Inc.'s profitability remained healthy in 4QFY23 – in line with our expectations. We witnessed one of the highest earnings growth in the last four quarters. Corporate earnings were driven by Financials and Auto, while Metals dragged aggregate profitability. Eventhough earnings growth was strong, it was lopsided. Within the Nifty, five companies (SBI, Tata Motors, BPCL, Reliance Industries, and Axis Bank) contributed 96% of the incremental YoY accretion in earnings. Nifty exits FY23 with 11% EPS growth.

- State capex can be a driver: FY24 state capex is likely to grow at ~22% YoY. An analysis of 19 states (comprising ~92% of state GDP) budget announced so far are indications that state fiscal deficit is likely to consolidate from 3.5% to 3.1% of GDP and there is likely to be 21.5% YoY growth in capital expenditure driven by Gujarat, AP & WB.

- Normal monsoon likely despite El Nino effect: IMD's Director has commented that El-Nino risks are moderate following the forecast of 'normal' range rainfall for the upcoming monsoon. On the positive side, reservoir levels are supportive for the next season if there were some deficiency in rainfall; reservoir levels are at 36% above LPA (long period average) of ~30%. Wheat procurement this year is ongoing at a robust pace with 65% of 341 LMT (Lakh metric tonne) already achieved. The current procurement of 223 LMT is already much above last year's total procurement at 188 LMT (which was severely impacted due to unseasonal rains). Other than oilseeds which is declining, other commodities are stable or rising.

- Domestic macros remain favourable: Domestic macros are favoring rural revival, barring rising risk of unseasonal rains and El Nino, the latter has historically resulted in deficient rains and lower agriculture income. Rural recovery is likely in near to medium term given a) Improvement in farm income due to rise in food grain production on a high base and higher price growth (namely wheat and rice), though the recent heat wave in the North may impact yields of wheat crop; b) Higher agriculture exports; c) Uptick in rural wages; d) Accelerated government capital spending; e) Pick-up in remittance as Covid-19 related disruptions are behind us; f) Easing inflationary pressures; g) Receding rural stress as is evident from declining MGNREGA employment; h) Resilient tractor demand

For CY23, we maintain our view that India's long-term growth story is intact. India's economy should continue to exhibit strength relative to other emerging markets, based on many macro indicators including strong Govt revenue collections, low corporate and bank leverage, and stable external position. This should somewhat insulate India from a global slowdown that sharp interest rate increases in western economies will cause.

Several factors will continue to drive India's outperformance, most of them fundamental in nature:

- External position is strong. Comfortable FX reserves (~$560bn), low external debt (around 20% of GDP and lowest amongst major economies), improving flows from remittances (World Bank estimate of 12% growth to $100bn in CY22) and abating FII selling (FII net buyers to the tune of $11bn in past four months after selling >$40bn in 9m from Oct'21) should provide support to the rupee.

- While the US and EU combat inflation, India has not suffered as severely; policy rates are up by much less than in the West.

- PMI both Services and Mfg. above 55 for many months.

- Tax collections above 15% for Centre and 25% for states.

- Corporate leverage down by 10ppt in last eight years to 31% of GDP).

- Capex momentum is picking up and the policy environment is supportive. However, a full-blown capex recovery is likely only in 2024.

- Overall policy environment is supportive with focus on structural economic reforms like financial inclusion, DBT, Make-in-India, GST, RERA, Bankruptcy court beginning to yield results.

- Banks are in in better health after getting past NPA and NBFC crisis of 2015-2018 period. NPAs have come off from the peak of 11.2% in FY18 to ~4.2% in FY23. Even after recent concerns raised over the debt exposure to a large corporate group highlighted by a set of investors, disclosures indicated that bank loans to the group have been largely stable over FY2019-22, and well below their prescribed exposure limits. This once again reinstates the view that banking sector health is much better as compared to in the past and there appears to be less probability of a large risk to asset quality of banks, which have seen consistent improvement in recent years.

- India's CAD will likely expand over 3.5% of GDP due to high commodity prices, but if crude stays near current levels of US$85/bbl, CAD can dip below 3%, and the rupee can stay stable.

How are we positioned in our funds?

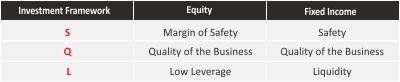

With macro situation being very dynamic and volatilities across asset classes increasing, we continue with our strategy of running well diversified portfolios. We are more focused on stock selections within the sector rather than trying to take large overweight / underweight positions among sectors. The focus continues to be on stock selection on a bottom-up basis anchored on our “SQL Investment Framework”

What should be your approach while investing into our Mutual Fund Schemes?

We expect the volatility to continue over the next few months as the market-outlook is likely to remain challenging. Valuations remain slightly above long-term averages. We have observed in the past that whenever crude has corrected due to demand destruction in economic recessions, India's earnings growth and market performance have not remained immune. However, if crude prices correct due to increase in supplies, India will definitely benefit. Coupled with lower prices of other commodities too, and with operating leverage, earnings would rise for corporates and rupee denominated trade could lead to a strong performance by the Indian economy.

Investors willing to invest in lumpsum can invest in ITI Balanced Advantage Fund. More conservative investors can invest in ITI Conservative Hybrid Fund, which has the potential to give better returns than traditional savings products and with much lower volatility than that of equity or aggressive hybrid funds. Investment in equity funds, particularly mid and small cap categories, should be done systematically over the next three to four months in the form of daily / weekly STPs or SIPs.

Our Investment Framework – SQL

Based on our combined investment learnings of more than 50 years, we have institutionalized very strong investment Framework -SQL, which is core to our fund management framework and approach to our portfolios. We strongly believe that good quality (Q), low leverage companies (L) bought with a reasonable good margin of safety (S) makes the investment very attractive and rewarding for our investors.

Our Risk Management Framework

Our Risk Management Framework & our Investment Framework are well thought-out and institutionalised to generate superior investment performance and creating a smooth investment experience for all our investors. They are framed based on our own investment experience and also imbibed learnings from some of the great investment houses and investment managers globally, which will stand the test of time and keep our investors interest at high standards. We have put risk limits based on fund mandates, market cap segments, sectors and stocks.