| CATEGORY OF SCHEME | Sectoral/ Thematic Fund |

| INVESTMENT OBJECTIVE | The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in banking and financial services. However, there can be no assurance that the investment objective of the scheme would be achieved. |

| Inception Date (Date of Allotment): | 06-Dec-21 |

| Benchmark: | Nifty Financial Services TRI |

| Minimum Application Amount: | Rs. 5,000/- and in multiples of Re. 1/- thereafter |

| Load Structure: | Entry Load: Nil Exit Load:1% if redeemed or switched out on or before completion of 12 months from the date of allotment of units · Nil, if redeemed or switched out after completion of 12 months from the date of allotment of units. |

| Total Expense Ratio (TER): | Including Additional Expenses and Goods and Service

Tax on Management Fees |

| Fund Manager | Mr. Nilay Dalal (Since 05 May 2023) |

| AUM (in Rs. Cr): | 270.65 |

| AAUM (in Rs. Cr): | 263.84 |

| % of top 5 holdings: | 53.50% |

| % of top 10 holdings: | 65.23% |

| No of scrips: | 32 |

| Average P/B | 3.04 |

| Average P/E | 16.33 |

| Portfolio Beta | NA |

| Portfolio Turnover Ratio | 1.84 |

^Scheme has not completed 3 years hence NA

*Risk free rate: 6.86 (Source: FIMMDA MIBOR) (P/E ratio taken on net equity level) |

|

Regular Plan

(in Rs.) |

Direct Plan

(in Rs.) |

|

| Growth: | 13.6757 |

14.4230 |

| IDCW: | 13.6757 |

14.4230 |

Name of the Instrument |

% to

NAV |

% to NAV

Derivatives |

|

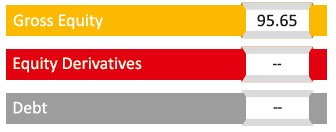

Equity & Equity Related Total |

95.65 |

||

Financial Services |

95.65 |

||

HDFC Bank Limited |

18.42 |

||

ICICI Bank Limited |

14.14 |

||

Axis Bank Limited |

9.45 |

||

State Bank of India |

8.51 |

||

Shriram Finance Limited |

2.97 |

||

Kotak Mahindra Bank Limited |

2.79 |

||

Bajaj Finance Limited |

2.73 |

||

ICICI Prudential Life Insurance Company Limited |

2.24 |

||

Muthoot Finance Limited |

1.99 |

||

City Union Bank Limited |

1.98 |

||

RBL Bank Limited |

1.94 |

||

L&T Finance Limited |

1.94 |

||

Aditya Birla Capital Limited |

1.92 |

||

Mahindra & Mahindra Financial Services Limited |

1.87 |

||

Power Finance Corporation Limited |

1.79 |

||

ICICI Securities Limited |

1.79 |

||

Cholamandalam Investment and Finance Company Ltd |

1.75 |

||

PB Fintech Limited |

1.63 |

||

Karur Vysya Bank Limited |

1.57 |

||

The Federal Bank Limited |

1.48 |

||

Suryoday Small Finance Bank Limited |

1.39 |

||

Indian Energy Exchange Limited |

1.37 |

||

DCB Bank Limited |

1.25 |

||

India Shelter Finance Corporation Limited |

1.23 |

||

Go Digit General Insurance Limited |

1.12 |

||

LIC Housing Finance Limited |

1.03 |

||

Jio Financial Services Limited |

0.99 |

||

Canara Bank |

0.98 |

||

IndusInd Bank Limited |

0.95 |

||

Bank of Baroda |

0.94 |

||

Manappuram Finance Limited |

0.75 |

||

Jana Small Finance Bank Limited |

0.74 |

||

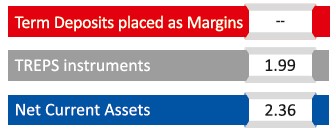

Short Term Debt & Net Current Assets |

4.35 |

Top Ten Holdings

| Period | Fund Returns (%) |

Benchmark Returns (%)

|

Additional Benchmark Returns (%) |

Fund (Rs) |

Benchmark (Rs) |

Additional Benchmark Returns (Rs) |

Regular - Growth |

||||||

| Last 1 Year | 16.9% |

17.9% |

26.7% |

11,687 |

11,789 |

12,666 |

| Since Inception | 13.0% |

12.9% |

16.1% |

13,676 |

13,651 |

14,645 |

Direct - Growth |

||||||

| Last 1 Year | 19.2% |

17.9% |

26.7% |

11,909 |

11,789 |

12,666 |

| Since Inception | 15.4% |

12.9% |

16.1% |

14,423 |

13,651 |

14,645 |

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. The performance data for 3 years period has not been provided, since scheme is in existence for less than 3 years. In case, the start / end date of the concerned period is a non-business date (NBD), the NAV of the previous date is considered for computation of returns. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: Nifty Financial Services TRI Additional Benchmark: Nifty 50 TRI. Fund Managers: Mr. Nilay Dalal (Managing since 05-May-23) and Mr. Rohan Korde (Managing since 29-Apr-22). Inception date of the scheme (06-Dec-21). Face Value per unit: Rs. 10. ITI Banking and Financial Services Fund NAV as on June 28, 2024: Rs. 13.6757 (Regular Growth Option), Rs. 14.4230 (Direct Growth Option)

| Period | Amount Invested |

Fund Value () |

Fund Returns (%) |

Benchmark Value () |

Benchmark Returns (%) |

Additional Benchmark Value () |

Additional Benchmark Returns (%) |

Regular - Growth |

|||||||

| Last 1 Year | 120,000 |

133,386 |

21.65% |

137,291 |

28.20% |

139,256 |

31.54% |

| Since Inception | 310,000 |

388,786 |

17.98% |

392,350 |

18.75% |

406,854 |

21.81% |

Direct - Growth |

|||||||

| Last 1 Year | 120,000 |

134,768 |

23.96% |

137,291 |

28.20% |

139,256 |

31.54% |

| Since Inception | 310,000 |

399,778 |

20.32% |

392,350 |

18.75% |

406,854 |

21.81% |

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: Nifty Financial Services TRI Additional Benchmark: Nifty 50 TRI. For SIP returns, monthly investment of Rs.10,000 invested on the 1st business day of every month has been considered. CAGR Returns (%) are computed after accounting for the cash flow by using the XIRR method (investment internal rate of return).

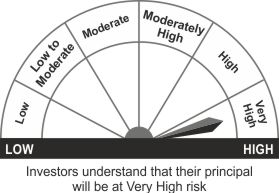

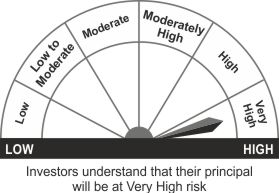

THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

- Capital appreciation over long term

- Investments in equity and equity related securities of companies engaged in banking and financial services

^Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Face Value per Unit: Rs. 10 unless other wise specified; Data is as of June 30, 2024 unless other wise specified.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully