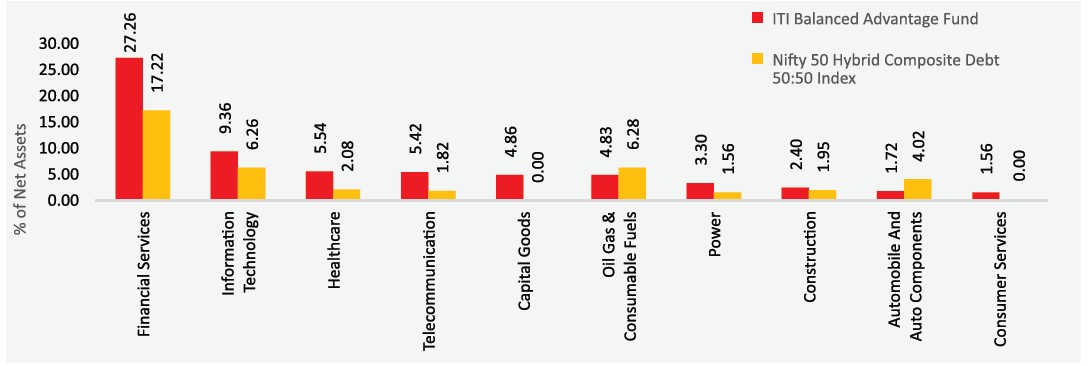

| CATEGORY OF SCHEME | Balanced Advantage |

| INVESTMENT OBJECTIVE | The investment objective of the Scheme is to seek capital appreciation by investing in equity and equity related securities and fixed income instruments. The allocation between equity instruments and fixed income will be managed dynamically so as to provide investors with long term capital appreciation. However, there can be no assurance that the investment objective of the scheme will be realized. |

| Inception Date (Date of Allotment): | 31-Dec-19 |

| Benchmark: | Nifty 50 Hybrid Composite Debt 50:50 Index |

| Minimum Application Amount: | Rs.5,000/- and in multiples of Rs. 1/- thereafter |

| Load Structure: | Entry Load: Nil Exit Load: 10% of the units allotted may be redeemed without any exit load, on or before completion of 3 months from the date of allotment of units. Any redemption in excess of such limit in the first 3 months from the date of allotment shall be subject to the following exit load i. 1% if redeemed or switched out on or before completion of 3 months from the date of allotment of units ii. Nil, if redeemed or switched out after completion of 3 months from the date of allotment of units. |

| Total Expense Ratio (TER):* | Including Additional Expenses and Goods and Service

Tax on Management Fees Regular Plan: 2.36% Direct Plan: 0.62% |

| Fund Manager | Mr. Rajesh Bhatia (Since 15-Sep-23) Total Experience: 31 years Mr. Vishal Jajoo (Since 15-Sep-23) Total Experience: 15 years Mr. Vikrant Mehta (Since 10-Feb-22) Total experience: 28 years |

| AUM (in Rs. Cr): | 369.59 |

| AAUM (in Rs. Cr): | 359.77 |

| % of top 5 holdings: | 26.99% |

| % of top 10 holdings: | 42.51% |

| No. of scrips: | 40 |

| Average Maturity: | 0.08 Years |

| Macaulay Duration: | 0.08 Years |

| Modified Duration: | 0.08Years |

| Yield to Maturity: | 6.79% |

| Standard Deviation^: | 7.20% |

| Beta^: | 0.79 |

| Sharpe Ratio^*: | 0.54 |

| Average P/B | 4.53 |

| Average P/E |

|

| Portfolio Turnover Ratio | 7.05 |

| ^Computed for the 3-yr period ended June 30, 2024. Based on monthly return. * Risk free rate: 6.86 (Source: FIMMDA MIBOR) | |

Regular Plan

(in Rs.) |

Direct Plan

(in Rs.) |

|

| Growth: | 13.7271 |

15.0386 |

| IDCW: | 13.0879 |

14.3959 |

Name of the Instrument |

% to

NAV |

% to NAV

Derivatives |

|

Equity & Equity Related Total |

60.93 |

7.19 |

|

Automobile and Auto Components |

2.30 |

-0.58 |

|

Mahindra & Mahindra Limited |

1.72 |

||

Tata Motors Limited |

0.57 |

-0.58 |

|

Capital Goods |

4.34 |

0.52 |

|

Siemens Limited |

1.92 |

||

ABB India Limited |

1.29 |

||

Cummins India Limited |

0.64 |

-0.64 |

|

Bharat Bijlee Limited |

0.48 |

||

Bharat Electronics Limited |

1.16 |

||

Construction |

0.47 |

1.93 |

|

Larsen & Toubro Limited |

0.47 |

1.93 |

|

Construction Materials |

0.52 |

||

Ambuja Cements Limited |

0.52 |

||

Consumer Durables |

2.00 |

-2.01 |

|

Titan Company Limited |

2.00 |

-2.01 |

|

Consumer Services |

1.56 |

||

Zomato Limited |

1.56 |

||

Fast Moving Consumer Goods |

0.76 |

-0.26 |

|

Tata Consumer Products Limited |

0.50 |

||

ITC Limited |

0.26 |

-0.26 |

|

Financial Services |

21.22 |

6.04 |

|

HDFC Bank Limited |

4.70 |

2.02 |

|

Axis Bank Limited |

2.86 |

||

ICICI Bank Limited |

2.71 |

2.06 |

|

State Bank of India |

2.14 |

||

SBI Life Insurance Company Limited |

1.74 |

||

ICICI Lombard General Insurance Company Limited |

1.57 |

||

IndusInd Bank Limited |

1.21 |

||

PB Fintech Limited |

1.15 |

||

REC Limited |

1.10 |

||

Home First Finance Company India Limited |

1.07 |

||

ICICI Securities Limited |

0.98 |

||

Kotak Mahindra Bank Limited |

1.96 |

||

Healthcare |

5.54 |

||

Sun Pharmaceutical Industries Limited |

2.34 |

||

Mankind Pharma Limited |

1.54 |

||

Concord Biotech Limited |

1.18 |

||

Apollo Hospitals Enterprise Limited |

0.48 |

||

Information Technology |

6.66 |

2.70 |

|

Infosys Limited |

3.87 |

0.60 |

|

Tata Consultancy Services Limited |

1.87 |

||

HCL Technologies Limited |

0.92 |

||

LTIMindtree Limited |

2.11 |

||

Metals & Mining |

2.95 |

-2.08 |

|

Adani Enterprises Limited |

1.11 |

-1.12 |

|

Tata Steel Limited |

0.97 |

-0.97 |

|

Hindalco Industries Limited |

0.87 |

||

Oil Gas & Consumable Fuels |

5.61 |

-0.79 |

|

Reliance Industries Limited |

5.61 |

-0.79 |

|

Power |

3.30 |

||

NTPC Limited |

3.30 |

||

Realty |

0.37 |

-0.37 |

|

DLF Limited |

0.37 |

-0.37 |

|

Telecommunication |

3.33 |

2.09 |

|

Bharti Airtel Limited |

3.33 |

2.09 |

|

Name of the Instrument |

Ratings |

% to NAV |

|

Certificate of Deposit |

5.48 |

||

Punjab National Bank |

ICRA A1+ |

2.69 |

|

ICICI Bank Limited |

ICRA A1+ |

2.40 |

|

Kotak Mahindra Bank Limited |

CRISIL A1+ |

0.40 |

|

Corporate Bond |

2.56 |

||

Power Finance Corporation Limited |

CRISIL AAA |

1.75 |

|

HDFC Bank Limited |

CRISIL AAA |

0.81 |

|

Commercial Paper |

2.93 |

||

L&T Finance Limited |

CRISIL A1+ |

1.33 |

|

National Housing Bank |

ICRA A1+ |

1.20 |

|

NTPC Limited |

CRISIL A1+ |

0.40 |

|

Government Bond |

4.06 |

||

6.89% GOI (MD 16/01/2025) |

SOVEREIGN |

4.06 |

|

Treasury Bill |

2.63 |

||

364 Days Tbill (MD 05/12/2024) |

SOVEREIGN |

2.63 |

|

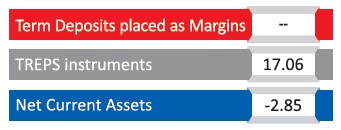

Short Term Debt & Net Current Assets |

14.22 |

Top Ten Holdings

Value of Investment of 10,000 |

||||||

| Period | Fund Returns (%) |

Benchmark Returns (%) |

Additional Benchmark Returns (%) |

Fund () |

Benchmark () |

Additional Benchmark () |

Regular - Growth |

||||||

| Last 1 Year | 22.3% |

17.0% |

26.7% |

12,228 |

11,690 |

12,666 |

| Last 3 Years | 10.8% |

11.2% |

16.6% |

13,582 |

13,752 |

15,826 |

| Since Inception | 7.3% |

12.8% |

17.7% |

13,727 |

17,190 |

20,811 |

Direct - Growth |

||||||

| Last 1 Year | 24.5% |

17.0% |

26.7% |

12,443 |

11,690 |

12,666 |

| Last 3 Years | 12.9% |

11.2% |

16.6% |

14,404 |

13,752 |

15,826 |

| Since Inception | 9.5% |

12.8% |

17.7% |

15,039 |

17,190 |

20,811 |

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. The performance data for 5 years period has not been provided, since scheme is in existence for less than 5 years. In case, the start / end date of the concerned period is a non-business date (NBD), the NAV of the previous date is considered for computation of returns. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: Nifty 50 Hybrid Composite Debt 50:50 Index Additional Benchmark: Nifty 50 TRI. Fund Managers: Mr. Rajesh Bhatia (Managing since 15-Sep-23), Mr. Vishal Jajoo (Managing since 15-Sep-23) and Mr. Vikrant Mehta (Managing since 10-Feb-22). Inception date of the scheme (31-Dec-19). Face Value per unit: Rs. 10. ITI Balanced Advantage Fund NAV as on June 28, 2024: Rs. 13.7271 (Regular Growth Option), Rs. 15.0386 (Direct Growth Option)

| Period | Amount Invested |

Fund Value () |

Fund Returns (%) |

Benchmark Value () |

Benchmark Returns (%) |

Additional Benchmark Value () |

Additional Benchmark Returns (%) |

Regular - Growth |

|||||||

| Last 1 Year | 120,000 |

134,153 |

22.93% |

132,165 |

19.62% |

139,256 |

31.54% |

| Last 3 Years | 360,000 |

446,000 |

14.49% |

438,949 |

13.37% |

480,654 |

19.80% |

| Since Inception | 550,000 |

736,332 |

12.77% |

751,384 |

13.67% |

883,946 |

21.01% |

Direct - Growth |

|||||||

| Last 1 Year | 120,000 |

135,455 |

25.11% |

132,165 |

19.62% |

139,256 |

31.54% |

| Last 3 Years | 360,000 |

459,598 |

16.60% |

438,949 |

13.37% |

480,654 |

19.80% |

| Since Inception | 550,000 |

773,195 |

14.96% |

751,384 |

13.67% |

883,946 |

21.01% |

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: Nifty 50 Hybrid Composite Debt 50:50 IndexAdditional Benchmark: Nifty 50 TRI. Additional Benchmark: Nifty 50 Hybrid Composite Debt 50:50 Index. For SIP returns, monthly investment of Rs.10,000 invested on the 1st business day of every month has been considered. CAGR Returns (%) are computed after accounting for the cash flow by using the XIRR method (investment internal rate of return).

Disclaimer - Fund SIP Performance

The performance details provided herein are of Growth option under Direct and Regular Plans. The Fund(s) offer Systematic Investment Plan (SIP) facility. To illustrate the advantages of SIP investments, this is how your investments would have grown if you had invested say Rs. 10,000 systematically on the first Business Day of every month over a period of time in the Growth Option of respective scheme. The returns are calculated by XIRR approach assuming investment of 10,000/- on the 1st working day of every month. XIRR helps in calculating return on investments given an initial and final value and a series of cash inflows and outflows with correct allowance for the time impact of the transactions.

Record Date |

Plan(s) Option(s) |

Individuals/ HUF (IDCW) (Rs per unit) |

Others (IDCW) (Rs per unit) |

Cum-IDCW NAV (Rs per unit) |

19-Jan-24 |

Regular Plan - Dividend Option |

0.4000 |

0.4000 |

12.8200 |

19-Jan-24 |

Direct Plan - Dividend Option |

0.4000 |

0.4000 |

13.9300 |

14-May-24 |

Regular Plan - Dividend Option |

0.1000 |

0.1000 |

12.8490 |

14-May-24 |

Direct Plan - Dividend Option |

0.1000 |

0.1000 |

14.0841 |

Pursuant to payment of IDCW, the NAV of the IDCW Option(s) of the Scheme/Plan(s) falls to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. For complete list of IDCW, visit www.itiamc.com.

THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

- Capital appreciation while generating income over medium to long term

- Dynamic Asset allocation between equity, equity related Instruments and fixed income instruments so as to provide with long term capital appreciation

^Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Face Value per Unit: Rs. 10 unless other wise specified; Data is as of June 30, 2024 unless other wise specified.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully