Dear Investors & Partners,

Nifty rebounds and closes above 24k in Jun'24

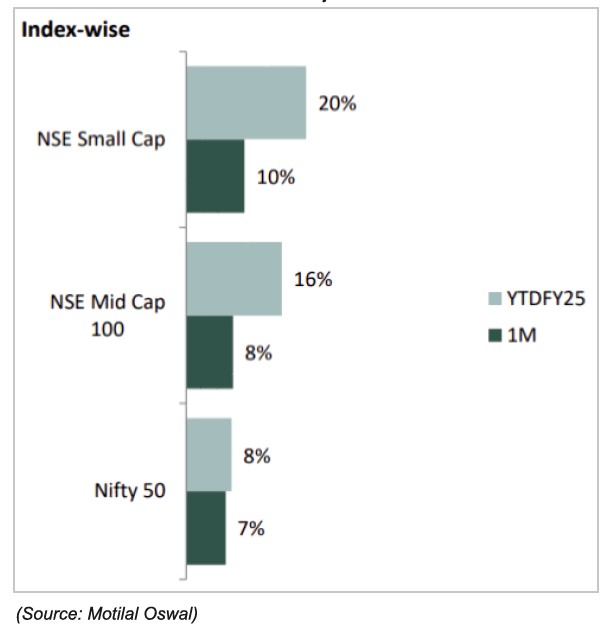

The Nifty, after consolidating in May'24, touched a fresh high of 24,174 before ending +6.6% MoM at 24,011 in Jun'24. Notably, the index was extremely volatile and swung around 2,893 points before closing 1,480 points higher. Midcaps and smallcaps outperformed largecaps by 1.2% and 3.1%, respectively, in Jun'24. Similarly, in CY24YTD, midcaps and smallcaps have outperformed largecaps and have risen 20.7% and 21%, respectively, vs. a 10.5% rise for the Nifty.

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison

with other investments. Index performance does not signify scheme returns

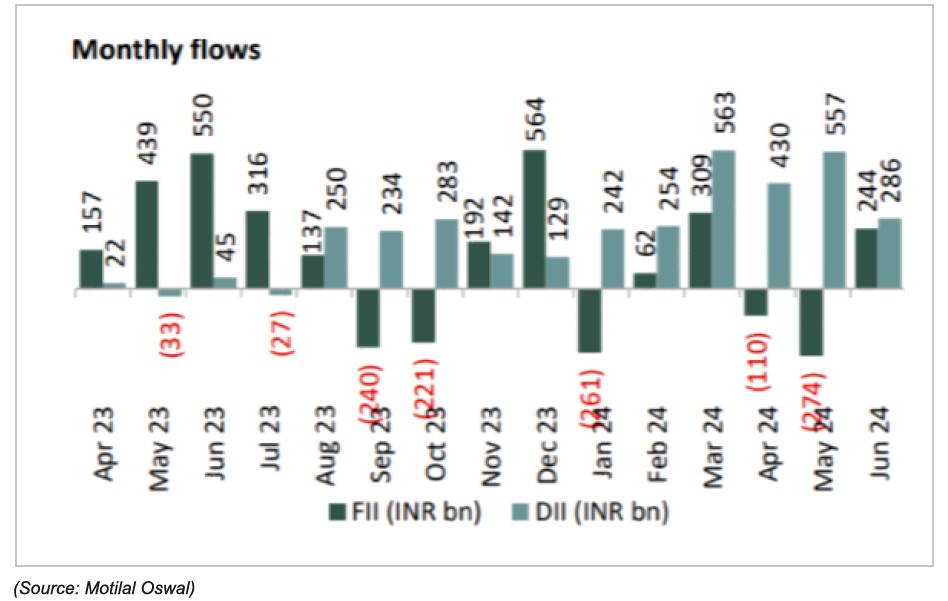

FIIs (Foreign institutional investors report inflows) after two consecutive months of outflows

FIIs turned buyers of USD3.1b in Jun'24, after remaining net sellers for two months. DIIs recorded inflows of USD3.4b in Jun'24 after clocking USD6.7b of inflows in May'24. FII inflows into Indian equities stand at USD0.3b in CY24YTD vs. inflows of USD21.4b in CY23. DII inflows into equities in CY24YTD continue to be strong at USD28.5b vs. USD22.3b in CY23.

Breadth favorable in Jun'24

Among sectors, Technology (+12%), Telecom (+11%), Real Estate (+8%), Private Banks (+8%), and Automobiles

(+8%) were the top gainers, whereas PSU Banks (-0.3%) was the only laggard MoM. Shriram Finance (+24%), Ultratech (+18%), Wipro (+17%), TechM (+16%), and Grasim (+15%) were the top performers, while Adani Ent. (-7%), Coal India (-4%), L&T (-3%), BPCL (-3%), and Maruti (-3%) were the key laggards.

Global Market Performance

Globally, equity indices have continued their positive run, with S&P and Nasdaq is up by 3% & 6% respect. in June-24. US economy, AI fueled demand and Fed's rate cut expectation, is driving the rally. In CYTD24, S&P 500 and Nasdaq is up 14% and 18% respectively and equal weighted Dow Jone is up only 4% over the same period. As, large part of gains in market cap weighted indices is led by few stocks led by Nvidia, Microsoft, Amazon, Meta, Apple.

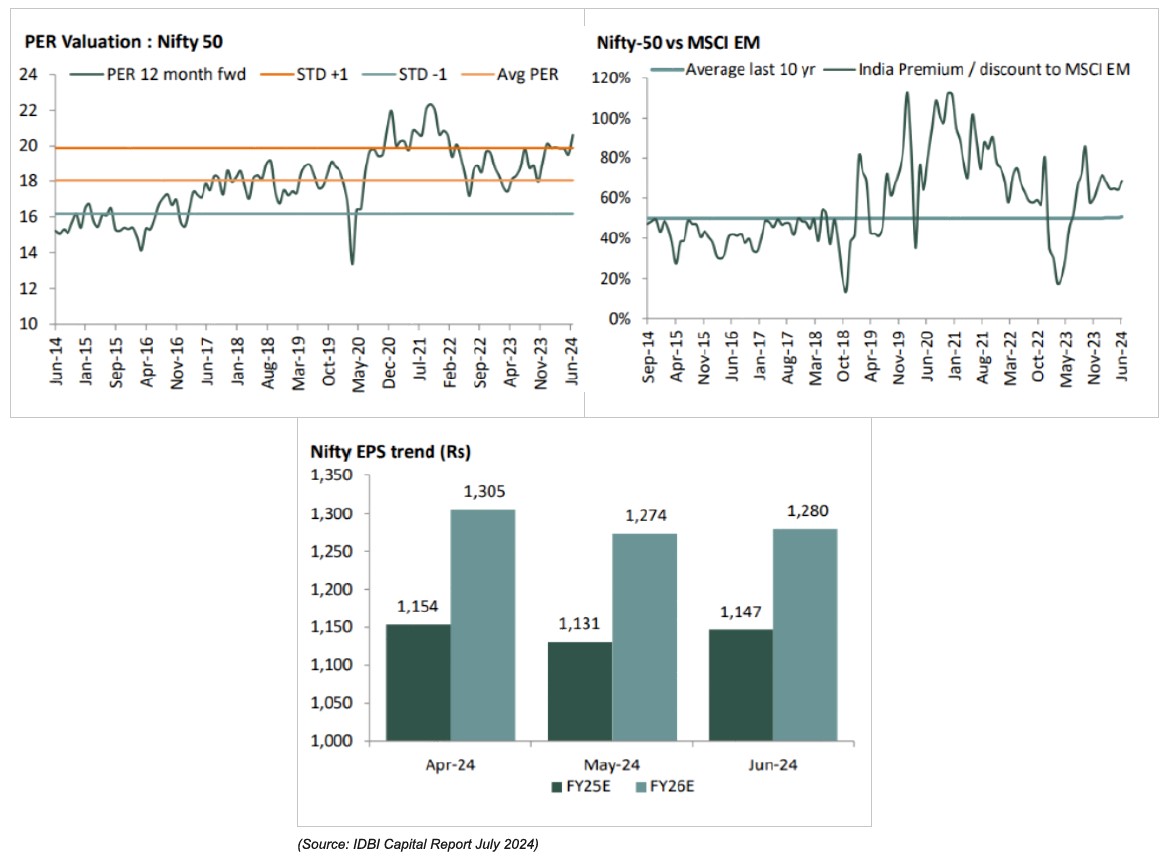

Valuations:

At the present level of valuations, the valuations of NIFTY is above the 1-year forward earnings of last 10 years. NIFTY is also trading at a premium to MSCI EM (Morgan Stanley Capital International Emerging Market) in terms of valuations. Earnings growth expectations in FY25-26E remains strong, with expectation of 12% pa in FY25E and FY26E.

Structural positive macro view remains intact:

Earnings – Corporate profit to GDP rebounds to a 15-year high in FY24: In 2024, the corporate profit to GDP ratio for the Nifty-500 Universe and listed India Inc. swelled to 4.8% and 5.2%, respectively, scaling a 15-year high. The YoY improvement was led by the BFSI, Oil & Gas, and Automobile sectors, which contributed 95% ofthe total improvement. Conversely, Metals, Technology, and Chemicals contributed adversely. The 0.8% YoY improvement in the 2024 profit to GDP ratio for Nifty-500 was propelled by the BFSI (0.3% increase), Oil & Gas (0.3% rise), and Automobile (0.2% increase) sectors.

Economy – Budget 2025 Preview: Spending growth likely to be increased in FY25: From the Budget 2025 perspective, we believe that the new government May largely retain its tax and non-debt capital receipt (including disinvestment) projections as presented during the Interim Budget in Feb'24. If so, a transfer of INR2.11t by the RBI implies excess receipts of about INR1.5t in FY25. A large part of these additional receipts, we believe, would be spent under various heads, while a small portion could be used to reduce the fiscal deficit.

Forecast of above normal monsoon: Above-normal rain will help the country improve its agricultural output and replenish water reservoirs at a time when several regions have faced severe heatwaves with the temperature going as high as over 49°C. The forecast comes as a relief after uneven precipitation and prolonged dry spell last year due to El Nino weighing on the farm sector.

The southwest monsoon rainfall over the country during June-September is likely to be 106% of the long period average.

Interest rate reduction should commence in 2HCY24: The European Central Bank (ECB) cut interest rates by 25 basis points, lowering its deposit rate to 3.75%. This had been at a record high and saw the ECB joining the likes of Canada, Sweden and Switzerland in lowering rates.

US Federal Reserve officials plan to reduce key interest rates one time in 2024 despite higher inflation, though the quantum and the beginning of the same is not year certain. However, its increasingly likely that the interest rate cycle has peaked.

Our View

India is currently enjoying the confluence of the macro and micro tailwinds with ~7% GDP growth, moderating inflation prints, range-bound crude prices, easing 10-year G-sec yield, stable currency, and resilient corporate earnings.

Earnings growth trajectory, capex, policy initiatives like PLI, etc. and the timing and quantum of interest rate easing globally, will be the key monitorable for sustained valuations and market growth. This is even as India has outperformed the MSCI index.

The incumbent Government is expected to continue for the third term, the focus would shift on the upcoming Union Budget. While there are nascent indications of rural demand bottoming out, it is too early to call out a recovery for certain.

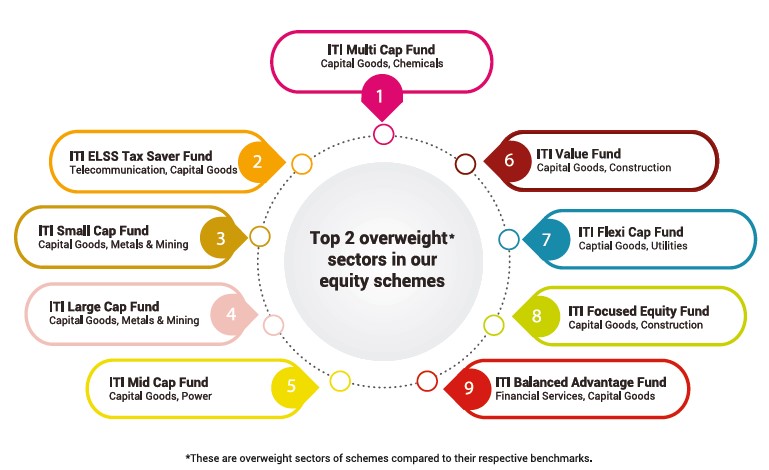

We continue to believe that the investment environment going forward would be a “stock picker's market” and would separate the men from the boys. There could be instances where companies operating in the same sector may end up reporting diverse set of financial results. Our approach in such an environment would be the same as we have been following over the last few quarters. It would revolve around the thesis to identify companies basis the “bottom up” approach.

Our Risk Management Framework & our Investment Framework are well thought-out and institutionalised to generate superior investment performance and creating a smooth investment experience for all our investors. They are framed based on our own investment experience and also imbibed learnings from some of the great investment houses and investment managers globally, which will stand the test of time and keep our investors interest at high standards. We have put risk limits based on fund mandates, market cap segments, sectors and stocks.

How are we positioned in our funds?

With macro situation being very dynamic and volatility increasing across asset classes, we continue with our strategy of running well-diversified portfolios. We are more focused on stock selection process within the sector rather than trying to take large overweight / underweight position among sectors. We would also refrain from taking aggressive cash calls.

What should be your approach while investing into our Mutual Fund Schemes?

We expect the volatility witnessed in the month of YTD CY24 to continue over the next few months as the market-outlook is likely to remain challenging. Valuations remain marginally above long-term averages. On the back of stable commodity prices especially crude oil and with operating leverage, earnings would rise for corporates and rupee denominated trade could lead to a strong performance by the Indian economy in CY24.

Investors wanting to invest in lumpsum should invest in ITI Balanced Advantage Fund, Value Fund and ITI ELSS Tax Saver Fund (formerly known as ITI Long Term Equity Fund). Investment in equity funds, particularly mid and small cap categories, should be done systematically over the next three to four months in the form of daily / weekly STPs or SIPs. While the current rally shows little signs of slowing down, retail investors must continue investing in well-managed funds via SIPs.