Debt Market Update

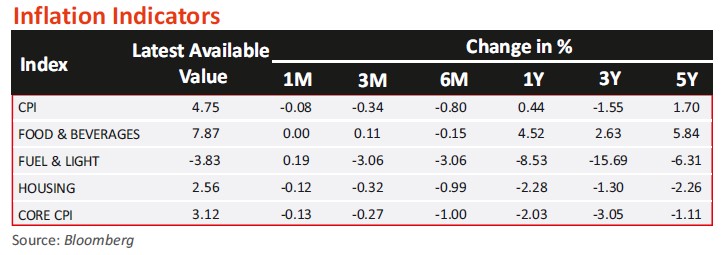

- Retail inflation (CPI) dropped to a 12-month low of 4.75% in May 2024, down from 4.83% in the previous month. CPI has now hovered within the RBI’s target range of 2%-6% for the ninth consecutive months. Food inflation was 8.69% in May 2024, marginally down from 8.70% in April 2024. Rural and urban retail inflation was at 5.28% and 4.15%, respectively. CPI inflation in May 2023 was 4.31%.

- Wholesale price index-based inflation (WPI) surged to 2.61% in May 2024, the highest in 15 months since February 2023 when it was 3.85%. It had dropped to 1.41% in March 2023. In the previous month, WPI inflation reached a 13-month high of 1.26%. Inflation trended higher rise due to increasing prices in sectors like food articles, food products manufacturing, crude petroleum, natural gas, mineral oils, and manufacturing. In May 2023, WPI had fallen to -3.48%.

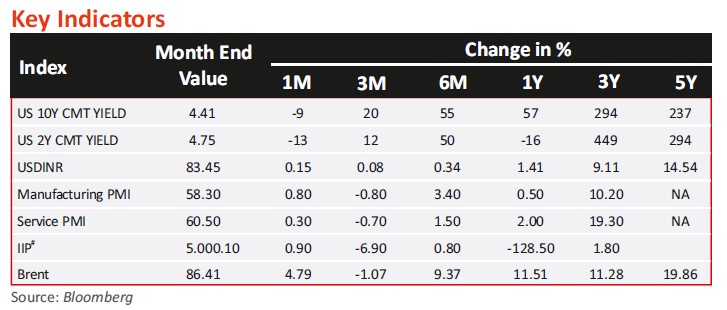

- Industrial Production (IIP) expanded marginally by 5% in April 2024 (4.9% in March 2024). IIP was 4.6% in April 2023. Manufacturing output increased by 3.9%, while mining and power output rose by 6.7% and 10.2% respectively.

- In June 2024, gross GST collection reached Rs 1.74 lakh crore (Rs 1.73 lakh crore in May 2024), reflecting 7.7% YoY growth. This growth is lower than the 12.4% and 10% increases seen in April 2024 and May 2024 respectively.

- Core sector growth slowed to 6.3% in May 2024, down from 6.7% in April 2024, due to a decline in the cement industry output, despite higher coal and electricity output. Factors like the heatwave and phased parliamentary elections may have impacted activity in some sectors.

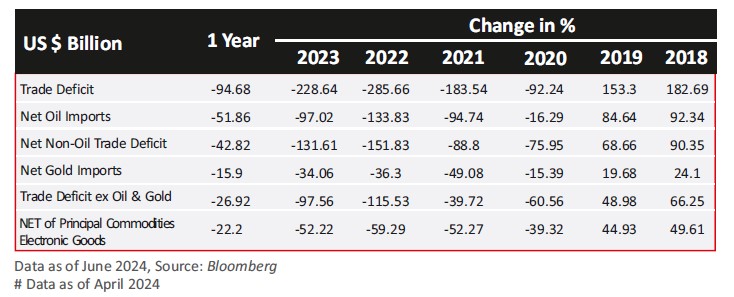

- Imports in May 2024 rose by 7.7% to USD61.91bn, driven by increased shipments of petroleum, transport equipment, silver, and vegetable oil. However, the trade deficit widened to a seven-month high of USD23.78bn. Decreasing inflation in advanced economies has given a boost to consumer purchasing power, leading to higher demand for Indian goods. Improved demand from the EU, UK, West Asia, and the US has increased order bookings by over 10%, signalling a recovery for labour-intensive export sectors.

- India’s fiscal deficit in 02MFY25 stood at ~3% of FY25BE. Gross tax revenue in 02MFY25 was ~12% of FY2025BE. Total expenditure in 02MFY24BE increased to ~13% of FY2025BE while capex at ~13% of FY2025BE.

Source: Bloomberg Internal Research

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. Index performance does not signify scheme performance