Debt Market Update

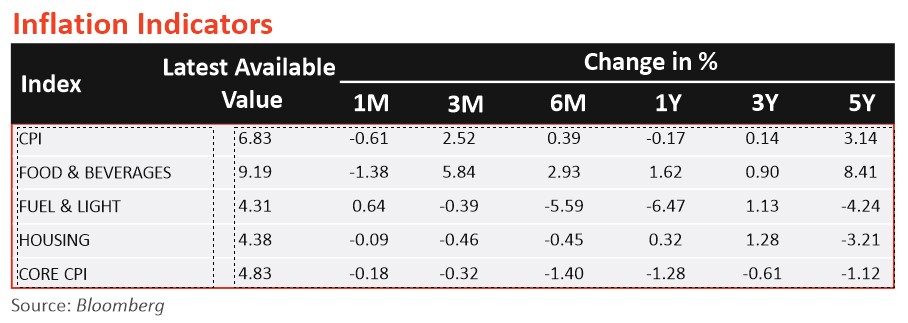

- India’s retail inflation eased slightly to 6.83% in August, from the 15-month high of 7.44% in July 2023, but the rise in food prices remained sticky at around 10% with rural inflation at over 7%.

- India’s wholesale prices remained in deflationary territory for the fifth month in succession in August 2023 with the decline in prices slowing to -0.52% from -1.36% in July 2023. Inflation in food and primary articles eased to nearly 6% vis-à-vis 7.5% in the previous month. The dip in deflation rate was triggered by hardening fuel and power prices from -12.8% in July 2023 to -6% in August 2023.

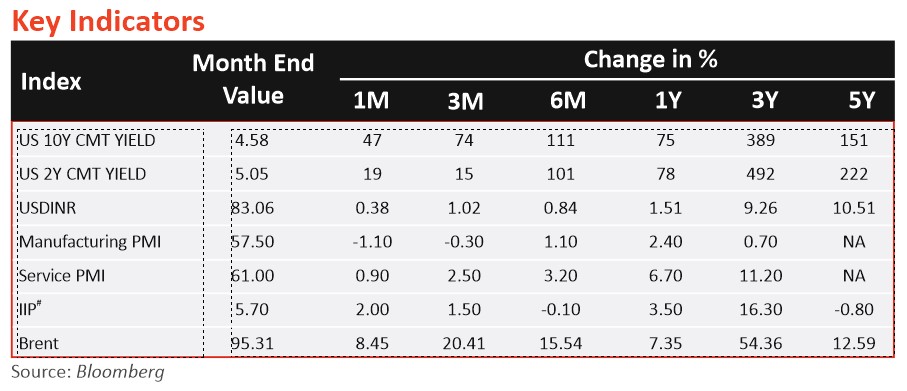

- India’s factory output (IIP) surged to a five-month high of 5.7% in July 2023, (3.8% in June 2023), driven by strong growth in mining and power. Nine of the manufacturing sectors posted negative growth including electronics which is alarming given that it is part of the PLI (production linked incentive) arrangement. The approaching festive season spanning September, October, and November will serve as a litmus test for the sustainability of the industry's growth, contingent upon the resurgence of consumer goods demand.

- The gross GST revenue collections for August 2023 exceeded Rs 1.59 lakh (1.65 lakh crore in July 2023). Year-on-year, GST collections were 11% higher vis-à-vis collections in the same month last year.

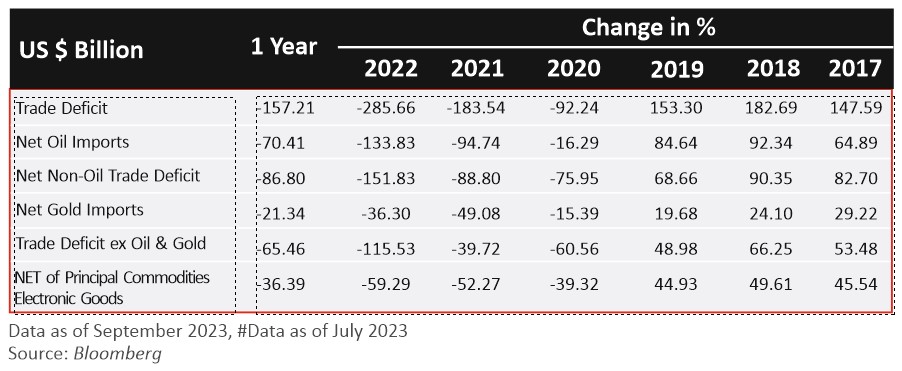

- India's merchandise trade deficit in August 2023 widened beyond estimates to USD24.2bn. India's merchandise exports stood at USD34.5bn, while imports were USD58.6bn in August 2023. Services exports in August 2023 were USD26.4bn vis-à-vis USD27.2bn in the previous month. Over the April-August 2023 period, services and merchandise exports fell nearly 5% YoY to USD306.3bn, while imports fell nearly 10% to USD343.8bn.

- The combined index of eight core Industries expanded to a 14-month high of 12.1% in August 2023 vis-à-vis 8% in July 2023. The corresponding number was 4.2% a year ago. Growth in August 2023 was spurred primarily by an expansion in production of crude oil, natural gas, and coal, with products, steel, cement, and electricity also growing. The performance in August 2023 is the highest since June 2022, when it was 13.2%.

- India’s fiscal deficit in 5 Month Financial Year 24 (5MFY24) stood at ~36% of FY24BE as compared to ~31.5% in the similar period last year. Gross tax revenue in 5MFY24 was 35% of FY2024E (17% higher than 5MFY23) and net tax revenue was 34% of FY2024BE (12% lower than 5MFY23), while expenditure in 5MFY24 was at 37% of FY2024BE.