Dear Investors & Partners,

The Nifty-50 reached the milestone of 20000 level in Sep'23 after a volatile and long journey from 18000-19000 levels. The index bounced back after declining in Aug'23. The index oscillated 967 points before closing 385 points (or 2% higher MoM (Month on month) at 19,638 level. The Nifty is up 8.5% in CY23YTD.

Conditions in US Markets (sticky inflation and higher yields) triggered selling by foreign institutions. FIIs were net sellers (Rs. 14,768 crores) while DIIs were net buyers (Rs. 20,313 crores).

- The large cap bellwether indices S&P BSE Sensex and Nifty 50 rose 1.5% and 2.0% respectively in September 2023. S&P BSE MidCap and S&P BSE SmallCap climbed 3.7% and 1.1% respectively.

- On the S&P BSE sectoral front, the leading performers were S&P PSU (10.6%), S&P BSE Power (7.1%) and S&P BSE Metal (6.1%).

September was an eventful month in terms of direct tax collections, GST collection figures and overall order inflows for the sector.

a. Direct tax collection: The Central Government's advance tax collections have recorded a remarkable 24 percent increase compared to the same period last year. This surge is a stark contrast to the modest 14 percent growth seen in the first quarter of this fiscal year, as reported by official sources. The 24 percent growth actually signifies a turning point in the government's fiscal outlook.

b. GST Collection: The month of September registered a 10% y-o-y growth in GST collection figure. GST collection crosses ₹ 1.60 lakh crore mark for the fourth time in FY 2023-24.

c. Opportunity canvass opening up for Indian companies: Larsen & Toubro which had a total order book of Rs. 4.12 lakh crore bagged a single order of Rs.32,000 crore from Aramco in the Middle East. This orders assumes significance in the wake of general global slowdown and the fact that the execution capabilities of the largest Indian infrastructure company getting recognised on a global landscape.

Apart from EPC contracts, Middle East is expected to open up a number of opportunities for Indian pipe manufacturers

This month also saw a recovery in monsoon compared to the precarious situation prevailed in the month of August 2023.

Monsoon update: Monsoon season ends with 'near-normal' rains (94.4% of Long Term Average (LTA)), which, along with the government policy measures including export curbs on essential food produce, should alleviate risks to food inflation. The situation has improved significantly in the month of September compared to the month of August 2023.

- Key pillars of the strength of the economy:

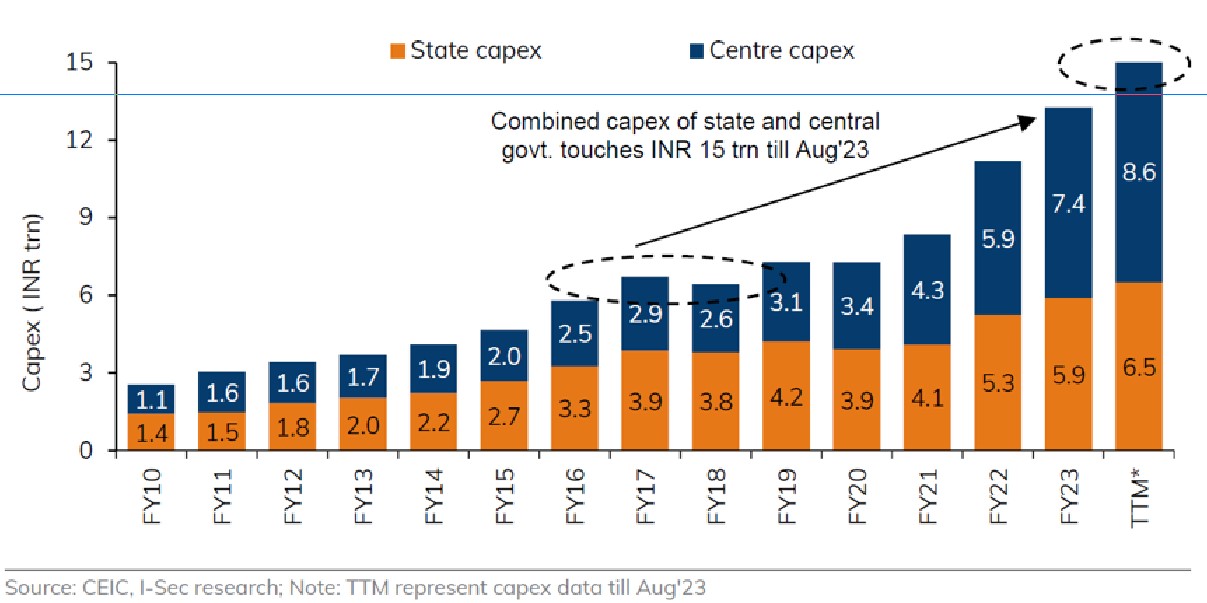

- Central and State Government capex touches new high on (Trailing 12 months) TTM basis

- While the historical consumption trends have always registered a tilt in favour of value for money segment, a new trend is emerging now. The number of “High-Networth Individuals” is set to increase the consumption landscape in the country: As on date there are 50 lakh households in the country having earnings more than USD 35,000 per annum. This figure is expected to jump 5x to 2.5 crore households over the coming few years. The consumption pattern of these HNIs is expected to provide buoyancy in consumption pattern of various products/services. This change in the consumption trend is already being witnessed in various segments: The largest Passenger car manufacturer in the country is seeing a shift towards SUVs in the overall vehicle sales figure. Similar trend is being registered in case of alcoholic beverage companies where the consumption of P&A (Premium & Assorted Beverages) is on the rise.

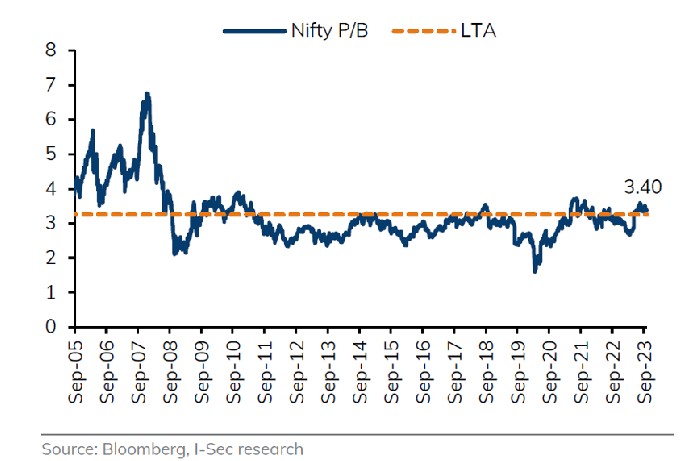

- Valuations still in a decent zone: The Nifty is trading at a 12-month forward P/E ratio of 18.6x. The P/B ratio is at 3.4x, just a bove the long term average. In terms of market-cap to GDP, the Indian markets quote at 110.9% which does not show sign of high-valuations.

FY24 view remains intact

For FY24, the short term may be impacted on account of the global geopolitical tension but we maintain our view that India's long-term growth story is intact. India's economy should continue to exhibit strength relative to other emerging markets, based on many macro indicators including strong Govt revenue collections, low corporate and bank leverage and stable external position. This should somewhat insulate India from a global economic slowdown.

How are we positioned in our funds?

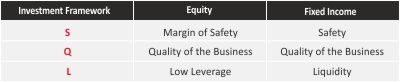

With macro situation being very dynamic and volatility increasing across asset classes, we continue with our strategy of running well-diversified portfolios. We are more focused on stock selection process within the sector rather than trying to take large overweight / underweight position among sectors. The focus continues to be on stock selection on a bottom-up basis anchored on our “SQL Investment Framework”.

What should be your approach while investing into our Mutual Fund Schemes?

We expect the volatility to continue over the next few months as the market-outlook is likely to remain challenging. In the short term, the equity markets will be dependent on the newsflow of the geopolitical tension which has recently emerged.

Valuations remain marginally above long-term averages. On the back of lower commodity prices and with operating leverage, earnings would rise for corporates and rupee denominated trade could lead to a strong performance by the Indian economy.

Investors wanting to invest in lumpsum can invest in ITI Balanced Advantage Fund and ITI Long Term Equity Fund. Investment in equity funds, particularly mid and small cap categories, should be done systematically over the next three to four months in the form of daily / weekly STPs or SIPs.

Our Investment Framework – SQL

Based on our combined investment learnings of more than 50 years, we have institutionalized very strong investment Framework -SQL, which is core to our fund management framework and approach to our portfolios. We strongly believe that good quality (Q), low leverage companies (L) bought with a reasonable good margin of safety (S) makes the investment very attractive and rewarding for our investors.

Our Risk Management Framework

Our Risk Management Framework & our Investment Framework are well thought-out and institutionalised to generate superior investment performance and creating a smooth investment experience for all our investors. They are framed based on our own investment experience and also imbibed learnings from some of the great investment houses and investment managers globally, which will stand the test of time and keep our investors interest at high standards. We have put risk limits based on fund mandates, market cap segments, sectors and stocks.