Equity Market Update

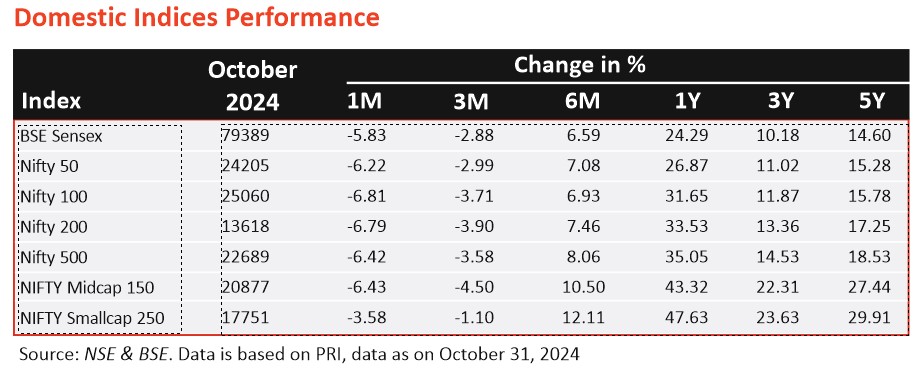

- Indian markets have seen significant volatility in the month of October 2024 with NIFTY 50 TRI declining by 6.12% during the month and NIFTY Midcap 150 TRI and NIFT Smallcap 250 TRI falling by 6.42% and 3.58% respectively. This volatility has been attributed to multiple factors, primarily to FIIs selling Indian equities. China announcing a stimulus package to revive its economy and Indian stocks trading at a relative premium to China resulted in the FIIs selling Indian equities to the tune of INR 1.14 Lac Crore in October 2024.

- The economic sector activity was also slightly muted. India's Services Sector Purchasing Managers' Index (PMI) dropped to 57.7 in September 2024 from 60.9 in the previous month, indicating a slowdown. Manufacturing PMI also declined, falling from 57.5 in August 2024 to 56.5 in September 2024, suggesting slower pace of growth.

- The Consumer Price Index (CPI) inflation rose to 5.49% in September 2024, up from 3.65% in August 2024, but remained within the Reserve Bank of India's (RBI) target range. The Wholesale Price Index (WPI) inflation increased to 1.84% in September 2024, up from 1.31% in August 2024, primarily due to rising food prices. India's Goods and Services Tax (GST) collection reached a six-month high of Rs 1.87 lakh crore in October 2024, reflecting an 8.9% year-on-year increase.

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. Index performance does not signify scheme performance Investors should consult their financial advisers if in doubt about whether the product is suitable for them.