Debt Market Update

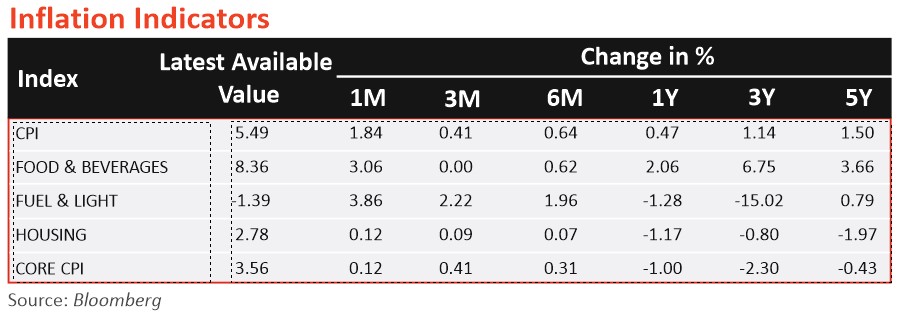

- Retail inflation (CPI) surged to 5.49% in September 2024 (3.65% in August 2024), driven by food price increases. Food inflation rose to 9.24% in September 2024, compared with 5.66% in the previous month.

- Wholesale inflation (WPI) rose to 1.84% in September 2024 from 1.31% in August 2024, driven by a surge in food prices. Primary food articles' inflation hit a 14-month high of 11.5%. This marks a shift from the -0.1% deflation in September 2023. Despite an overall negative wholesale inflation (-0.7%) in FY24, prices have stayed above 1% since April, with deflation in seven out of the 12 months.

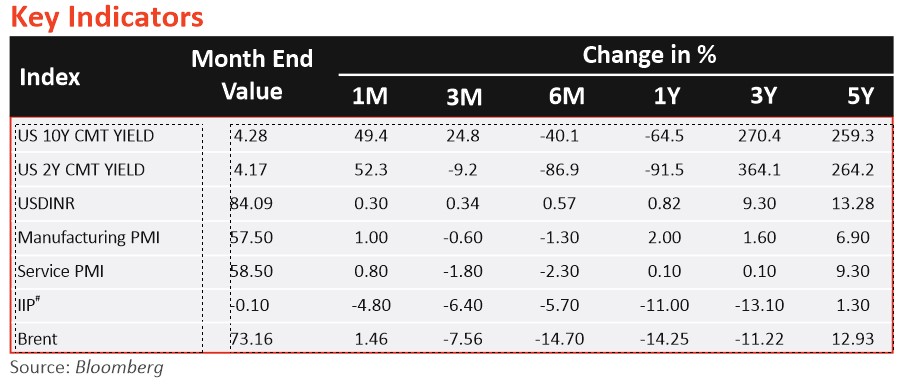

- August 2024 saw IIP contracting by 0.1, following a 4.7% growth in July 2024. Mining, manufacturing, and electricity showed -4.2%, 1%, and -3.7% changes respectively. Heavy rains likely impacted mining. By use, IIP saw -2.6% in primary goods, 0.7% in capital goods, 3% in intermediate goods, 1.9% in infrastructure, 5.2% in consumer durables, and -4.5% in non-durables.

- India’s core sector output grew by 2% year-on-year in September 2024, a rebound from August’s 1.6% contraction. Key sectors, which form 40.27% of the IIP, showed gains: refinery products surged 5.8%, cement grew 7.1%, coal rose 2.6%, and fertilisers increased 1.9%. This growth indicates positive industrial and economic momentum.

- GST collections expanded to Rs 1.87 lakh crore in October, a 9% year-on-year spike, driven by increased compliance and economic growth. This fiscal year, total collections have reached Rs 12.74 lakh crore, a 9.4% rise. Domestic GST grew by 10.6%, while import GST rose 4%.

- India’s merchandise trade deficit for September 2024 was USD20.8bn (USD29.7bn in August 2024), driven by a steep fall in gold imports from USD10.1bn in August 2024 to USD4.4bn. Merchandise exports fell slightly to USD34.6bn, while imports dropped sharply to USD55.4bn. Services exports and imports remained steady at approximately USD30.6bn and USD16.3bn, respectively.

Source: RBI, Bloomberg, CCIL, MOSPI

*BE - Budget Estimates

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. Index performance does not signify scheme performance Investors should consult their financial advisers if in doubt about whether the product is suitable for them.