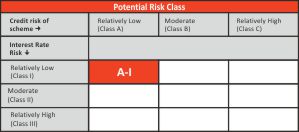

| CATEGORY OF SCHEME | Liquid Fund |

| INVESTMENT OBJECTIVE | The investment objective of the Scheme is to provide reasonable returns, commensurate with low risk while providing a high level of liquidity, through a portfolio of money market and debt securities. However, there can be no assurance that the investment objective of the scheme will be realised. |

| Inception Date (Date of Allotment): | 24-Apr-19 |

| Benchmark: | CRISIL Liquid Debt A-I Index |

| Minimum Application Amount: | Rs.5,000/- and in multiples of Rs. 1/- thereafter |

| Load Structure: | Entry Load: Nil Exit Load: Investor exit upon |

| subscription Up to Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Day 7 onwards |

Exit Load % 0.0070% 0.0065% 0.0060% 0.0055% 0.0050% 0.0045% 0.0000% |

| Total Expense Ratio (TER): | Including Additional Expenses and Goods and Service

Tax on Management Fees |

| Fund Manager | Mr. Vikrant Mehta (Since 18-Jan-21) Total Experience: 28 years |

| AUM (in Rs. Cr): | 42.04 |

| AAUM (in Rs. Cr): | 56.01 |

| Average Maturity: | 21 Days |

| Macaulay Duration: | 21 Days |

| Modified Duration: | 21 Days |

| Yield to Maturity: | 6.75% |

Regular Plan

(in Rs.) |

Direct Plan

(in Rs.) |

|

Growth |

1,190.4889 |

1,196.8150 |

Daily IDCW |

1,001.0000 |

1,001.0000 |

Weekly IDCW |

1,001.5715 |

1,001.5804 |

Fortnightly IDCW |

1,001.5665 |

NA |

Monthly IDCW |

1,001.5672 |

1,001.5794 |

Annual IDCW |

1,194.1342 |

1,197.7433 |

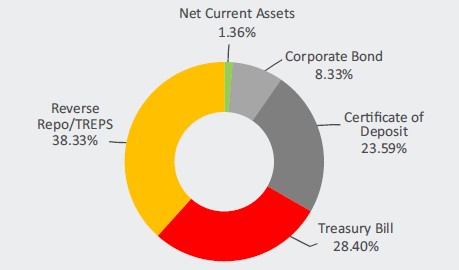

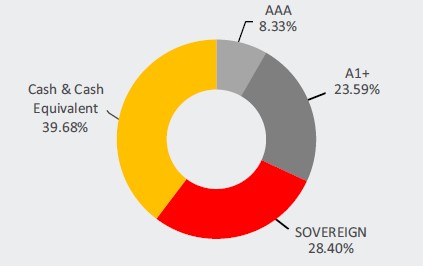

| Name of Instrument | Ratings |

Market Value (Rs. Lakhs) |

% to NAV |

| Debt Instrument | |||

| Certificate of Deposit | |||

| HDFC Bank Limited | CARE A1+ |

991.76 |

23.59 |

| Corporate Bond | |||

| Export Import Bank of India | CRISIL AAA |

350.07 |

8.33 |

| Treasury Bill | |||

| 91 Days Tbill (MD 20/07/2023) | SOVEREIGN |

697.61 |

16.59 |

| 91 Days Tbill (MD 10/08/2023) | SOVEREIGN |

496.34 |

11.81 |

| Reverse Repo/TREPS | |||

| Clearing Corporation of India Ltd | NA |

1611.41 |

38.33 |

| Net Current Assets | NA |

56.98 |

1.36 |

| Total Net Assets | 100.00 |

Value of Investment of 10,000 |

||||||

| Period | Fund Returns (%) |

Benchmark Returns (%) |

Additional Benchmark Returns (%) |

Fund () |

Benchmark () |

Additional Benchmark () |

Regular - Growth |

||||||

Last 7 days |

6.53% |

6.53% |

8.50% |

10,013 |

10,013 |

10,016 |

Last 15 days |

6.51% |

6.77% |

5.48% |

10,027 |

10,028 |

10,023 |

Last 30 days |

6.38% |

6.79% |

7.04% |

10,052 |

10,056 |

10,058 |

| Last 3 months | 6.49% |

7.00% |

7.87% |

10,162 |

10,175 |

10,196 |

| Last 6 months | 6.46% |

6.91% |

6.99% |

10,320 |

10,343 |

10,347 |

Last 1 Year |

6.05% |

6.51% |

6.45% |

10,605 |

10,651 |

10,645 |

Last 3 Year |

4.11% |

4.55% |

4.33% |

11,284 |

11,429 |

11,355 |

Since Inception |

4.25% |

4.90% |

5.26% |

11,905 |

12,215 |

12,396 |

Direct - Growth |

||||||

Last 7 days |

6.69% |

6.53% |

8.50% |

10,013 |

10,013 |

10,016 |

Last 15 days |

6.67% |

6.77% |

5.48% |

10,027 |

10,028 |

10,023 |

Last 30 days |

6.54% |

6.79% |

7.04% |

10,054 |

10,056 |

10,058 |

| Last 3 months | 6.66% |

7.00% |

7.87% |

10,166 |

10,175 |

10,196 |

| Last 6 months | 6.63% |

6.91% |

6.99% |

10,329 |

10,343 |

10,347 |

Last 1 Year |

6.22% |

6.51% |

6.45% |

10,622 |

10,651 |

10,645 |

Last 3 Year |

4.25% |

4.55% |

4.33% |

11,329 |

11,429 |

11,355 |

Since Inception |

4.39% |

4.90% |

5.26% |

11,968 |

12,215 |

12,396 |

Past performance may or may not be sustained in future. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: CRISIL Liquid Debt A-I Index Additional Benchmark: CRISIL 1 Year T-Bill Index. Fund Manager: Mr. Vikrant Mehta from (Managing since January 18, 2021). Returns less than 1 year period are simple annualized and greater than 1 year are compounded annualized. Inception date of the scheme (24-Apr-19). Face Value per unit: Rs. 1000

Record Date |

Plan(s) Option(s) |

Individuals/ HUF (IDCW) (Rs per unit) |

Others (IDCW) (Rs per unit) |

Cum-IDCW NAV (Rs per unit) |

25-Apr-23 |

Regular Plan - Monthly IDCW Option |

5.2846 |

5.2846 |

1006.2846 |

25-Apr-23 |

Direct Plan - Monthly IDCW Option |

5.4159 |

5.4159 |

1006.4159 |

25-May-23 |

Regular Plan - Monthly IDCW Option |

5.5181 |

5.5181 |

1006.5181 |

25-May-23 |

Direct Plan - Monthly IDCW Option |

5.6355 |

5.6355 |

1006.6355 |

26-Jun-23 |

Regular Plan - Monthly IDCW Option |

5.5561 |

5.5561 |

1006.5561 |

26-Jun-23 |

Direct Plan - Monthly IDCW Option |

5.6820 |

5.6820 |

1006.6820 |

Pursuant to payment of IDCW, the NAV of the IDCW Option(s) of the Scheme/Plan(s) falls to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. For complete list of IDCW, visit www.itiamc.com.

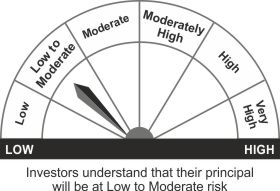

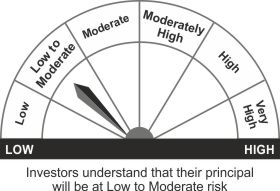

THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

- Regular income over short term.

- Investment in money market and debt instruments.

^Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Face Value per Unit: Rs. 1000 unless otherwise specified; CD - Certificate of Deposit; CP - Commercial Papers;

Data is as of June 30, 2023 unless otherwise specified.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully