Debt Market Update

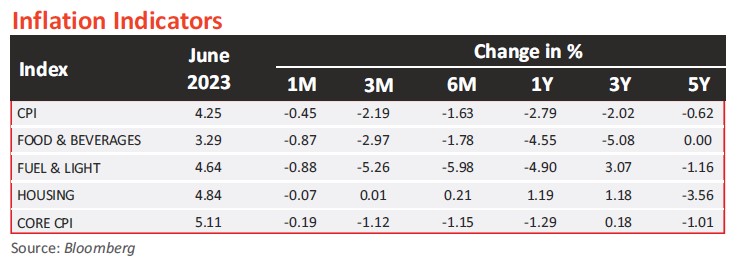

- India’s retail inflation (CPI) eased to a more than 2-year low of 4.25% in May 2023 (4.70% in April 2023). CPI has remained within the RBI’s tolerance band of 2-6% for the third consecutive month. CPI trended lower thanks to a high base effect pulling down inflation numbers and easing of food inflation in May 2023.

- Wholesale Price Index inflation (WPI) declined to over 7-year low of -3.48% in May 2023 (-0.92% in April 2023) thanks to a high base effect and also a sustained moderation in prices of mineral oils, basic metals, food products, textiles, non-food articles, crude petroleum & natural gas, and chemical & chemical products. This is the 12th straight month of decline in WPI-based inflation.

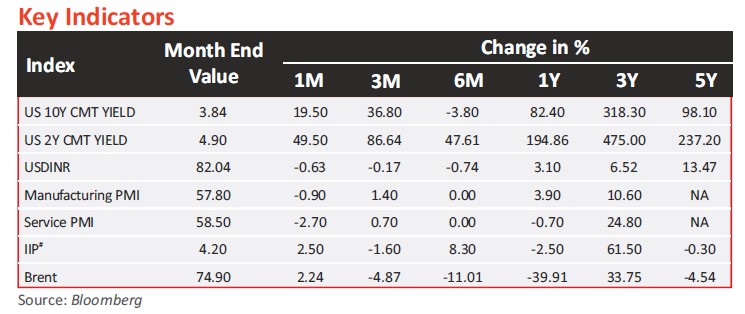

- India's industrial output, as measured by the IIP surged to 4.2% in April 2023 from 1.7% in March 2023 backed by robust manufacturing output (up 4.9%) and mining (5.1%), while power generation contracted by 1.1%.

- India’s overall exports (merchandise and services) in May 2023 were estimated at USD60.3bn, declining nearly 6% year-on-year. Overall imports in May 2023 were assessed to be USD70.6bn, sliding 7.45% year-on-year.

- The production of eight infrastructure (core) sectors registered a growth of 4.3% in May 2023 (3.5% in April 2023). Revival of the capex cycle sustained the recovery with strong growth in cement and steel production. Though year-on-year growth was unimpressive, month-on-month performance of certain high frequency indicators was notable.