Dear Investors & Partners,

The month of December 2023 was quite eventful with regard to the impact on equity markets in general.

Election verdict: Expected political continuity should boost investor confidence. BJP's recent win in the 3 state elections of MP, Rajasthan and Chhattisgarh is much better than the market expectations and further reinforces the consensus expectations of a Current Goverment win 2024 national elections with a greater likelihood of 300+seats for the BJP.

Fed policy: The FOMC in it's latest meeting signalled the end of rate hikes. The historic tightening of monetary policy is likely over as inflation fell faster than expected and with a discussion of cuts in borrowing costs coming in CY24.

RBI policy: The RBI MPC voted unanimously to hold the repo rate at 6.5%. The MPC revised its real GDP growth projection to 7% (earlier: 6.5%).

The month of December 2023 saw significant gains in large-cap stocks fuelling the rally alongside mid-caps, while small caps took a breather. Sustained trend of profit growth, capital expenditures, and stable liquidity were key themes during the month. FIIs bought net equities worth Rs 66,135 crores in December 2023, with DIIs logging in net purchase of 12,942 crore.

The large cap bellwether indices S&P BSE Sensex and Nifty 50 (TRI) climbed 7.8% and 7.9% respectively in December 2023. S&P BSE MidCap and S&P BSE SmallCap rose 7.5% and 5.7% respectively. Year-on-year basis, S&P BSE Sensex and Nifty 50 surged 18.7% and 20.0% respectively while S&P BSE MidCap and S&P BSE SmallCap soared 45.5% and 47.5% respectively.

On the S&P BSE sectorial front, the leading performers in December 2023 were S&P BSE Power (18.2%), S&P BSE PSU (15.3%) and S&P Oil & Gas (12.0%).

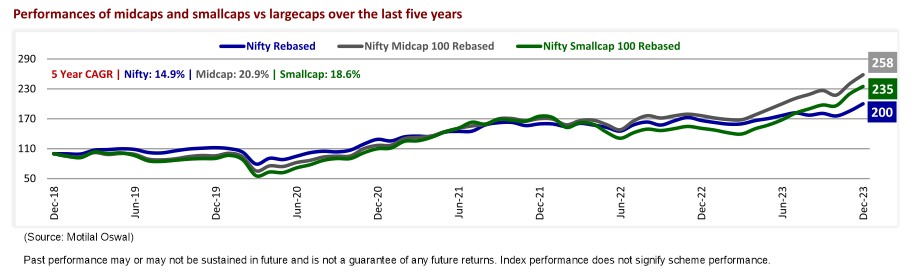

Nifty hits record high, ends CY23 with 20% returns: In CY23, the Nifty recorded an impressive 20% YoY gain. Despite weak global macros, rising interest rates, and geopolitical uncertainties, Indian equity markets remained resilient, clocking eight consecutive years of positive returns!

Over the last 5 years period as well, mid caps and small caps have outperformed the large caps by a significant margin.

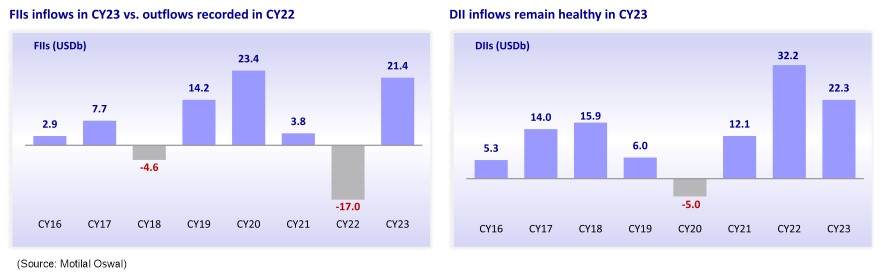

- Strong FIIs/DIIs inflows: FII inflows into Indian equities stood at USD21.4bn in CY23 vs. outflows of USD17bn in CY22. During the last eight years, FIIs have invested USD51.8bn cumulatively in the Indian market, with only two years of outflows. DII inflows into equities in CY23 remained strong at USD22.3bn vs. USD32.2bn in CY22. With just one year of outflows since CY16, DIIs have invested USD102.8b cumulatively over the last eight years.

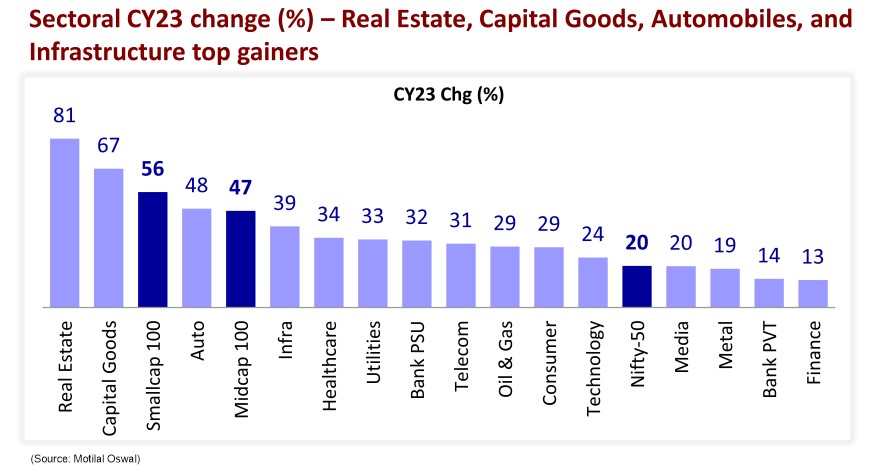

- All sectors delivered positive returns in CY23: Among the sectors, the top gainers were Real Estate (+81%), Capital Goods (+67%), Automobiles (+48%), Infrastructure (+39%), and Healthcare (+34%).

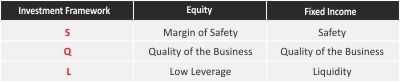

Our Investment Framework – SQL

Based on our combined investment learnings of more than 50 years, we have institutionalized very strong investment Framework -SQL, which is core to our fund management framework and approach to our portfolios. We strongly believe that good quality (Q), low leverage companies (L) bought with a reasonable good margin of safety (S) makes the investment very attractive and rewarding for our investors.

Our Risk Management Framework

Our Risk Management Framework & our Investment Framework are well thought-out and institutionalised to generate superior investment performance and creating a smooth investment experience for all our investors. They are framed based on our own investment experience and also imbibed learnings from some of the great investment houses and investment managers globally, which will stand the test of time and keep our investors interest at high standards. We have put risk limits based on fund mandates, market cap segments, sectors and stocks.

How are we positioned in our funds?

With macro situation being very dynamic and volatility increasing across asset classes, we continue with our strategy of running well-diversified portfolios. We are more focused on stock selection process within the sector rather than trying to take large overweight / underweight position among sectors. We would also refrain from taking aggressive cash calls. While the focus continues to be on stock selection on a bottom-up basis we would gradually tilt the portfolios towards large cap scrips compared to their midcap/small cap counter parts.

Top 2 overweight sectors in our equity schemes are as under:

- ITI Multicap fund: Capital goods, Consumer Services

- ITI ELSS Tax saver: Capital Goods, Consumer Services

- ITI Small cap fund: Capital goods, textiles

- ITI Large cap fund: Construction, Construction material

- ITI Mid cap fund: Capital goods, Construction

- ITI Value fund: Power, Consumer durables

- ITI Flexicap fund: Capital goods, Textiles

- ITI Focussed Equity: Capital goods, Autos

What should be your approach while investing into our Mutual Fund Schemes?

We expect the volatility to continue over the next few months as the market-outlook is likely to remain challenging. Valuations remain marginally above long-term averages. On the back of lower commodity prices especially crude oil and with operating leverage, earnings would rise for corporates and rupee denominated trade could lead to a strong performance by the Indian economy in Cy24.

Investors wanting to invest in lumpsum can invest in ITI Balanced Advantage Fund, Value Fund and ELSS Tax Saver Fund. Investment in equity funds, particularly mid and small cap categories, should be done systematically over the next three to four months in the form of daily / weekly STPs or SIPs. While the current rally shows little signs of slowing down, retail investors must continue investing in well-managed funds via SIPs.