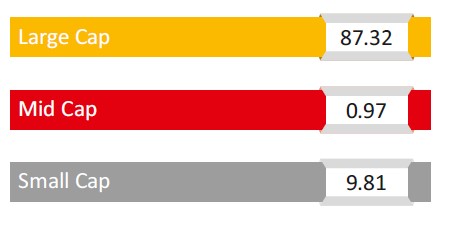

| CATEGORY OF SCHEME | Large Cap Fund |

| INVESTMENT OBJECTIVE | The investment objective of the Scheme is to seek to generate long term capital appreciation by predominantly investing in equity and equity related securities of large cap stocks. However, there can be no assurance that the investment objective of the scheme would be achieved. |

| Inception Date (Date of Allotment): | 24-Dec-20 |

| Benchmark: | Nifty 100 TRI |

| Minimum Application Amount: | Rs. 5,000/- and in multiples of Re. 1/- thereafter |

| Load Structure: | Entry Load: Nil Exit Load:1% if redeemed or switched out on or before completion of 3 months from the date of allotment of units · Nil, if redeemed or switched out after completion of 3 months from the date of allotment of units. |

| Total Expense Ratio (TER): | Including Additional Expenses and Goods and Service

Tax on Management Fees |

| Fund Manager | Mr Rajesh Bhatia (Since 01-Jan-2024) |

| AUM (in Rs. Cr): |

|

| AAUM (in Rs. Cr): | 353.33 |

| % of top 5 holdings: | 28.99% |

| % of top 10 holdings: | 44.07% |

| No. of scrips: | 55 |

| Standard Deviation^: | 12.83% |

| Beta^: | 0.97 |

| Sharpe Ratio^*: | 0.75 |

| Average P/B | 7.73 |

| Average P/E | 20.48 |

| Portfolio Turnover Ratio | 1.01 |

| ^Computed for the 3-yr period ended August 31,

2024. Based on monthly return. * Risk free rate: 6.80 (Source: FIMMDA MIBOR) |

|

Regular Plan

(in Rs.) |

Direct Plan

(in Rs.) |

|

| Growth: | 18.4663 |

19.9639 |

| IDCW: | 18.4663 |

19.9639 |

Name of the Instrument |

% to

NAV |

% to NAV

Derivatives |

|

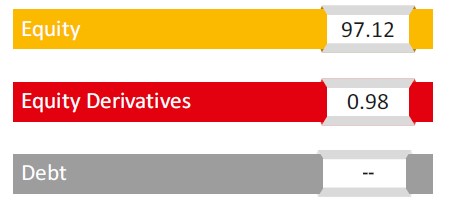

Equity & Equity Related Total |

97.12 |

0.98 |

|

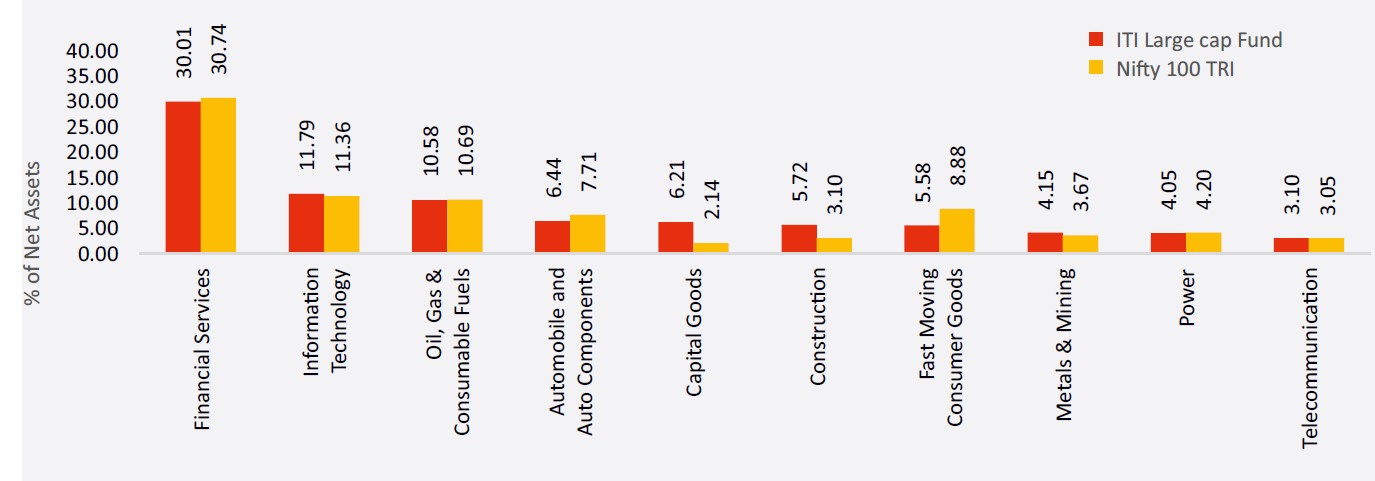

Automobile and Auto Components |

6.44 |

||

Mahindra & Mahindra Limited |

2.21 |

||

Tata Motors Limited |

2.03 |

||

Maruti Suzuki India Limited |

1.35 |

||

TVS Motor Company Limited |

0.86 |

||

Capital Goods |

6.21 |

||

Hindustan Aeronautics Limited |

1.45 |

||

Man Industries (India) Limited |

1.26 |

||

Sanghvi Movers Limited |

1.04 |

||

Bharat Electronics Limited |

0.96 |

||

Siemens Limited |

0.85 |

||

Bharat Heavy Electricals Limited |

0.66 |

||

Construction |

5.72 |

||

Larsen & Toubro Limited |

3.21 |

||

IRCON International Limited |

0.95 |

||

KNR Constructions Limited |

0.87 |

||

Engineers India Limited |

0.69 |

||

Construction Materials |

1.96 |

||

Ambuja Cements Limited |

1.26 |

||

Grasim Industries Limited |

0.69 |

||

Consumer Durables |

1.06 |

||

Titan Company Limited |

1.06 |

||

Fast Moving Consumer Goods |

5.58 |

||

ITC Limited |

2.47 |

||

Nestle India Limited |

1.26 |

||

Dabur India Limited |

1.20 |

||

Varun Beverages Limited |

0.65 |

||

Financial Services |

29.03 |

0.98 |

|

ICICI Bank Limited |

6.24 |

||

HDFC Bank Limited |

5.23 |

0.98 |

|

Axis Bank Limited |

3.54 |

||

State Bank of India |

3.15 |

||

Bank of Baroda |

1.97 |

||

Life Insurance Corporation Of India |

1.85 |

||

REC Limited |

1.41 |

||

IndusInd Bank Limited |

1.21 |

||

Karur Vysya Bank Limited |

1.04 |

||

Manappuram Finance Limited |

0.96 |

||

SBI Life Insurance Company Limited |

0.90 |

||

Jio Financial Services Limited |

0.83 |

||

Piramal Enterprises Limited |

0.70 |

||

Healthcare |

2.89 |

||

Sun Pharmaceutical Industries Limited |

1.88 |

||

Cipla Limited |

1.01 |

||

Information Technology |

11.79 |

||

Infosys Limited |

7.45 |

||

Tata Consultancy Services Limited |

2.61 |

||

Birlasoft Limited |

1.11 |

||

Zaggle Prepaid Ocean Services Limited |

0.62 |

||

Metals & Mining |

4.15 |

||

Hindalco Industries Limited |

1.77 |

||

Vedanta Limited |

1.38 |

||

JSW Steel Limited |

1.01 |

||

Oil Gas & Consumable Fuels |

10.58 |

||

Reliance Industries Limited |

5.55 |

||

Oil & Natural Gas Corporation Limited |

1.53 |

||

Coal India Limited |

1.44 |

||

GAIL (India) Limited |

1.19 |

||

Indian Oil Corporation Limited |

0.86 |

||

Power |

4.05 |

||

NTPC Limited |

3.01 |

||

Power Grid Corporation of India Limited |

1.04 |

||

Realty |

2.17 |

||

DLF Limited |

1.60 |

||

Brigade Enterprises Limited |

0.58 |

||

Services |

2.37 |

||

InterGlobe Aviation Limited |

1.40 |

||

Container Corporation of India Limited |

0.97 |

||

Telecommunication |

3.10 |

||

Bharti Airtel Limited |

3.10 |

||

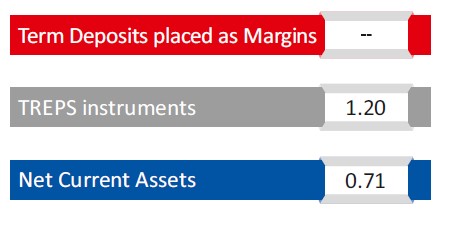

Short Term Debt & Net Current Assets |

1.91 |

Top Ten Holdings

| Period | Amount Invested |

Fund Value () |

Fund Returns (%) |

Benchmark Value () |

Benchmark Returns (%) |

Additional Benchmark Value () |

Additional Benchmark Returns (%) |

Regular - Growth |

|||||||

| Last 1 Year | 120000 |

142717 |

37.02% |

144158 |

39.48% |

141155 |

34.36% |

| Last 3 Years | 360000 |

510673 |

24.10% |

507988 |

23.72% |

494043 |

21.70% |

| Since Inception | 450000 |

665257 |

21.30% |

672578 |

21.92% |

654245 |

20.35% |

Direct - Growth |

|||||||

| Last 1 Year | 120000 |

144328 |

39.77% |

144158 |

39.48% |

141155 |

34.36% |

| Last 3 Years | 360000 |

527759 |

26.52% |

507988 |

23.72% |

494043 |

21.70% |

| Since Inception | 450000 |

693813 |

23.70% |

672578 |

21.92% |

654245 |

20.35% |

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: Nifty 100 TRI Additional Benchmark: Nifty 50 TRI. For SIP returns, monthly investment of Rs.10,000 invested on the 1st business day of every month has been considered. CAGR Returns (%) are computed after accounting for the cash flow by using the XIRR method (investment internal rate of return).

Disclaimer - Fund SIP Performance

The performance details provided herein are of Growth option under Direct and Regular Plans. The Fund(s) offer Systematic Investment Plan (SIP) facility. To illustrate the advantages of SIP investments, this is how your investments would have grown if you had invested say Rs. 10,000 systematically on the first Business Day of every month over a period of time in the Growth Option of respective scheme. The returns are calculated by XIRR approach assuming investment of 10,000/- on the 1st working day of every month. XIRR helps in calculating return on investments given an initial and final value and a series of cash inflows and outflows with correct allowance for the time impact of the transactions.

| Period | Fund Returns (%) |

Benchmark Returns (%)

|

Additional Benchmark Returns (%) |

Fund (Rs) |

Benchmark (Rs) |

Additional Benchmark Returns (Rs) |

Regular - Growth |

||||||

| Last 1 Year | 40.1% |

38.3% |

32.6% |

14,013 |

13,829 |

13,264 |

| Last 3 Years | 15.3% |

16.1% |

15.2% |

15,345 |

15,650 |

15,274 |

| Since Inception | 18.1% |

20.3% |

19.4% |

18,466 |

19,780 |

19,208 |

Direct - Growth |

||||||

| Last 1 Year | 42.9% |

38.3% |

32.6% |

14,291 |

13,829 |

13,264 |

| Last 3 Years | 17.7% |

16.1% |

15.2% |

16,323 |

15,650 |

15,274 |

| Since Inception | 20.6% |

20.3% |

19.4% |

19,964 |

19,780 |

19,208 |

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. The performance data for 5 years period has not been provided, since scheme is in existence for less than 5 years. In case, the start / end date of the concerned period is a non-business date (NBD), the NAV of the previous date is considered for computation of returns. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: Nifty 100 TRI Additional Benchmark: Nifty 50 TRI. Fund Managers: Mr Rajesh Bhatia (Managing Since 01-Jan-2024), Mr Rohan Korde (Managing Since 01-Jan-2024) and Mr. Vishal Jajoo (Managing Since 01-Jan-2024) . Inception date of the scheme (24-Dec-20). Face Value per unit: Rs. 10. ITI Large Cap Fund NAV as on August 30, 2024: Rs. 18.4663 (Regular Growth Option), Rs. 19.9639 (Direct Growth Option)

THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

- Capital appreciation over long term

- Investment in equity and equity related instruments of large cap companies

^Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Face Value per Unit: Rs. 10 unless other wise specified; Data is as of August 31, 2024 unless other wise specified.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully