Debt Market Update

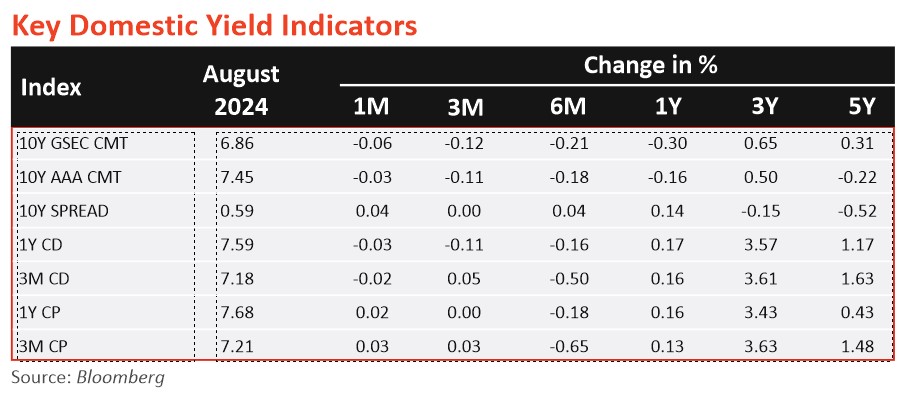

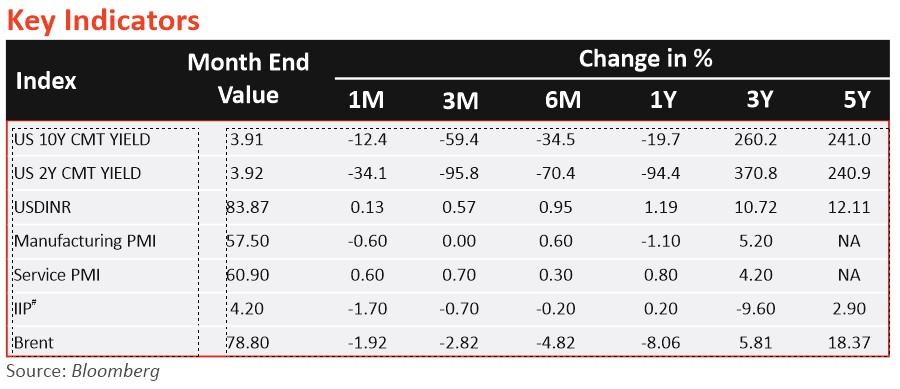

- Retail inflation (CPI) in July 2024, dropped to 3.54% (5.08% in June 2024), the lowest in 59 months, driven by declining food prices. Food inflation fell to 5.42%, its lowest print since June 2023. Despite falling from the previous month’s higher food inflation (9.36% in June), it is believed the current decrease may be temporary. Retail inflation has remained below the RBI’s tolerance level for 11 months.

- Wholesale inflation cooled in July to 2.04%, down from 3.36% in June, due to lower food and primary article prices. This marks the lowest inflation rate in three months. Food inflation, a key driver, dropped to 3.55% in July from 8.68% in June, led by a significant decrease in vegetable prices. WPI has been positive since November 2023. Non-food articles saw a price decline of 2.90% in July 2024 via-a-vis 1.95% decline in June 2024. Fuel and power prices rose 1.72% (1.03% rise in June 2024); crude petroleum and natural gas prices rose by 9.12% (12.55% rise in June 2024); manufactured products' prices rose by 1.58% (1.43% in June 2024).

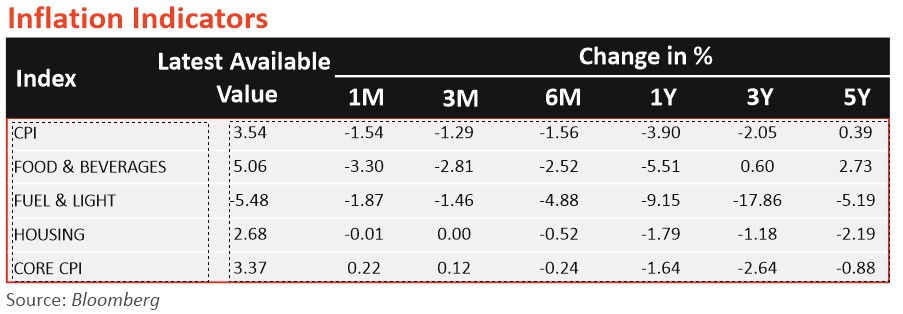

- Industrial output (IIP) expanded by 4.24% annually in June, due to weaker manufacturing growth. This follows a seven-month high of 5.9% in May 2024. Manufacturing output rose 2.6% in June 2024, a decline from last year's 3.5%. Electricity generation increased by 8.6%, and mining grew by 10.3%. Capital goods production saw a modest 2.4% rise, while consumer durables surged by 8.6%. Infrastructure/construction goods grew by 4.4%.

- India's GDP growth slowed to a five-quarter low of 6.7% in Q1FY25, down from 7.8% in the previous quarter. This slowdown was mainly due to reduced government spending linked to election activities and the impact of heatwaves. While the growth rate was below the RBI’s forecast of 7.2%, the Gross Value Added (GVA) growth rate improved to 6.8% from 6.3% in the previous quarter, indicating a positive trend in economic activity. Private consumption grew at its fastest pace in seven quarters, at 7.4%, and investment also showed strength with a 7.5% increase in gross fixed capital formation (GFCF), driven by private investments. Industrial production rose by 5.2%, and the services sector grew by 7.3%, marking a four-quarter high. However, government consumption contracted slightly, and agricultural growth disappointed with just 2% growth.

- India’s core sector output grew 6.1% in July 2024, up from 5.1% in June, driven by increased business activity and road projects. Cement, steel, fertilizers, and refinery products saw production gains, while crude oil and natural gas output declined. Coal and electricity output grew but at a slower pace compared to June. The growth is attributed to improved business conditions and construction activity. Meanwhile, manufacturing activity slightly decreased in July 2024.

- Gross GST collections in August 2024 increased 10% to Rs 1.75 lakh crore, driven by higher domestic consumption. However, net GST collections fell 9.2% to Rs 1.5 lakh crores due to increased refunds. Year-to-date, GST collections rose 10.1%, reflecting economic resilience.

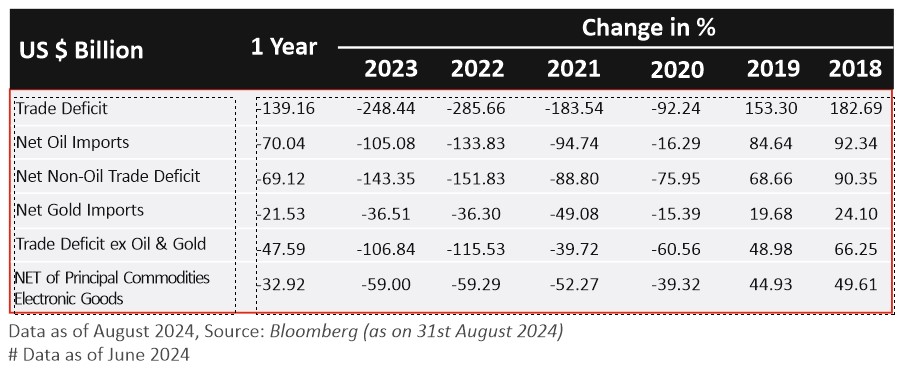

- India's merchandise goods trade deficit widened in July to USD23.5bn, up from USD20.98bn in June 2024, driven by rising imports and subdued global demand. Merchandise exports fell to USD33.98bn, continuing a downward trend from May 2024, while imports increased to USD57.48 billion. Geopolitical challenges and global economic slowdowns have dampened export growth, particularly in petroleum products. However, exports of electronic goods, engineering goods, and pharmaceuticals showed resilience. Services exports rose to USD28.43bn in July 2024, while total exports (goods and services) reached USD62.42bn, slightly higher than the previous year. Rising crude oil imports and steady gold imports remain a concern.

- The central government’s fiscal deficit in 4MFY25 remained low at ~17% of FY2025BE. Total receipts were at ~32% of FY2025BE, 32% higher than 4MFY24, led by personal income taxes and non-tax revenue. Gross tax revenue was ~28% of FY2025BE. Centre’s expenditure in 4MFY25 was ~27% of FY2025BE (5.8% lower than 4MFY24). Revenue expenditure was ~28% of FY2025BE (2.3% lower than 4MFY24) while capital expenditure in 4MFY25 was at ~24% of FY2025BE (18% lower than in 4MFY24).

Source: RBI, Bloomberg, CCIL, MOSPI

*BE - Budget Estimates

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. Index performance does not signify scheme performance