Dear Investors & Partners,

Equity market performance in August 2024

Despite huge volatility in the global markets, Nifty-50 recovered from lower levels and closed 1% higher while recording a new all-time high of 25,268 in August. The index formed a higher high for the third consecutive month. Mid cap and small cap also gained 1% each for the month. RBI maintained the status quo on rates at 6.5% as expected. The inflation estimate and the GDP estimate for FY25 were also held static at 4.5% and 7.2% respectively.

Among sectors, Healthcare (+7%), Technology (+5%), Telecom (+2%), Consumer (+2%), and Financial (+1%) were the only gainers, whereas PSU Banks (-6%), Real Estate (-4%), Capital Goods (- 3%), Utilities (-2%), and Media (-2%) were the key laggards MOM (Month on Month).

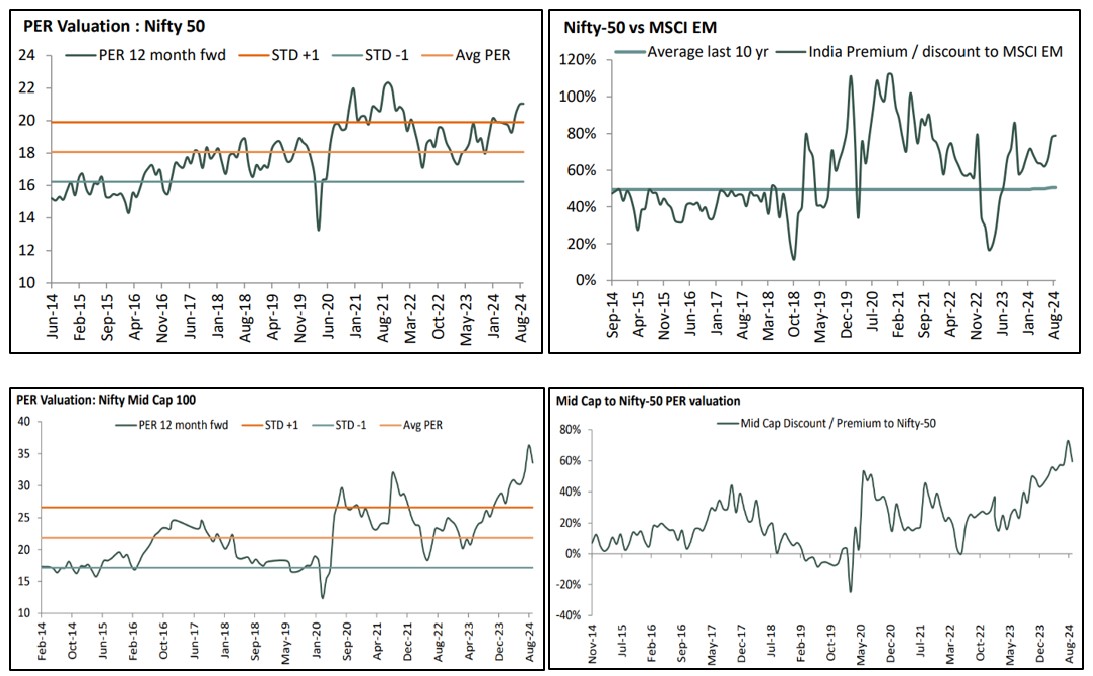

India's contribution to the worlds market capitalisation was at the highest at 4.6% (as compared to a low of 1.6% and average of 2.7% in the past 15 years). As far as valuations are concerned, India's valuation premium to Morgan Stanley Capital International Emerging Markets (MSCI EM) is trading above its historical averages. The Midcap 100 index is trading above +1 Std Deviation and its valuation premium over Nifty-50 has increased in the last 12 months.

Source: Bloomberg, IDBI Capital, as on 31st August 2024

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison

with other investments. Index performance does not signify scheme returns

Strong institutional flows:

Foreign Institutional Investors (FII) turned buyers for the third consecutive month of USD1.4b in Aug'24. Domestic Institutional Investors (DII) inflows continue to remain strong at USD5.8b in Aug'24. FII inflows into Indian equities stand at USD5.1b in CY24YTD vs. inflows of USD21.4b in CY23. DII inflows into equities in CY24YTD continue to be strong at USD37b vs. USD22.3b in CY23.

Global environment continues to be mixed:

The S&P 500 posted 2.3% gain in August, while Dow Jones Industrial Average (DJIA) climbed nearly 1.8%. The Nasdaq Composite clinched a 0.7% advance for the period. The S&P 500 notched its fourth straight winning month. A surge in consumer staples, real estate and health care helped lift the broad market index in August. S&P 500 reported 13% earnings growth for the second quarter which was the strongest earnings growth since Q4CY21. Leading the way, the tech, financials and healthcare sectors saw earnings growth of more than 20%. Only two sectors, though - materials and real estate - ended the season with earnings contractions. Revenue growth of 5.5% for S&P 500 companies was also better than the expectations of 4.2%. Materials and industrials saw revenue contractions.

Among the key global markets, Brazil (+7%), Indonesia (+6%), the US (+2%), MSCI EM (+1%), India (+1%) ended higher in local currency terms. However, Russia (-11%), Korea (-3%), China (-3%), and Japan (-1%) ended lower MoM in Aug'24. Over the last 12 months, the MSCI India Index (+40%) has significantly outperformed the MSCI EM Index (+12%). Over the last 10 years, the MSCI India Index has notably outperformed the MSCI EM index by a robust 205%

Earnings review – 1QFY25: A muted quarter

The 1QFY25 corporate earnings came in line, with overall growth primarily propelled once again by domestic cyclicals. Notable contributions were witnessed from the Healthcare, Real Estate, Capital Goods, and Metals sectors. In contrast, earnings growth was adversely affected by Oil marketing companies (OMCs).

Rainfall:

- We find that the 5% surplus rainfall at all-India level camouflages the spatial disparity to the extent that 26% of the subdivisions of India are seeing deficient rainfall (the highest being in Bihar, UP, Haryana, Punjab) .

- There is still only a 50% chance of La Nina developing in the latter half of 2024 (as per Australian Bureau of Metrology). In the recent past, when La-Nina develops, the resultant climatic conditions tend to remain for 6-7 months (favourable scenario for India).

- La Nina conditions may lead to higher moisture content conducive for good rabi sowing (RBI)

- SW monsoon accounts for 80% of the total rainfall. With change in climatic conditions, August-September (55%) sees higher rainfall than July-August (42%).

- July-August rains (in mm) have been less than the normal distribution of rainfall.

- Water reservoir levels improving, but more progress required – especially in the North (Rabi growing region).

- East, NE and NW regions are not only deficient in rainfall, but also deficient in reservoir levels.

- Despite rainfall dispersion, 89% of Kharif sowing completed (1.4% YoY)

- Wheat is a winter crop. Given the current status of rainfall and water reservoir levels, the Rabi crop production may get impacted. The probability of La Nina and rainfall patterns in Aug-Sep will give further clarity.

- Will La Nina come to rescue and ease food inflation in H2FY25? History shows that in La Nina years, inflation is less.

India is currently enjoying the confluence of the macro and micro tailwinds with ~7% GDP growth, moderating inflation prints, range-bound crude prices, easing 10-year G-sec yield, stable currency, and resilient corporate earnings. The Nifty Midcap 100 index and the Small Cap index are trading at a 12-month forward P/E ratio which is at a premium to their long-term average. Nevertheless, markets remained in their optimistic mode, as they shrugged off weak earnings while rewarding even modest beats in the 1QFY25 earnings season. Versus expectations, though, negative surprises were few, concentrated in discretionary. Industrials, metals, and durables had higher sales and EBITDA than estimated. Indian markets ended the month at a new high level, gaining 4% amid volatile sessions ahead of the Union Budget.

The FY2025 Union Budget delivered a prudent balance between capital expenditure, fiscal prudence and welfarism. The budget did minor tinkering on tax rates for individuals, while capital gains taxes were rationalized across asset classes.

While valuations are elevated, this is a function of:

- Better quality of growth: While Return on Equity (RoEs) may peak at much lower levels compared with the 2000s cycle, balance sheets and free cashflows of corporates are better with a focus on capital allocation. However, that does not imply that high valuations are sustainable.

- India's growth and balance sheet differential to EMs: Post-covid, Indian corporate earnings have been better than Ems, with a better deleveraged balance sheet.

- Strong domestic flows: This however is a feature of most bull markets, though the quantum may vary.

Going forward the focus would be on demand scenario in rural areas and visibility of any step up in the nascent recovery. While there are nascent indications of rural demand bottoming out, it is too early to call out a recovery for certain.

We continue to believe that the investment environment going forward would be a “stock picker's market” and would separate the men from the boys. There could be instances where companies operating in the same sector may end up reporting diverse set of financial results. Our approach in such an environment would be the same as we have been following over the last few quarters. It would revolve around the thesis to identify companies basis the “bottom up” approach.

Our Risk Management Framework & our Investment Framework are well thought-out and institutionalised to aim to generate superior investment performance and creating a smooth investment experience for all our investors. They are framed based on our own investment experience and also imbibed learnings from peers of the great investment houses and investment managers globally, which will stand the test of time and keep our investors interest at high standards. We have put risk limits based on fund mandates, market cap segments, sectors and stocks.

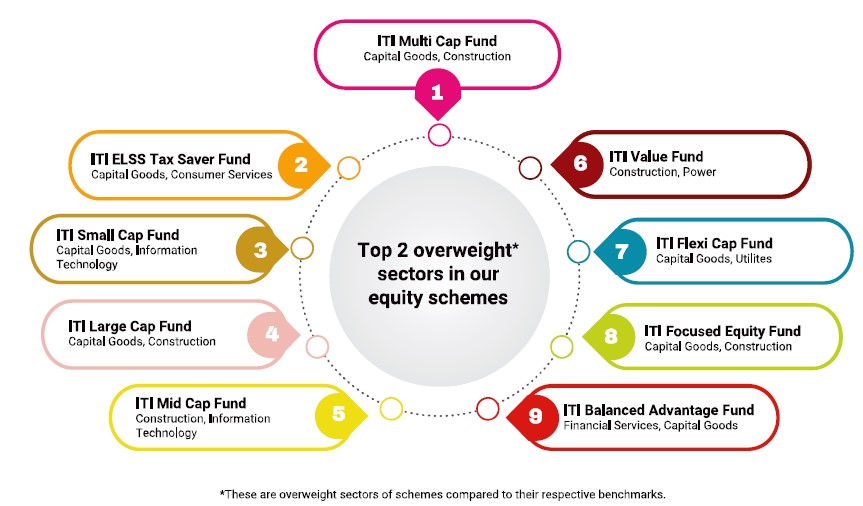

How are we positioned in our funds?

With macro situation being very dynamic and volatility increasing across asset classes, we continue with our strategy of running well-diversified portfolios. We are more focused on stock selection process within the sector rather than trying to take large overweight / underweight position among sectors. We would also refrain from taking aggressive cash calls.

What should be your approach while investing into our Mutual Fund Schemes?

We expect the volatility witnessed in the month of YTD CY24 to continue over the next few months as the market-outlook is likely to remain challenging. Valuations remain marginally above long-term averages. On the back of stable commodity prices especially crude oil and with operating leverage, earnings would rise for corporates and rupee denominated trade could lead to a strong performance by the Indian economy in Cy24.

Investors wanting to invest in lumpsum should invest in ITI Balanced Advantage Fund, Value Fund and ITI ELSS Tax Saver Fund (formerly known as ITI Long Term Equity Fund). Investment in equity funds, particularly mid and small cap categories, should be done systematically over the next three to four months in the form of daily / weekly STPs or SIPs. While the current rally shows little signs of slowing down, retail investors must continue investing in well-managed funds via SIPs.