| CATEGORY OF SCHEME | Ultra Short Duration |

| INVESTMENT OBJECTIVE | The investment objective of the Scheme is to generate regular income and capital appreciation through investment in a portfolio of short term debt & money market instruments such that the Macaulay duration of the portfolio is between 3 - 6 months. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved. |

| Inception Date (Date of Allotment): | 05-May-2021 |

| Benchmark: | CRISIL Ultra Short Duration Fund AI Index |

| Minimum Application Amount: | Rs.5,000/- and in multiples of Rs. 1/- thereafter |

| Load Structure: | Entry Load: Nil Exit Load: Nil |

| Total Expense Ratio (TER): | Including Additional Expenses and Goods and Service

Tax on Management Fees |

| Fund Manager | Mr. Vikrant Mehta (Since 05-May-2021) Total Experience: 28 years |

| AUM (in Rs. Cr): | 131.79 |

| AAUM (in Rs. Cr): | 120.52 |

| Average Maturity: | 101 Days |

| Macaulay Duration: | 97 Days |

| Modified Duration: | 93 Days |

| Yield to Maturity: | 5.69% |

Regular Plan

(in Rs.) |

Direct Plan

(in Rs.) |

|

| Growth | 1,038.3003 |

1,050.0531 |

| Daily IDCW | 1,001.0000 |

1,001.0000 |

| Weekly IDCW | 1,001.0000 |

1,001.0000 |

| Fortnightly IDCW | 1,001.4737 |

1,001.5675 |

| Monthly IDCW | 1,001.4728 |

1,001.5654 |

| Annual IDCW | 1,038.3106 |

1,050.6083 |

| Name of Instrument | Ratings |

Market Value (Rs. Lakhs) |

% to NAV |

| Debt Instrument | |||

| Corporate Bond | |||

| Aditya Birla Finance Limited | ICRA AAA |

200.04 |

1.52 |

| Bharat Petroleum Corporation Limited | CRISIL AAA |

809.97 |

6.15 |

| Export Import Bank of India | CRISIL AAA |

351.18 |

2.66 |

| Housing & Urban Development Corporation Limited | ICRA AAA |

1001.49 |

7.60 |

| National Highways Auth Of Ind | CRISIL AAA |

100.17 |

0.76 |

| NHPC Limited | ICRA AAA |

232.24 |

1.76 |

| Power Grid Corporation of India Limited | CRISIL AAA |

777.77 |

5.90 |

| REC Limited | CRISIL AAA |

500.08 |

3.79 |

| Reliance Industries Limited | CRISIL AAA |

100.17 |

0.76 |

| Government Bond | |||

| 6.69% GOI (MD 27/06/2024) | SOVEREIGN |

600.90 |

4.56 |

| Treasury Bill | |||

| 182 Days Tbill (MD 15/09/2022) | SOVEREIGN |

498.99 |

3.79 |

| 182 Days Tbill (MD 24/11/2022) | SOVEREIGN |

1974.69 |

14.98 |

| 91 Days Tbill (MD 17/11/2022) | SOVEREIGN |

494.19 |

3.75 |

| 91 Days Tbill (MD 24/11/2022) | SOVEREIGN |

493.67 |

3.75 |

| Reverse Repo/TREPS | |||

| Clearing Corporation of India Ltd | NA |

4803.00 |

36.44 |

| Net Current Assets | NA |

240.40 |

1.82 |

| Total Net Assets | 100.00 |

Value of Investment of 10,000 |

||||||

| Period | Fund Returns (%) |

Benchmark Returns (%) |

Additional Benchmark Returns (%) |

Fund () |

Benchmark () |

Additional Benchmark () |

Regular - Growth |

||||||

Last 1 Year |

2.87% |

4.06% |

3.17% |

10,286 |

10,405 |

10,316 |

Since Inception |

2.89% |

4.05% |

3.40% |

10,383 |

10,538 |

10,452 |

Direct - Growth |

||||||

Last 1 Year |

3.75% |

4.06% |

3.17% |

10,374 |

10,405 |

10,316 |

Since Inception |

3.77% |

4.05% |

3.40% |

10,501 |

10,538 |

10,452 |

Past performance may or may not be sustained in future. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: CRISIL Ultra Short Duration Fund AI Index # Additional Benchmark: CRISIL 1 Year T-Bill Index. Fund Managers: Mr. Vikrant Mehta is managing the scheme since its inception 5th May 2021. Returns less than 1 year period are simple annualized and greater than 1 year are compounded annualized. Inception date of the scheme (05-May-2021). Face Value per unit: Rs. 1000

Record Date |

Plan(s) Option(s) |

Individuals/ HUF (IDCW) (Rs per unit) |

Others (IDCW) (Rs per unit) |

Cum-IDCW NAV (Rs per unit) |

27-Jun-22 |

Regular Plan - Monthly IDCW Option |

3.3813 |

3.3813 |

1004.3813 |

25-Jul-22 |

Regular Plan - Monthly IDCW Option |

3.3841 |

3.3841 |

1004.3841 |

25-Jul-22 |

Direct Plan - Monthly IDCW Option |

4.0351 |

4.0351 |

1005.0351 |

25-Aug-22 |

Regular Plan - Monthly IDCW Option |

4.0477 |

4.0477 |

1005.0477 |

25-Aug-22 |

Direct Plan - Monthly IDCW Option |

4.7682 |

4.7682 |

1005.7682 |

Pursuant to payment of IDCW, the NAV of the IDCW Option(s) of the Scheme/Plan(s) falls to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. For complete list of IDCW, visit www.itiamc.com.

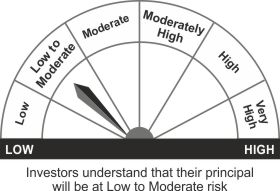

THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

- Regular income over short term

- Investments in debt and money market instruments, such that the Macaulay duration of the portfolio is between 3 months - 6 months.

^Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Data is as of August 31, 2022 unless otherwise specified

Mutual Fund investments are subject to market risks, read all scheme related documents carefully