| CATEGORY OF SCHEME | Sectoral/Thematic |

| INVESTMENT OBJECTIVE | The investment objective of the scheme is to seek to generate long term capital appreciation through investing in equity and equity related securities of companies engaged in Pharma and Healthcare. However, there can be no assurance that the investment objective of the scheme would be achieved. |

| Inception Date (Date of Allotment): | 08-Nov-21 |

| Benchmark: | Nifty Healthcare TRI |

| Minimum Application Amount: | Rs.5,000/- and in multiples of Rs. 1/- thereafter |

| Load Structure: | Entry Load: Nil Exit Load: 1% if redeemed or switched out on or before completion of 12 months from the date of allotment of units · Nil, if redeemed or switched out after completion of 12 months from the date of allotment of units. |

| Total Expense Ratio (TER): | Including Additional Expenses and Goods and Service

Tax on Management Fees |

| Fund Manager | Mr. Rohan Korde (Since 08-Nov-21) Total Experience: 19 years Mr. Pratibh Agarwal (Since 29-Apr-22) Total Experience: 11 years Ms. Hetal Gada (Since 29-Apr-22) Total Experience: 7 years |

| AUM (in Rs. Cr): | 165.32 |

| AAUM (in Rs. Cr): | 166.08 |

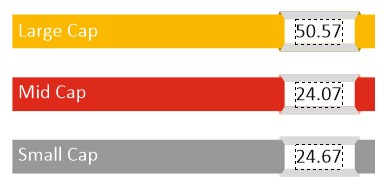

| % of top 5 holdings: | 49.91% |

| % of top 10 holdings: | 71.49% |

| No. of scrips: | 30 |

| Standard Deviation^: | NA |

| Beta^: | NA |

| Sharpe Ratio^*: | NA |

| Average P/B | 5.33 |

| Average P/E | 42.15 |

| Portfolio Beta | 0.60 |

| ^Scheme has not completed 3 years hence NA * Risk free rate: 5.34 (Source: FIMMDA MIBOR) |

|

Regular Plan

(in Rs.) |

Direct Plan

(in Rs.) |

|

| Growth: | 9.1727 |

9.3463 |

| IDCW: | 9.1727 |

9.3463 |

Name of the Instrument |

% to

NAV |

% to NAV

Derivatives |

|

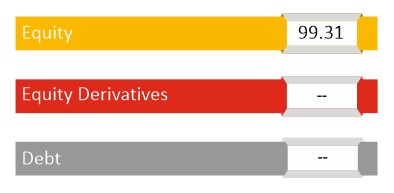

Equity & Equity Related Total |

99.31 |

||

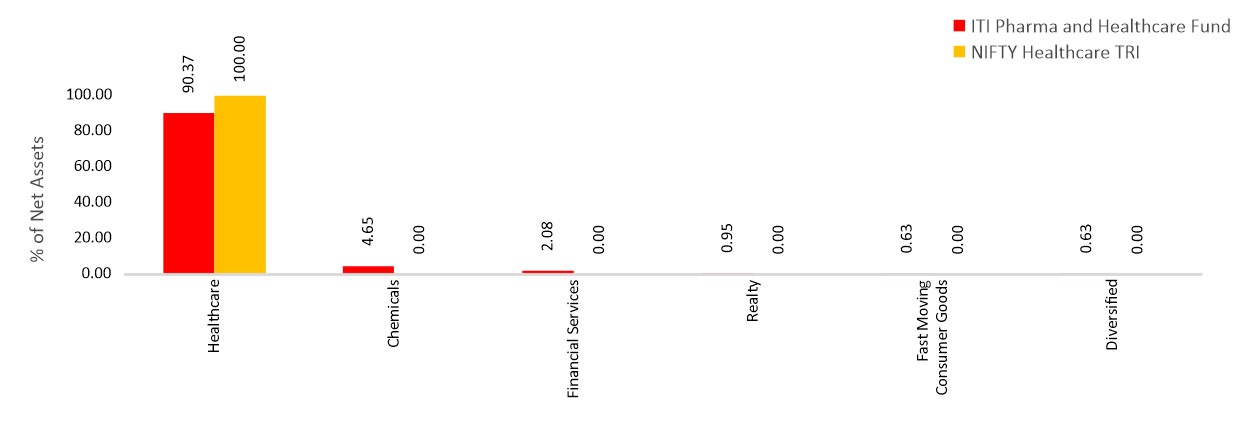

Chemicals |

4.65 |

||

Astec LifeSciences Limited |

3.37 |

||

Gujarat Fluorochemicals Limited |

1.27 |

||

Diversified |

0.63 |

||

TTK Healthcare Limited |

0.63 |

||

Fast Moving Consumer Goods |

0.63 |

||

Advanced Enzyme Technologies Limited |

0.63 |

||

Financial Services |

2.08 |

||

ICICI Lombard General Insurance Company Limited |

1.06 |

||

SBI Life Insurance Company Limited |

1.02 |

||

Healthcare |

90.37 |

||

Sun Pharmaceutical Industries Limited |

20.18 |

||

Lupin Limited |

8.07 |

||

Cipla Limited |

7.51 |

||

Torrent Pharmaceuticals Limited |

7.09 |

||

Divi's Laboratories Limited |

7.06 |

||

Dr. Reddy's Laboratories Limited |

6.65 |

||

GlaxoSmithKline Pharmaceuticals Limited |

4.44 |

||

Natco Pharma Limited |

3.84 |

||

Alkem Laboratories Limited |

3.27 |

||

Ajanta Pharma Limited |

2.88 |

||

Narayana Hrudayalaya Limited |

2.65 |

||

Suven Pharmaceuticals Limited |

2.22 |

||

Fortis Healthcare Limited |

2.15 |

||

FDC Limited |

1.94 |

||

Kovai Medical Center and Hospital Limited |

1.75 |

||

Aster DM Healthcare Limited |

1.72 |

||

Zydus Lifesciences Limited |

1.58 |

||

Max Healthcare Institute Limited |

1.49 |

||

JB Chemicals & Pharmaceuticals Limited |

1.19 |

||

Syngene International Limited |

0.99 |

||

IPCA Laboratories Limited |

0.80 |

||

Indoco Remedies Limited |

0.53 |

||

Hester Biosciences Limited |

0.37 |

||

Realty |

0.95 |

||

Alembic Limited |

0.95 |

||

Short Term Debt & Net Current Assets |

0.69 |

Top Ten Holdings

| Period | Fund Returns (%) |

Benchmark Returns (%) |

Additional Benchmark Returns (%) |

Regular - Growth |

|||

| Last 6 Months | 0.60% |

-1.24% |

13.49% |

| Since Inception | -10.24% |

-8.04% |

-0.60% |

Direct - Growth |

|||

| Last 6 Months | 2.96% |

-1.24% |

13.49% |

| Since Inception | -8.09% |

-8.04% |

-0.60% |

Past performance may or may not be sustained in future. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: Nifty Healthcare TRI # Additional Benchmark: Nifty 50 TRI. Fund Managers: Mr. Rohan Korde (Since 08-Nov-21). Mr. Pratibh Agarwal (Since 29-Apr-22). and Ms. Hetal Gada (Since 29-Apr-22). Inception date of the scheme (Since 08-Nov-2021). Face Value per unit: Rs. 10.

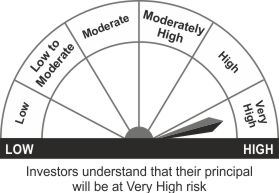

THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

- Capital appreciation over long term

- Investments in equity and equity related securities of companies engaged in Pharma and Healthcare.

^Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Face Value per Unit: Rs. 10 unless other wise specified; Data is as of August 31, 2022 unless other wise specified

Mutual Fund investments are subject to market risks, read all scheme related documents carefully