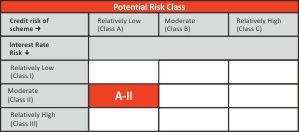

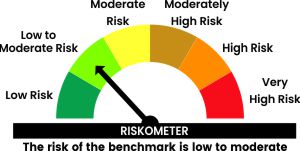

| CATEGORY OF SCHEME | Ultra Short Duration |

| INVESTMENT OBJECTIVE | The investment objective of the Scheme is to generate regular income and capital appreciation through investment in a portfolio of short term debt & money market instruments such that the Macaulay duration of the portfolio is between 3 - 6 months. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved. |

| Inception Date (Date of Allotment): | 05-May-2021 |

| Benchmark: | CRISIL Ultra Short Duration Debt A-I Index |

| Minimum Application Amount: | Rs.5,000/- and in multiples of Rs. 1/- thereafter |

| Load Structure: | Entry Load: Nil Exit Load: Nil |

| Total Expense Ratio (TER): | Including Additional Expenses and Goods and Service

Tax on Management Fees |

| Fund Manager | Mr. Laukik Bagwe (Since 01-Feb-25) Total experience: 25 years |

| AUM (in Rs. Cr): | 205.73 |

| AAUM (in Rs. Cr): | 205.03 |

| Average Maturity: | 171 Days |

| Macaulay Duration: | 169 Days |

| Modified Duration: | 163 Days |

| Yield To Maturity (Regular & Direct) Plans : |

6.75% |

Regular Plan

(in Rs.) |

Direct Plan

(in Rs.) |

|

| Growth | 1,223.9342 |

1,265.6957 |

| Daily IDCW | 1,002.9241 |

1,001.9884 |

| Weekly IDCW | 1,003.4188 |

NA |

| Fortnightly IDCW | 1,003.1855 |

NA |

| Monthly IDCW | 1,003.1976 |

1,003.7591 |

| Annual IDCW | 1,223.9848 |

1,267.3097 |

| Name of Instrument | Ratings |

Market Value (Rs. Lakhs) |

% to NAV |

Debt Instrument |

|||

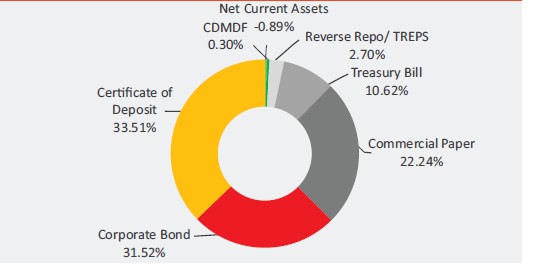

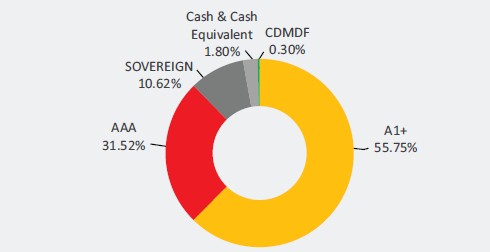

Certificate of Deposit |

|||

Axis Bank Limited |

CRISIL A1+ |

1953.31 |

9.49 |

Indian Bank |

CRISIL A1+ |

1911.04 |

9.29 |

HDFC Bank Limited |

CARE A1+ |

1664.74 |

8.09 |

IDFC First Bank Limited |

CRISIL A1+ |

544.60 |

2.65 |

Canara Bank |

CRISIL A1+ |

522.00 |

2.54 |

Punjab National Bank |

CRISIL A1+ |

299.25 |

1.45 |

Commercial Paper |

|||

Bajaj Finance Limited |

CRISIL A1+ |

1991.97 |

9.68 |

ICICI Securities Limited |

CRISIL A1+ |

1494.21 |

7.26 |

Indian Oil Corporation Limited |

ICRA A1+ |

1088.89 |

5.29 |

Corporate Bond |

|||

REC Limited |

CRISIL AAA |

1985.54 |

9.65 |

Small Industries Dev Bank of India |

ICRA AAA |

1503.21 |

7.31 |

National Bank For Agriculture and Rural Development |

CRISIL AAA |

1485.58 |

7.22 |

Power Grid Corporation of India Limited |

CRISIL AAA |

1261.14 |

6.13 |

Bharat Petroleum Corporation Limited |

CRISIL AAA |

249.71 |

1.21 |

Corporate Debt Market Development Fund |

|||

Corporate Debt Market Development Fund Class A2 |

62.36 |

0.30 |

|

Treasury Bill |

|||

91 Days Tbill (MD 12/06/2025) |

SOVEREIGN |

1489.95 |

7.24 |

91 Days Tbill (MD 19/06/2025) |

SOVEREIGN |

694.53 |

3.38 |

Reverse Repo/TREPS |

|||

Clearing Corporation of India Ltd |

NA |

554.91 |

2.70 |

Net Current Assets |

NA |

-184.09 |

-0.89 |

Total Net Assets |

100.00 |

Value of Investment of 10,000 |

||||||

| Period | Fund Returns (%) |

Benchmark Returns (%) |

Additional Benchmark Returns (%) |

Fund () |

Benchmark () |

Additional Benchmark () |

Regular - Growth |

||||||

Last 7 days |

4.99% |

5.58% |

7.88% |

10,010 |

10,011 |

10,015 |

Last 15 days |

6.15% |

6.72% |

8.15% |

10,025 |

10,028 |

10,034 |

Last 30 days |

8.22% |

8.88% |

11.83% |

10,068 |

10,073 |

10,097 |

Last 3 Months |

7.46% |

8.23% |

8.71% |

10,182 |

10,201 |

10,212 |

Last 6 Months |

6.85% |

7.64% |

7.86% |

10,340 |

10,379 |

10,390 |

Last 1 Year |

6.74% |

7.65% |

7.86% |

10,674 |

10,765 |

10,786 |

Last 3 Years |

6.03% |

7.09% |

6.64% |

11,924 |

12,285 |

12,133 |

Since Inception |

5.20% |

6.30% |

5.90% |

12,239 |

12,762 |

12,569 |

Direct - Growth |

||||||

| Last 7 days | 5.71% |

5.58% |

7.88% |

10,011 |

10,011 |

10,015 |

| Last 15 days | 6.87% |

6.72% |

8.15% |

10,028 |

10,028 |

10,034 |

| Last 30 days | 8.95% |

8.88% |

11.83% |

10,074 |

10,073 |

10,097 |

| Last 3 Months | 8.22% |

8.23% |

8.71% |

10,200 |

10,201 |

10,212 |

| Last 6 Months | 7.66% |

7.64% |

7.86% |

10,380 |

10,379 |

10,390 |

| Last 1 Year | 7.61% |

7.65% |

7.86% |

10,761 |

10,765 |

10,786 |

| Last 3 Years | 6.92% |

7.09% |

6.64% |

12,228 |

12,285 |

12,133 |

| Since Inception | 6.08% |

6.30% |

5.90% |

12,657 |

12,762 |

12,569 |

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments.The performance data for 5 years period has not been provided, since scheme is in existence for less than 5 years. In case, the start / end date of the concerned period is a non-business date (NBD), the NAV of the previous date is considered for computation of returns. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: CRISIL Ultra Short Duration Debt A-I Index Additional Benchmark: CRISIL 1 Year T-Bill Index. Fund Manager: Mr. Laukik Bagwe (Since 01-Feb-25) Inception date of the scheme (05-May-2021). Face Value per unit: Rs. 1000. ITI Ultra Short Duration Fund NAV as on April 30, 2025: Rs. 1223.9342 (Regular Plan Growth Option), Rs. 1265.6957 (Direct Plan Growth Option)

Record Date |

Plan(s) Option(s) |

Individuals/ HUF (IDCW) (Rs per unit) |

Others (IDCW) (Rs per unit) |

Cum-IDCW NAV (Rs per unit) |

26-02-2025 |

Regular Plan - Monthly IDCW Option |

5.4414 |

5.4414 |

1006.4414 |

25-03-2025 |

Regular Plan - Monthly IDCW Option |

5.0062 |

5.0062 |

1006.0062 |

25-04-2025 |

Regular Plan - Monthly IDCW Option |

6.3713 |

6.3713 |

1009.3142 |

Pursuant to payment of IDCW, the NAV of the IDCW Option(s) of the Scheme/Plan(s) falls to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. For complete list of IDCW, visit www.itiamc.com.

THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

- Regular income over short term

- Investments in debt and money market instruments, such that the Macaulay duration of the portfolio is between 3 months - 6 months.

^Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

*Please refer to Scheme Information Document where concept of Macaulay's Duration is explained

Face Value per Unit: Rs. 1000 unless otherwise specified Data is as of April 30, 2025 unless otherwise specified.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully