| CATEGORY OF SCHEME | Sectoral/ Thematic Fund |

| INVESTMENT OBJECTIVE | To generate long-term capital appreciation by investing primarily in Equity and Equity related securities of companies engaged in consumption and consumption related activities or allied sectors. However, there can be no assurance that the investment objective of the scheme would be achieved. |

| Inception Date (Date of Allotment): | Mar 06, 2025 |

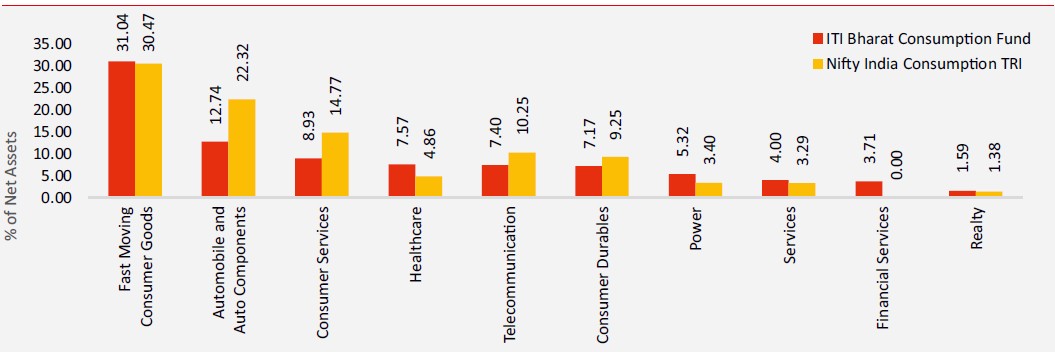

| Benchmark: | Nifty India Consumption TRI |

| Minimum Application Amount: | Rs. 5,000/- and in multiples of Rs. 1/- thereafter |

| Load Structure: | Entry Load: Nil

|

| Total Expense Ratio (TER): | Including Additional Expenses and Goods and

Service Tax on Management Fees |

| Fund Manager | Mr. Rohan Korde (Since 06-Mar-25)

Total Experience : 17 years |

| AUM (in Rs. Cr): | 183.39 |

| AAUM (in Rs. Cr): | 172.30 |

| % of top 5 holdings: | 24.48% |

| % of top 10 holdings: | 37.38% |

| No of scrips: | 60 |

| Standard Deviation^: | NA |

| Beta^: | NA |

| Sharpe Ratio^*: | NA |

| Average P/B | 11.58 |

| Average P/E | 43.82 |

| Portfolio Turnover Ratio | - |

^Scheme has not completed 3 years hence NA

* Risk free rate: 6.00 (Source: FIMMDA MIBOR) |

|

Regular Plan

(in Rs.) |

Direct Plan

(in Rs.) |

|

| Growth: | 10.7519 |

10.7861 |

| IDCW: | 10.7519 |

10.7861 |

Name of the Instrument |

% to

NAV |

% to NAV

Derivatives |

|

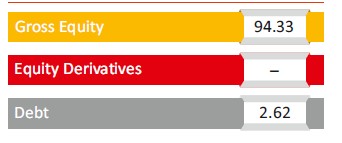

Equity & Equity Related Total |

94.33 |

||

Automobile and Auto Components |

12.74 |

||

Mahindra & Mahindra Limited |

4.05 |

||

Eicher Motors Limited |

2.36 |

||

Maruti Suzuki India Limited |

2.30 |

||

TVS Motor Company Limited |

1.94 |

||

Bajaj Auto Limited |

1.08 |

||

Hero MotoCorp Limited |

1.01 |

||

Capital Goods |

0.88 |

||

Escorts Kubota Limited |

0.88 |

||

Chemicals |

0.81 |

||

Sumitomo Chemical India Limited |

0.81 |

||

Consumer Durables |

7.17 |

||

Titan Company Limited |

3.32 |

||

Blue Star Limited |

1.84 |

||

Asian Paints Limited |

1.29 |

||

Havells India Limited |

0.71 |

||

Consumer Services |

8.93 |

||

The Indian Hotels Company Limited |

2.26 |

||

Trent Limited |

1.92 |

||

Lemon Tree Hotels Limited |

1.14 |

||

Info Edge (India) Limited |

0.98 |

||

Vishal Mega Mart Limited |

0.97 |

||

Eternal Limited |

0.96 |

||

Avenue Supermarts Limited |

0.70 |

||

Fast Moving Consumer Goods |

31.04 |

||

ITC Limited |

6.83 |

||

Hindustan Unilever Limited |

4.05 |

||

Tata Consumer Products Limited |

2.53 |

||

Varun Beverages Limited |

1.77 |

||

Godfrey Phillips India Limited |

1.65 |

||

Nestle India Limited |

1.62 |

||

Emami Limited |

1.52 |

||

Britannia Industries Limited |

1.47 |

||

CCL Products (India) Limited |

1.45 |

||

Godrej Consumer Products Limited |

1.16 |

||

Bikaji Foods International Limited |

1.05 |

||

Mrs. Bectors Food Specialities Limited |

0.98 |

||

United Spirits Limited |

0.98 |

||

Procter & Gamble Hygiene and Health Care Limited |

0.97 |

||

Marico Limited |

0.94 |

||

AWL Agri Business Limited |

0.91 |

||

Jyothy Labs Limited |

0.69 |

||

Colgate Palmolive (India) Limited |

0.44 |

||

Financial Services |

3.71 |

||

Housing & Urban Development Corporation Limited |

1.05 |

||

IndusInd Bank Limited |

0.99 |

||

Karur Vysya Bank Limited |

0.89 |

||

HDFC Life Insurance Company Limited |

0.78 |

||

Healthcare |

7.57 |

||

Max Healthcare Institute Limited |

1.91 |

||

Apollo Hospitals Enterprise Limited |

1.57 |

||

Krishna Institute Of Medical Sciences Limited |

1.25 |

||

Divi's Laboratories Limited |

0.95 |

||

Abbott India Limited |

0.95 |

||

Aster DM Healthcare Limited |

0.93 |

||

Miscellaneous |

1.09 |

||

Ather Energy Limited |

1.09 |

||

Oil Gas & Consumable Fuels |

1.20 |

||

Reliance Industries Limited |

1.20 |

||

Power |

5.32 |

||

Tata Power Company Limited |

2.61 |

||

Adani Energy Solutions Limited |

0.96 |

||

Adani Power Limited |

0.91 |

||

NTPC Limited |

0.84 |

||

Realty |

1.59 |

||

Godrej Properties Limited |

0.86 |

||

DLF Limited |

0.72 |

||

Services |

4.00 |

||

InterGlobe Aviation Limited |

3.10 |

||

eClerx Services Limited |

0.90 |

||

Telecommunication |

7.40 |

||

Bharti Airtel Limited |

6.23 |

||

Bharti Hexacom Limited |

1.17 |

||

Textiles |

0.88 |

||

Page Industries Limited |

0.88 |

||

Short Term Debt & Net Current Assets |

5.67 |

Top Ten Holdings

THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

- Capital appreciation over long term

- Invest predominantly in equity and equity related instruments of companies that are likely to benefit directly or indirectly from the domestic consumption led demand

^Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Nifty India Consumption (TRI)]

Face Value per Unit: Rs. 10 unless other wise specified; Data is as of April 30, 2025 unless other wise specified.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully