| CATEGORY OF SCHEME | Focused Fund |

| INVESTMENT OBJECTIVE | The investment objective of the scheme is to seek to generate long term capital appreciation by investing in a concentrated portfolio of equity & equity related instruments of upto 30 companies across market capitalization. However, there can be no assurance that the investment objective of the scheme would be achieved. |

| Inception Date (Date of Allotment): | 19th June, 2023 |

| Benchmark: | Nifty 500 TRI |

| Minimum Application Amount: | Rs. 5,000/- and in multiples of Rs. 1/- thereafter |

| Load Structure: | Entry Load: Not Applicable Exit Load: · 1% if redeemed or switched out on or before completion of 12 months from the date of allotment of units; · Nil, if redeemed or switched out after completion of 12 months from the date of allotment of units. |

| Total Expense Ratio (TER): | Including Additional Expenses and Goods and

Service Tax on Management Fees |

| Fund Manager | Mr. Dhimant Shah (Since 19-June-2023) |

| AUM (in Rs. Cr): | 370.36 |

| AAUM (in Rs. Cr): | 350.15 |

| % of top 5 holdings: | 22.81% |

| % of top 10 holdings: | 40.19% |

| No of scrips: | 30 |

| Standard Deviation^: | NA |

| Beta^: | NA |

| Sharpe Ratio^*: | NA |

| Average P/B | 7.40 |

| Average P/E | 26.02 |

| Portfolio Beta | NA |

| Portfolio Turnover Ratio | 0.88 |

^Scheme has not completed 3 years hence NA

* Risk free rate: 6.75 (Source: FIMMDA MIBOR) |

|

Regular Plan

(in Rs.) |

Direct Plan

(in Rs.) |

|

| Growth: | 13.2348 |

13.4592 |

| IDCW: | 13.2348 |

13.4592 |

Name of the Instrument |

% to

NAV |

% to NAV

Derivatives |

|

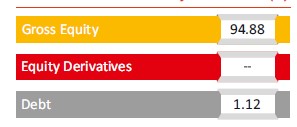

Equity & Equity Related Total |

94.88 |

||

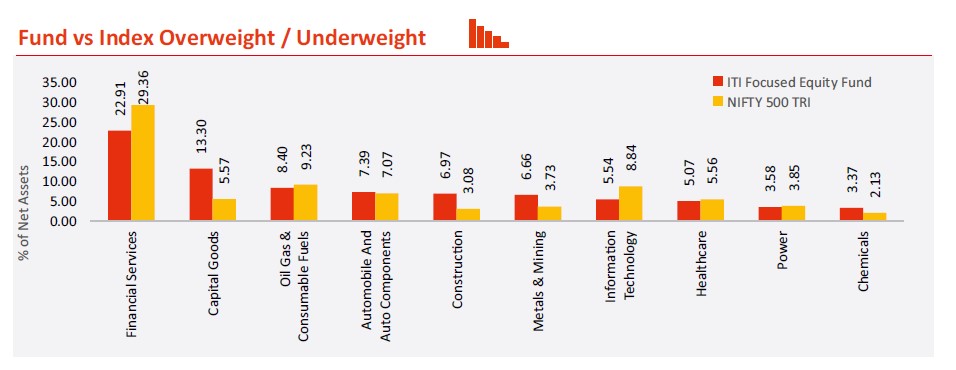

Automobile and Auto Components |

7.39 |

||

Maruti Suzuki India Limited |

2.91 |

||

Craftsman Automation Limited |

2.54 |

||

ZF Commercial Vehicle Control Systems India Limited |

1.95 |

||

Capital Goods |

13.30 |

||

Kaynes Technology India Limited |

3.14 |

||

Graphite India Limited |

3.06 |

||

AIA Engineering Limited |

2.73 |

||

Praj Industries Limited |

2.19 |

||

Hindustan Aeronautics Limited |

2.18 |

||

Chemicals |

3.37 |

||

Solar Industries India Limited |

3.37 |

||

Construction |

6.97 |

||

Sterling And Wilson Renewable Energy Limited |

3.86 |

||

Larsen & Toubro Limited |

3.12 |

||

Construction Materials |

2.30 |

||

UltraTech Cement Limited |

2.30 |

||

Fast Moving Consumer Goods |

3.18 |

||

ITC Limited |

3.18 |

||

Financial Services |

22.91 |

||

ICICI Bank Limited |

5.16 |

||

HDFC Bank Limited |

4.37 |

||

Power Finance Corporation Limited |

4.06 |

||

Multi Commodity Exchange of India Limited |

3.53 |

||

State Bank of India |

3.32 |

||

SBI Life Insurance Company Limited |

2.47 |

||

Healthcare |

5.07 |

||

Sun Pharmaceutical Industries Limited |

2.68 |

||

Abbott India Limited |

2.39 |

||

Information Technology |

5.54 |

||

Tata Consultancy Services Limited |

2.85 |

||

Oracle Financial Services Software Limited |

2.69 |

||

Metals & Mining |

6.66 |

||

National Aluminium Company Limited |

3.59 |

||

Vedanta Limited |

3.08 |

||

Oil Gas & Consumable Fuels |

8.40 |

||

Reliance Industries Limited |

5.36 |

||

Oil & Natural Gas Corporation Limited |

3.04 |

||

Power |

3.58 |

||

SJVN Limited |

3.58 |

||

Realty |

3.30 |

||

Prestige Estates Projects Limited |

3.30 |

||

Telecommunication |

2.90 |

||

Bharti Airtel Limited |

2.90 |

||

Mutual Fund Units |

1.12 |

||

ITI Banking & PSU Debt Fund -Direct Plan -Growth Option |

1.12 |

||

Short Term Debt & Net Current Assets |

3.99 |

Top Ten Holdings

| Period | Fund Returns (%) |

Benchmark Returns (%) |

Additional Benchmark Returns (%) |

Benchmark (Rs) |

Fund (Rs) |

Additional Benchmark Returns (Rs) |

Regular - Growth |

||||||

| Last 6 Months | 55.1% |

50.7% |

37.6% |

12,447 |

12,270 |

11,727 |

| Since Inception | 37.4% |

35.7% |

24.7% |

13,235 |

13,091 |

12,135 |

Direct - Growth |

||||||

| Last 6 Months | 57.6% |

50.7% |

37.6% |

12,545 |

12,270 |

11,727 |

| Since Inception | 40.0% |

35.7% |

24.7% |

13,459 |

13,091 |

12,135 |

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: Nifty 500 TRI Additional Benchmark: Nifty 50 TRI. Fund Managers: Mr. Dhimant Shah (Managing since 19-June-2023) and Mr. Rohan Korde (Managing since 19-June-2023). Inception date of the scheme is (19-June-23). Face Value per unit: Rs. 10. Simple annualized returns have been provided as per the extant guidelines since the scheme has completed 6 months but not 1 year. ITI Focused Equity Fund NAV as on April 30, 2024: Rs. 13.2348 (Regular Growth Option), Rs. 13.4592 (Direct Growth Option)

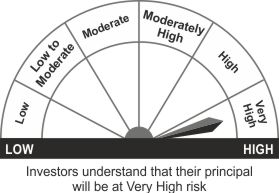

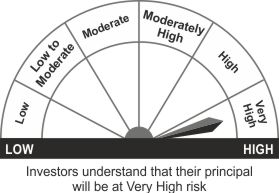

THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

- Capital appreciation over long term

- Investments in a concentrated portfolio of equity & equity related instruments of up to 30 companies

^Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Face Value per Unit: Rs. 10 unless other wise specified; Data is as of April 30, 2024 unless other wise specified.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully