Debt Market Update

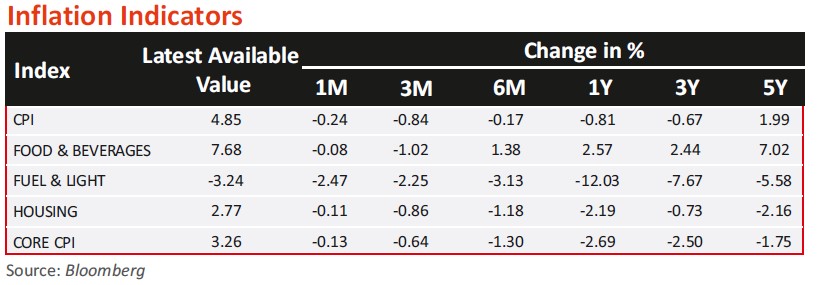

- CPI (retail inflation) in March 2024 fell to a ten-month low of 4.85% (5.09%. in February 2024), the lowest since May 2023 when it recorded 4.31%. The latest inflation reading indicates a continuing downward trend in consumer prices. Food inflation slightly decreased to 8.52% from 8.66% last month. The central bank forecasts CPI inflation at 4.5% this fiscal year. Although remaining within the RBI's 2%-6% acceptable range for seven months, it has exceeded the 4% medium-term target for 54 consecutive months.

- As of March 2024, India's annual rate of inflation based on WPI hit a three-month peak of 0.53% owing mainly to increase in food and primary articles prices viz. electricity, crude petroleum, natural gas, machinery, equipment, and other manufacturing products. Overall, wholesale inflation trended lower by 0.7% ending March FY24, a sharp contrast to the previous year’s 9.41% increase.

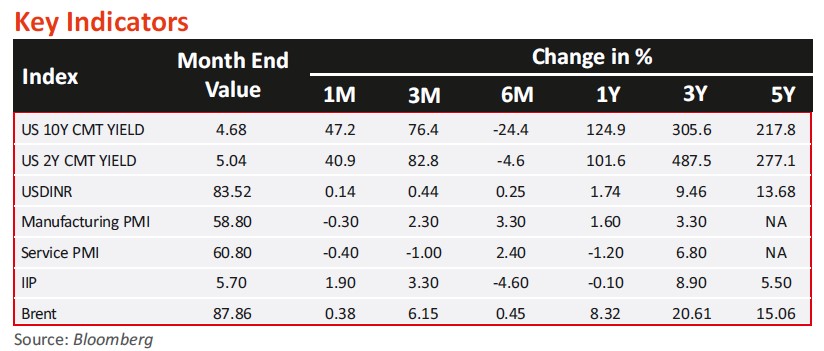

- Industrial output (IIP) expanded to 5.7% in February 2024, marking an improvement from the 4.1% increase in January 2024. IIP growth can be attributed to overall expansion in key sectors like coal, crude oil, natural gas, refinery products, fertilizers, steel, cement, and electricity—comprising about 40% of the IIP—suggesting a robust industrial performance. However, the performance across sectors was uneven, with consumer non-durables shrinking by 3.8%, while consumer durables surged by 12.3%. Over April 2023 – February 2024, the IIP grew at 5.9%, slightly higher than the 5.6% in the same period the previous year.

- April 2024 GST collections raced to a record Rs 2.10 lakh crore (1.78 lakh crore in March 2024), a 12.4% surge year-on-year. The growth is largely driven by a 13.4% rise in domestic transactions and an 8.3% increase in imports.

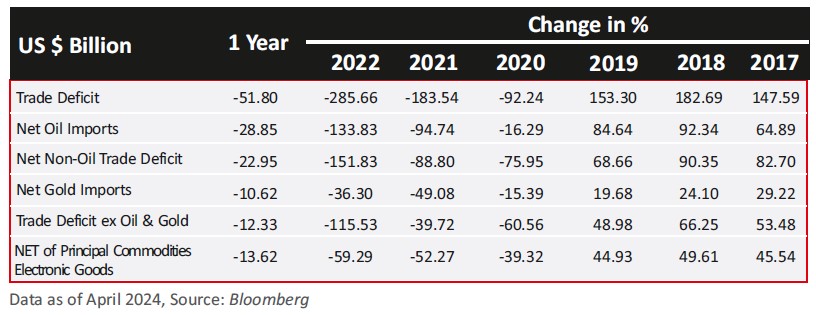

- The country’s merchandise exports decreased to USD437.1bn. In contrast, services exports expanded by 4.4%, scaling a record high of USD339.6bn, up from USD325.3bn the previous year. The services sector also saw a decline in imports, dropping by 2.46% to USD177.6bn from USD182.1 bn in FY23. This performance highlights an expansion in services exports alongside a reduction in imports for the year.

- The combined eight core sectors, compromising coal, crude oil, steel, cement, electricity, fertilizers, refinery products, and natural gas, expanded by 5.2% in March 2024. This was slower than the 7.1% growth in February 2024 but marked an improvement over the 4.2% growth in March 2023. The growth rate for these sectors in FY24 was 7.5%, slightly lower than the 7.8% seen in the same period last year. The slowdown in March 2024 growth was primarily due to a contraction or reduced pace of growth in five of the sectors, with crude oil production growing at just 2% compared to 7.9% in the preceding month.

Source: Bloomberg Internal Research

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. Index performance does not signify scheme performance