Dear Investors & Partners,

Equity market performance in April'24

The Nifty-50 index was up 1.2% MoM in Apr-24, thus closing higher for the third successive month. Small cap and mid cap indices were up by 11% & 6% respectively. Mid caps / small caps outperformed large caps by 4.6%/10.2% in Apr'24. There was mixed trend among the sectors, with Metal, Realty sector leading with +11% & +8% MoM and IT was weak.

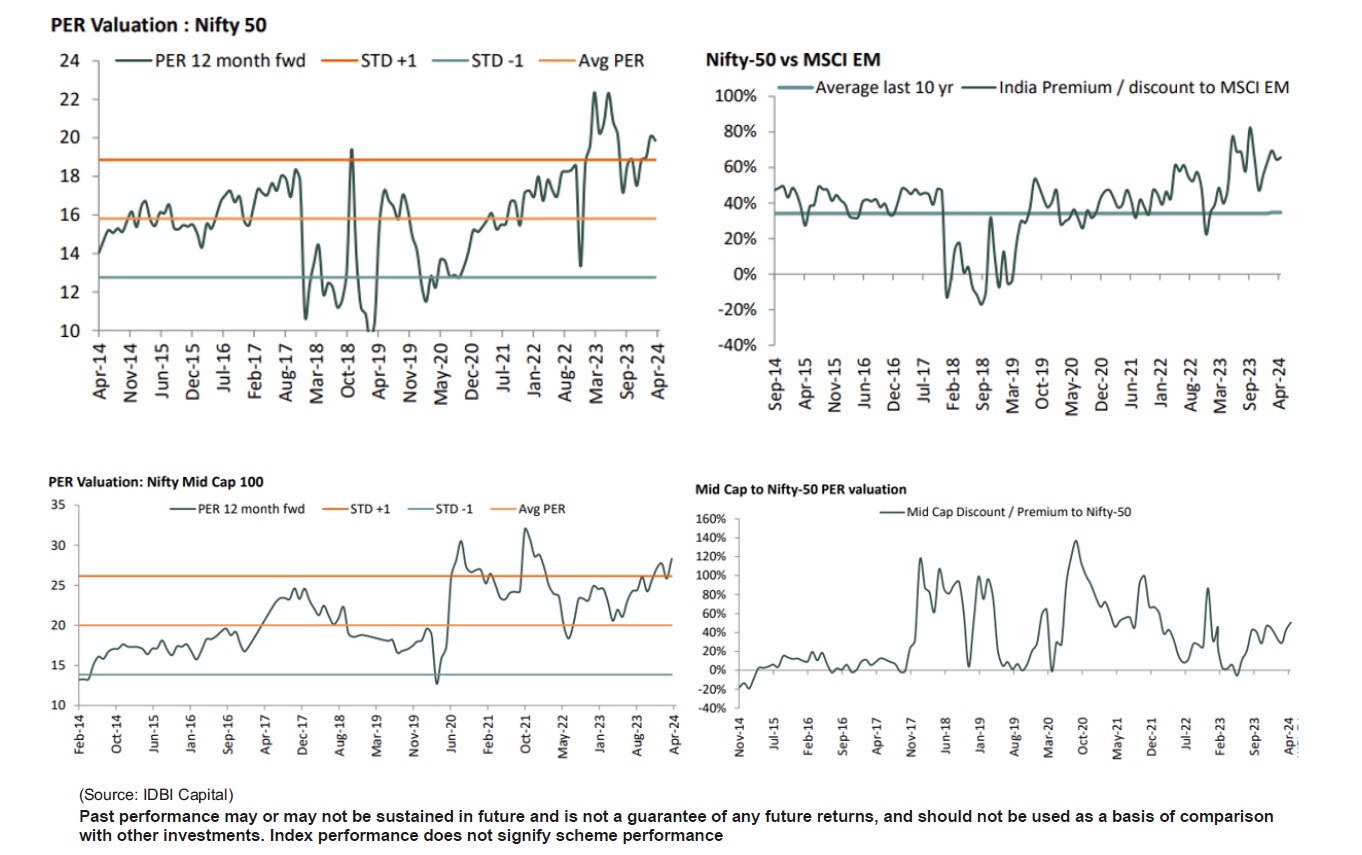

As far as valuations are concerned, India's valuation premium to Morgan Stanley Capital International Emerging Markets (MSCI EM) is trading above its historical averages. The Nifty is trading at a 12-month forward P/E ratio of 19.7x, near its LPA of 20.3x (3% discount). The Mid cap 100 index is trading above +1 Std Deviation and its valuation premium over Nifty-50 has increased in the last 12 months.

Strong institutional flows:

Domestic ins DII + FII flows stood at ~USD50.5b in FY24, the highest ever in any financial year. The continued rise in retail participation, along with increasing SIP contributions and the addition of new demat accounts (over 3.6m accounts per month during Oct'23-Mar'24) amid the ongoing trend of financialization of savings, has supported the markets in the face of global volatility.

DIIs recorded the ninth consecutive month of inflows in Apr'24 at USD5.3b. FIIs recorded outflows of USD1.1b in Apr'24. FII inflows into Indian equities stand at USD0.3b in CY24YTD vs. inflows of USD21.4b in CY23. DII inflows into equities in CY24YTD continue to be strong at USD18.4b vs. USD22.3b in CY23.

Global environment continues to be mixed:

US Fed maintained its target range for federal funds rate at 5.25 – 5.5% in its May'24 policy meet due to 'lack of further progress' towards bringing inflation to its objective of 2% and solid growth in economic activity. US 10-year bond yield climbed ~50 bps since Mar'24 to touch a 10 month high of ~4.7%, but settled lower at ~4.5% on weaker US employment market was weak. Geo-political risks in the Middle East after flaring up in Apr'24 have moderated, bringing respite on oil price front.

Stable quarterly earnings season required to support valuations:

Nifty-50 has reported ~19% YoY EPS growth in 9MFY24 and implied for Q4FY24 is ~7% YoY. FY25 EPS growth expectation is ~15% YoY. Given that the valuations across indices are higher than the 10 year historical average, a stable earnings season would be crucial to avoid in the near -term blips, even as the long-term outlook remains strong for the Indian economy and markets.

Midway through the ongoing 4QFY24 season, so far there have not been many positive surprises. Most earnings have been meeting with street expectations, while a few companies have delivered negative surprises. This has resulted in limited upgrades in earnings, even though long-term optimism stays intact.

Structural positive macro view remains intact:

- Healthy GDP growth: Real GDP growth crossed 8% for the third successive quarter in 3QFY24 vs 8.1% (revised higher from 7.6%) in 2QFY24 and 4.3% in 3QFY23 (revised lower from 4.8%). 1QFY24 GDP growth was also revised higher to 8.2% from 7.8%. Consequently, GDP growth for 9MFY24 stood at 8.2%. Higher-than-expected GDP growth was partly led by a downward revision in 3QFY23 growth (to 4.3% from 4.8% earlier) and a very high growth in real net indirect taxes, driven by lower subsidies.

- Revised fiscal deficit target should be met: The surge in Govt. direct tax collections in Aug-Feb'24 is likely to offset the shortfall from indirect tax collections & higher spending on food and fertilizer subsidies. Thus, despite the expectation of expenditure overrun, the Govt. should manage to meet the revised fiscal deficit target of 5.8% of the GDP in FY24RE. (Revenue Estimate)

- State capex pick-up: Following in the footsteps of the Centre, the combined capex of 17 major states (~80% of the total capex by all the states) sharply grew by 34% yoy to Rs 4.8tn during 11MFY24 vs Rs3.6tn in 11MFY23 and Rs 2.7tn in 11MFY20 (pre-covid period). Notably, this marks the highest level of capex these states have ever seen in the first eleven months of any fiscal year. The sharp jump in States' capex has been supported by higher-than-budgeted GST collection, and a faster disbursal of Rs 1tn loan from the Centre. This interest-free 50-year loan has been extended to states for capital expenditure. The strong capex momentum can continue in FY25, as the states' fiscal position is quite comfortable. This trend is positive for cement demand, construction companies' payment cycles, and companies' order books, and it contributes towards spurring rural demand revival.

- Private investment cycle recovery will be key: While there was a sharp increase in corporate profitability since FY20, private capex pickup had relatively lagged. Capex increased 26% in FY23, and private capital projects ordering in 9MFY24 increased 33% YoY. Based upon this data, it is possible that some green shoots are already visible.

- Interest rate reduction should commence in 2HCY24: US Federal Reserve officials plan to reduce key interest rates three times in 2024 despite higher inflation, though the quantum and the beginning of the same is not year certain. However, its increasingly likely that the interest rate cycle has peaked.

India is currently enjoying the confluence of the macro and micro tailwinds with ~7% GDP growth, moderating inflation prints, range-bound crude prices, easing 10-year G-sec yield, stable currency, and resilient corporate earnings. Nifty is trading at a 12-month forward P/E ratio which is at a premium to its long-term average, as is the NSE Midcap 100 index.

Earnings growth trajectory, capex, policy initiatives like PLI, etc., Lok Sabha election outcome, and the timing and quantum of interest rate easing globally, will be monitorables for sustained valuations and market growth. This is even as India has outperformed the MSCI index.

Going forward the focus would be on demand scenario in rural areas as the rural segment continues to be weak on account of lower than expected monsoon. While there are nascent indications of rural demand bottoming out, it is too early to call out a recovery for certain. Also the upcoming elections and the phase of Government formation may lead to some delay in announcement and ordering of various projects/equipments. Stability and continuation in policy post elections would augur very well for our markets despite any short term volatility.

We continue to believe that the investment environment going forward would be a “stock picker's market” and would separate the men from the boys. There could be instances where companies operating in the same sector may end up reporting diverse set of financial results. Our approach in such an environment would be the same as we have been following over the last few quarters. It would revolve around the thesis to identify companies basis the “bottom up” approach.

Source - Motilal Oswal, Bloomberg, Internal research.

Our Risk Management Framework & our Investment Framework are well thought-out and institutionalised to generate superior investment performance and creating a smooth investment experience for all our investors. They are framed based on our own investment experience and also imbibed learnings from some of the great investment houses and investment managers globally, which will stand the test of time and keep our investors interest at high standards. We have put risk limits based on fund mandates, market cap segments, sectors and stocks.

How are we positioned in our funds?

With macro situation being very dynamic and volatility increasing across asset classes, we continue with our strategy of running well-diversified portfolios. We are more focused on stock selection process within the sector rather than trying to take large overweight / underweight position among sectors. We would also refrain from taking aggressive cash calls.

What should be your approach while investing into our Mutual Fund Schemes?

We expect the volatility witnessed in the month of YTD CY24 to continue over the next few months as the market-outlook is likely to remain challenging. Valuations remain marginally above long-term averages. On the back of stable commodity prices especially crude oil and with operating leverage, earnings would rise for corporates and rupee denominated trade could lead to a strong performance by the Indian economy in CY24.

Investors wanting to invest in lumpsum should invest in ITI Balanced Advantage Fund, Value Fund and ITI ELSS Tax Saver Fund (formerly known as ITI Long Term Equity Fund). Investment in equity funds, particularly mid and small cap categories, should be done systematically over the next three to four months in the form of daily / weekly STPs or SIPs. While the current rally shows little signs of slowing down, retail investors must continue investing in well-managed funds via SIPs.