| CATEGORY OF SCHEME | Flexi cap Fund |

| INVESTMENT OBJECTIVE | The investment objective of the scheme is to generate long-term capital appreciation from a diversified portfolio that dynamically invests in equity and equity-related securities of companies across various market capitalisation. However, there can be no assurance that the investment objective of the scheme would be achieved. |

| Inception Date (Date of Allotment): | 17th Feb 2023 |

| Benchmark: | Nifty 500 Total Return Index |

| Minimum Application Amount: | Rs. 5,000/- and in

multiples of Rs. 1/- thereafter |

| Load Structure: | Entry Load: Not Applicable Exit Load: · 1% if redeemed or switched out on or before completion of 12 months from the date of allotment of units; · Nil, if redeemed or switched out after completion of 12 months from the date of allotment of units. |

| Total Expense Ratio (TER): | Including Additional Expenses and Goods and Service Tax on Management Fees Regular Plan: 2.34% Direct Plan: 0.41% |

| Fund Manager | Mr. Dhimant Shah (Since 17-Feb-2023) |

| AUM (in Rs. Cr): | 403.54 |

| AAUM (in Rs. Cr): | 394.37 |

| % of top 5 holdings: | 16.75% |

| % of top 10 holdings: | 27.38% |

| No of scrips: | 63 |

| Standard Deviation^: | NA |

| Beta^: | NA |

| Sharpe Ratio^*: | NA |

| Average P/B | 5.58 |

| Average P/E | 35.59 |

| Portfolio Beta | 1.01 |

^Scheme has not completed 3 years hence NA

* Risk free rate: 6.84 (Source: FIMMDA MIBOR) |

|

Regular Plan

(in Rs.) |

Direct Plan

(in Rs.) |

|

| Growth: | 12.1224 |

12.2930 |

| IDCW: | 12.1224 |

12.2930 |

Name of the Instrument |

% to

NAV |

% to NAV

Derivatives |

|

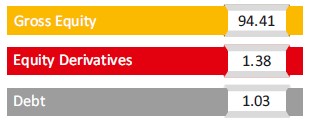

Equity & Equity Related Total |

94.41 |

1.38 |

|

Automobile and Auto Components |

9.78 |

1.03 |

|

Craftsman Automation Limited |

2.17 |

||

ZF Commercial Vehicle Control Systems India Limited |

1.73 |

||

TVS Motor Company Limited |

1.50 |

||

Schaeffler India Limited |

1.36 |

||

MRF Limited |

1.02 |

||

Rajratan Global Wire Limited |

1.02 |

||

Minda Corporation Limited |

0.97 |

||

Hero MotoCorp Limited |

1.03 |

||

Capital Goods |

17.92 |

0.35 |

|

AIA Engineering Limited |

2.11 |

||

Inox Wind Limited |

1.95 |

||

Suzlon Energy Limited |

1.89 |

||

Finolex Cables Limited |

1.81 |

||

Sanghvi Movers Limited |

1.63 |

||

Bharat Electronics Limited |

1.46 |

||

Kirloskar Pneumatic Company Limited |

1.41 |

||

Vesuvius India Limited |

1.40 |

||

Kirloskar Oil Engines Limited |

1.37 |

||

Avalon Technologies Limited |

1.05 |

||

Carborundum Universal Limited |

0.94 |

||

Jupiter Wagons Limited |

0.74 |

||

Hindustan Aeronautics Limited |

0.14 |

0.35 |

|

Chemicals |

4.76 |

||

Vishnu Chemicals Limited |

1.40 |

||

Linde India Limited |

1.29 |

||

EID Parry India Limited |

1.04 |

||

Gujarat Fluorochemicals Limited |

1.02 |

||

Construction |

3.63 |

||

Larsen & Toubro Limited |

2.47 |

||

ITD Cementation India Limited |

1.16 |

||

Construction Materials |

2.22 |

||

UltraTech Cement Limited |

2.22 |

||

Consumer Durables |

1.88 |

||

Dixon Technologies (India) Limited |

0.95 |

||

Cera Sanitaryware Limited |

0.93 |

||

Consumer Services |

2.96 |

||

The Indian Hotels Company Limited |

1.62 |

||

Zomato Limited |

1.34 |

||

Fast Moving Consumer Goods |

4.10 |

||

ITC Limited |

2.16 |

||

Godfrey Phillips India Limited |

1.94 |

||

Financial Services |

24.46 |

||

HDFC Bank Limited |

5.04 |

||

ICICI Bank Limited |

3.87 |

||

Multi Commodity Exchange of India Limited |

2.20 |

||

Axis Bank Limited |

1.89 |

||

State Bank of India |

1.59 |

||

Jio Financial Services Limited |

1.58 |

||

IDFC Limited |

1.53 |

||

Manappuram Finance Limited |

1.46 |

||

Power Finance Corporation Limited |

1.40 |

||

Canara Bank |

1.32 |

||

IndusInd Bank Limited |

1.30 |

||

Union Bank of India |

1.27 |

||

Healthcare |

5.09 |

||

Abbott India Limited |

1.49 |

||

Sun Pharmaceutical Industries Limited |

1.32 |

||

Mankind Pharma Limited |

1.25 |

||

Concord Biotech Limited |

1.03 |

||

Information Technology |

3.00 |

||

Coforge Limited |

1.75 |

||

LTIMindtree Limited |

1.25 |

||

Metals & Mining |

1.34 |

||

Jindal Steel & Power Limited |

1.34 |

||

Oil Gas & Consumable Fuels |

4.70 |

||

Reliance Industries Limited |

3.16 |

||

Coal India Limited |

0.98 |

||

IRM Energy Ltd |

0.56 |

||

Power |

1.99 |

||

NTPC Limited |

1.99 |

||

Realty |

1.05 |

||

Oberoi Realty Limited |

1.05 |

||

Telecommunication |

1.91 |

||

Bharti Airtel Limited |

1.91 |

||

Textiles |

2.53 |

||

Arvind Limited |

1.45 |

||

Ganesha Ecosphere Limited |

1.08 |

||

Utilities |

1.12 |

||

VA Tech Wabag Limited |

1.12 |

||

Mutual Fund Units |

1.03 |

||

ITI Banking & PSU Debt Fund -Direct Plan -Growth Option |

1.03 |

||

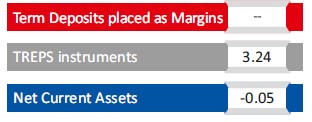

Short Term Debt & Net Current Assets |

3.19 |

Top Ten Holdings

| Period | Amount Invested |

Fund Value () |

Fund Returns (%) |

Benchmark Value () |

Benchmark Returns (%) |

Additional Benchmark Value () |

Regular - Growth |

||||||

| Last 6 Months | 31.8% |

21.9% |

12.8% |

11,510 |

11,061 |

10,633 |

| Since Inception | 30.3% |

18.3% |

10.4% |

12,037 |

11,248 |

10,717 |

Direct - Growth |

||||||

| Last 6 Months | 34.1% |

21.9% |

12.8% |

11,611 |

11,061 |

10,633 |

| Since Inception | 32.7% |

18.3% |

10.4% |

12,194 |

11,248 |

10,717 |

Past performance may or may not be sustained in future. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: Nifty 500 TRI Additional Benchmark: Nifty 50 TRI. Fund Managers: Mr. Dhimant Shah (Managing since 17-Feb-2023) and Mr. Rohan Korde (Managing since 17-Feb-2023). Inception date of the scheme (17-Feb-23). Face Value per unit: Rs. 10. Simple annualized returns have been provided as per the extant guidelines since the scheme has completed 6 months but not 1 year.

THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

- Capital appreciation over long term

- Investments in a diversified portfolio consisting of equity and equity related instruments across market capitalization

^Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Face Value per Unit: Rs. 10 unless other wise specified; Data is as of October 31, 2023 unless other wise specified.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully