| CATEGORY OF SCHEME | Banking and PSU Fund |

| INVESTMENT OBJECTIVE | The investment objective of the Scheme is to generate income / capital appreciation through investments in debt and money market instruments consisting predominantly of securities issued by entities such as Scheduled Commercial Banks (SCBs), Public Sector undertakings (PSUs), Public Financial Institutions (PFIs) and Municipal Bonds. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved. |

| Inception Date (Date of Allotment): | 22-Oct-20 |

| Benchmark: | CRISIL Banking and PSU Debt Index |

| Minimum Application Amount: | Rs.5,000/- and in multiples of Rs. 1/- thereafter |

| Load Structure: | Entry Load: Nil Exit Load: Nil |

| Total Expense Ratio (TER): | Including Additional Expenses and Goods and Service Tax on Management Fees Regular Plan: 0.70% Direct Plan: 0.15% |

| Fund Manager | Mr. Vikrant Mehta (Since 18-Jan-21) Total Experience: 28 years |

| AUM (in Rs. Cr): | 27.44 |

| AAUM (in Rs. Cr): | 27.38 |

| Average Maturity: | 0.21 Year |

| Macaulay Duration: | 0.20 Year |

| Modified Duration: | 0.19 Year |

| Yield to Maturity: | 6.57% |

Regular Plan

(in Rs.) |

Direct Plan

(in Rs.) |

|

Growth |

10.8066 |

10.9275 |

IDCW |

10.8066 |

10.9275 |

| Name of Instrument | Ratings |

Market Value (Rs. Lakhs) |

% to NAV |

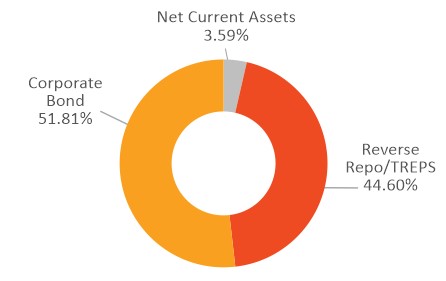

| Debt Instrument | |||

| Corporate Bond | |||

| Bharat Petroleum Corporation Limited | CRISIL AAA |

200.46 |

7.30 |

| Chennai Petroleum Corporation Limited | CRISIL AAA |

249.09 |

9.08 |

| National Highways Auth Of Ind | CRISIL AAA |

250.01 |

9.11 |

| NHPC Limited | ICRA AAA |

271.00 |

9.87 |

| Power Grid Corporation of India Limited | CRISIL AAA |

200.90 |

7.32 |

| Power Finance Corporation Limited | CRISIL AAA |

250.28 |

9.12 |

| Reverse Repo/TREPS | |||

| Clearing Corporation of India Ltd | NA |

1224.00 |

44.60 |

| Net Current Assets | NA |

98.62 |

3.59 |

| Total Net Assets | 100.00 |

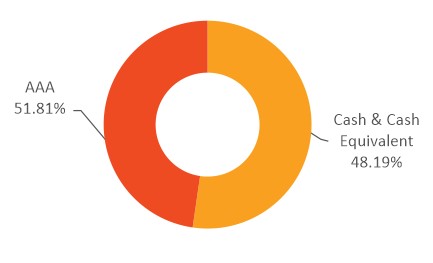

| HIGH CREDIT QUALITY Invests a minimum of 80% in Debt Instruments of Banks, PSUs & PFIs, which are generally high quality in nature |

|

| HIGH LIQUIDITY Banks, PSUs & PFIs Debt Instruments are generally highly liquid |

|

| PERFORMANCE This category of funds have provided stable returns during various market phases and have better risk reward |

|

| TAXATION Investing for a holding period of more than 3 years, gives an edge over conventional Fixed Income products due to benefit of indexation without a significant higher credit risk |

| Period | Fund Returns (%) |

Benchmark Returns (%) |

Additional Benchmark Returns (%) |

Benchmark (Rs) |

Fund (Rs) |

Additional Benchmark Returns (Rs) |

Regular - Growth |

||||||

| Last 1 Year | 3.62% |

2.21% |

-0.96% |

10,364 |

10,222 |

9,904 |

| Since Inception | 3.91% |

3.48% |

0.51% |

10,807 |

10,717 |

10,104 |

Direct - Growth |

||||||

| Last 1 Year | 4.19% |

2.21% |

-0.96% |

10,422 |

10,222 |

9,904 |

| Since Inception | 4.48% |

3.48% |

0.51% |

10,928 |

10,717 |

10,104 |

Past performance may or may not be sustained in future. Different Plans i.e. Regular Plan and Direct Plan under the scheme have different expense structure. Benchmark: CRISIL Banking and PSU Debt Index # Additional Benchmark: CRISIL 10 Year Gilt Index. Fund Manager: Mr. Vikrant Mehta from (January 18, 2021). Inception date of the scheme (22-Oct-20). Face Value per unit: Rs. 10.

THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

- Regular income over short to medium term

- Investments in debt and money market instruments, consisting predominantly of securities issued by Banks, Public Sector undertakings, Public Financial Institutions & Municipal Bonds

^Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Data is as of October 31, 2022 unless otherwise specified

Mutual Fund investments are subject to market risks, read all scheme related documents carefully