Dear Partners

As has been mentioned in our previous communication to you, we continue to like India's long-term story. Nevertheless, in the wake of commodity price volatility, inflation, policy rate hikes, adverse currency movements and the (now what seems to be interminable) Ukraine – Russia conflict, if the global stagflation type scenario continues for longer, the Indian market could feel the heat. In this backdrop, we maintain our strategy of holding sector neutral portfolios to navigate this uncertainty.

India's relative strength remains…

Given the Fed's hawkish stance, a period of rising rates with slowing economies is not inconceivable. The Indian Economy is in a better shape as it has been driven by supply side reforms and a prudent monetary and fiscal policy. Moreover, tightening fiscal and monetary policies can address inflation only from the demand side. Simultaneously, from the supply side, trade disruptions, export bans and the resulting surge in global commodity prices will continue to stoke inflation if Russia-Ukraine conflict persists, and global supply chains remain un-repaired. Hence the possibility of widespread stagflation.

Compared to other nations, including the advanced economies, India is relatively better prepared to handle external shocks that could be created by the tightening of the monetary policy stance. We reiterate our observation that as compared to previous periods of hawkish policy stance, this time around, the inflation differential is in India's favour, due to which policymakers may not follow the Fed completely. India's low external debt, which has insulated it from extreme external volatility and our foreign exchange reserves which could cover imports for >8 months, make it a bright spot vis-à-vis other countries. India has been a fast-growing economy, even during the difficult times of the pandemic, underpinned by structural reforms, which should serve well ahead.

The flipside to this strength in the market is that rising interest rates and slowing earnings have taken the market to higher valuations. Markets can remain well above fair value if flows are strong and there is recapitulation by some of the FIIs in having a re-exposure to India. While the domestic flows remain resilient, foreign investor inflows were also positive the end of October and early November (though we cannot say for certain if this trend will sustain). If the trend sustains, then it may possibly negate the negative global sentiment.

Driven by structural positives :- Two of the structural positives for Indian corporates like the balance sheet strength at every level – government, corporates and households and economic policy stability after a period of disruptive reforms viz. demonetisation, GST, RERA, the bankruptcy law helped maintain this positive outlook. Commodity prices having fallen from their recent peaks would also lead to imports moderating and BOP deficit coming under control and improve forex reserves. From a slightly futuristic view point the PLI schemes should help fortifying our manufacturing base significantly

Domestic demand environment remains optimistic in post festive season as well. Domestic consumption has traditionally been one of the main drivers of India's economic growth. Pent up domestic demand and significant deleveraging across sectors has aided recovery to a large extent. Corporates appear to indicate a stable to optimistic demand outlook partly also aided by formalisation of the Economy.

Hence, even if most global banks and agencies have downgraded their growth outlook for India to below 7%; as per the IMF, the world as a whole will slow down from 6.0% in 2021 to 3.2% in 2022 and 2.7% in 2023 as per estimates. Despite the cut in estimates, excluding Saudi Arabia, as per the IMF, India is the only economy that is likely to witness a GDP growth rate of over 6%, which will be higher than major advanced and emerging market economies.

Rural recovery underway and import substitution the themes to watch out for: - While rural demand has taken a knock since the pandemic and has not participated in the recovery till now, this year's Diwali was the country's first season of celebration since the pandemic began and the trends were decent. With no virus-related restrictions and with the rural market seeing good rains, consumption could bounce back in CY23 and this could lead to a recovery in the rural sector as well.

China's continued adherence to the zero-Covid strategy, in addition to the already existing efforts to diversify from China can lead to global capital increasingly look at India as a favourable investment opportunity and can potentially continue to attract good FDI flows, which can lead to India emerging as a manufacturing hub in key global value chains. India is generally considered an attractive destination because of its market size and also being a possible hub for exports in the region.

How are we positioned in our funds?

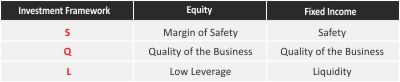

With macro situation being very dynamic and volatilities across asset classes increasing, we continue with our strategy of running well diversified portfolios. We are more focused on stock selections within the sector rather than trying to take large overweight / underweight positions among sectors. The focus continues to be on stock selection on a bottom-up basis anchored on our “SQL Investment Framework”

What should be your approach while investing into our Mutual Fund Schemes?

We expect the volatility to continue over the next few months as the market-outlook is likely to remain challenging. With markets having seen a good bounce back till August, we saw some consolidation in September-October. However, valuations remain slightly above long-term averages. We have observed in the past that whenever crude has corrected due to demand destruction in economic recessions, India's earnings growth and market performance have not remained immune. However, if crude prices correct due to increase in supplies, India will definitely benefit. Coupled with lower prices of other commodities too, and with operating leverage, earnings would rise for corporates and rupee denominated trade could lead to a strong performance by the Indian economy.

Our Investment Framework – SQL

Based on our combined investment learnings of more than 50 years, we have institutionalized very strong and unique investment Framework -SQL, which is core to our fund management framework and approach to our portfolios. We strongly believe that good quality (Q), low leverage companies (L) bought with a reasonable good margin of safety (S) makes the investment very attractive and rewarding for our investors.

Our Risk Management Framework

Our Risk Management Framework & our unique Investment Framework are well thought-out and institutionalised to generate superior investment performance and creating a smooth investment experience for all our investors. They are framed based on our own investment experience and also imbibed learnings from some of the great investment houses and investment managers globally, which will stand the test of time and keep our investors interest at high standards. We have put risk limits based on fund mandates, market cap segments, sectors and stocks.