Debt Market Update

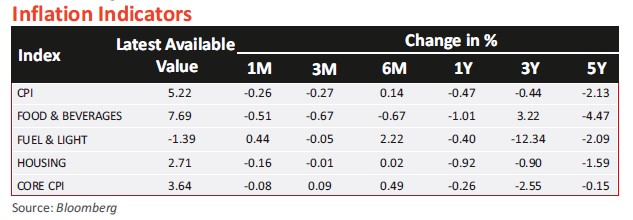

- Consumer Price Index (CPI) inflation eased to 5.2% in December 2024 from 5.5% in November 2024, though it remained above the 5% mark for the fourth consecutive month. The decline was largely attributed to lower food prices, particularly in vegetables, key staples, and pulses. With inflation showing signs of moderation and economic growth slowing, attention is now on the RBI's stance on potential rate cuts.

- WPI inflation increased to 2.37% year-on-year in December 2024 from 1.89% in November 2024. The rise was driven by costlier primary articles and manufactured goods. Food prices played a significant role, climbing 8.89% in December, with vegetable prices surging 28.65% and pulses registering a 5.02% increase.

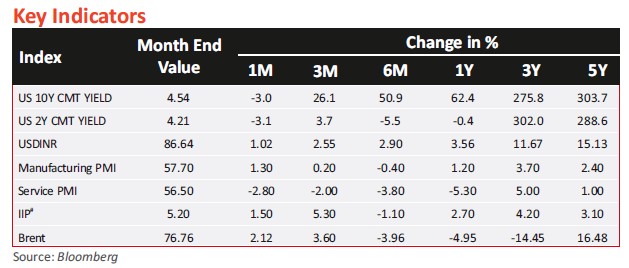

- Industrial production (IIP) saw a notable increase in November 2024, reaching a six-month peak of 5.2%, up from 3.7% in October. Growth was fueled by a robust manufacturing sector (5.8%), along with steady expansions in mining (1.9%) and electricity (4.4%). The core sector grew by 4.3%, with infrastructure goods output hitting a 13-month high of 10%, supported by higher government spending. Consumer durables recorded the highest growth at 13.1%, whereas non-durables saw a modest rise of 0.6%. The increase was largely driven by festive demand and a favourable base effect, although overall momentum remained subdued, as sequential industrial production declined by 1.2%.

- Core industries experienced a 4% growth in December 2024, slightly lower than the 4.4% recorded in November 2024, continuing a four-month expansion streak. These key sectors, which make up 40% of the IIP, had played a role in pushing industrial output to a six-month peak of 5.2% in November. However, the deceleration in core sector growth raises economic concerns, especially as GDP has declined to a seven-quarter low of 5.4%.

- GST collections for January 2025 rose 12.3% year-on-year to Rs 1.96 lakh crore (Rs 1.76 lakh crore in December 2024). Year-to-date collections scaled to Rs 16.33 lakh crore, marking a 9.1% rise from the previous year but falling 18.98% short of the fiscal 2024 target.

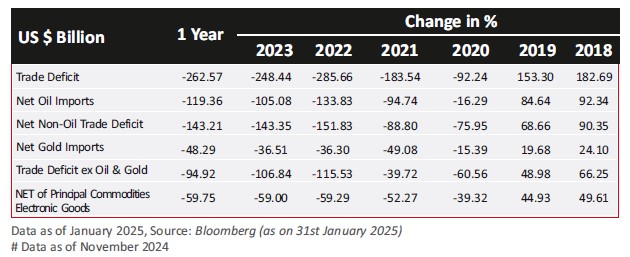

- India's merchandise trade deficit contracted to USD21.9bn in December 2024, a significant reduction from USD37.8bn in November 2024. Export earnings touched USD38.0bn, while imports stood at approximately USD60bn. The trade ministry recently revised import figures for precious metals, such as gold, after an earlier miscalculation overstated imports between April and November by USD 5 billion. Consequently, the trade deficit for that period was adjusted downward by USD13.6bn to USD188.8bn. In December 2024, gold imports amounted to USD4.7bn, while oil imports were valued at USD15.2bn.

- The Union Budget 2026 sought to balance fiscal discipline with economic stimulation. Efforts to spur middle-class consumption included raising the tax exemption threshold while adjusting tax rates for higher income brackets. Additionally, key sectors such as agriculture and the gig economy received policy support. The government aims to lower the fiscal deficit to 4.4% of GDP in 2025-26, down from 4.8%, reflecting a commitment to financial stability.

Source: RBI, Bloomberg, CCIL, MOSPI

*BE - Budget Estimates

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. Index performance does not signify scheme performance Investors should consult their financial advisers if in doubt about whether the product is suitable for them.