| CATEGORY OF SCHEME | Large & Mid Cap Fund |

| INVESTMENT OBJECTIVE | The investment objective of the Scheme is to seek to generate long term capital appreciation by investing in equity and equity related securities of large cap & mid cap stocks. However, there can be no assurance that the investment objective of the scheme would be achieved. |

| Inception Date (Date of Allotment): | Sept 11, 2024 |

| Benchmark: | NIFTY Large Midcap 250 Total Return Index |

| Minimum Application Amount: | Rs. 5,000/- and in multiples of Rs. 1/- thereafter |

| Load Structure: | Entry Load: Not Applicable Exit Load: 0.50% if redeemed or switched out on or before completion of 3 months from the date of allotment of units Nil, if redeemed or switched out after completion of 3 months from the date of allotment of units. No Entry / Exit Load shall be levied on units allotted on Reinvestment of Income Distribution cum Capital Withdrawal Option. In respect of Systematic Transactions such as SIP, STP, SWP, Exit Load, if any, prevailing on the date of registration / enrolment for SIP/STP/SWP shall be levied for all the opted Installments. Redemption of units would be done on First in First out Basis (FIFO). *The entire Exit Load, net of Goods & service tax, shall be credited to the Scheme |

| Total Expense Ratio (TER): | Including Additional Expenses and Goods and

Service Tax on Management Fees |

| Fund Manager | Mr. Alok Ranjan (Since 04-Nov-24)

Total Experience : 15 years |

| AUM (in Rs. Cr): | 829.83 |

| AAUM (in Rs. Cr): | 843.96 |

| % of top 5 holdings: | 16.21% |

| % of top 10 holdings: | 28.54% |

| No of scrips: | 72 |

| Standard Deviation^: | NA |

| Beta^: | NA |

| Sharpe Ratio^*: | NA |

| Average P/B | 9.16 |

| Average P/E | 30.48 |

| Portfolio Beta | NA |

| Portfolio Turnover Ratio | - |

^Scheme has not completed 3 years hence NA

* Risk free rate: 7.15 (Source: FIMMDA MIBOR) |

|

Regular Plan

(in Rs.) |

Direct Plan

(in Rs.) |

|

| Growth: | 9.7500 |

9.8050 |

| IDCW: | 9.7500 |

9.8050 |

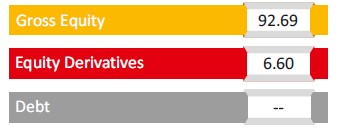

Equity & Equity Related Total |

92.69 |

6.60 |

|

Automobile and Auto Components |

2.54 |

||

Mahindra & Mahindra Limited |

0.96 |

||

TVS Motor Company Limited |

0.94 |

||

Sansera Engineering Limited |

0.65 |

||

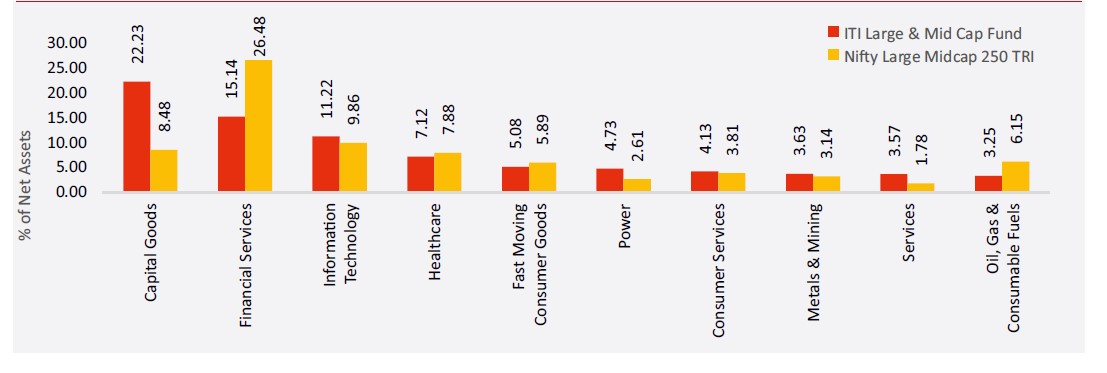

Capital Goods |

22.23 |

||

Welspun Corp Limited |

3.11 |

||

KEI Industries Limited |

2.90 |

||

CG Power and Industrial Solutions Limited |

2.81 |

||

Cummins India Limited |

2.04 |

||

Hindustan Aeronautics Limited |

1.99 |

||

Shyam Metalics and Energy Limited |

1.30 |

||

Usha Martin Limited |

1.25 |

||

Mazagon Dock Shipbuilders Limited |

1.05 |

||

Azad Engineering Ltd |

1.04 |

||

APL Apollo Tubes Limited |

1.03 |

||

Bharat Electronics Limited |

0.96 |

||

Jindal Saw Limited |

0.93 |

||

Bharat Heavy Electricals Limited |

0.72 |

||

Transrail Lighting Limited |

0.63 |

||

Tega Industries Limited |

0.47 |

||

Chemicals |

2.20 |

||

Supreme Petrochem Limited |

1.78 |

||

Vishnu Chemicals Limited |

0.42 |

||

Construction |

2.01 |

||

Engineers India Limited |

1.54 |

||

Larsen & Toubro Limited |

0.47 |

||

Consumer Durables |

2.04 |

||

Kalyan Jewellers India Limited |

1.06 |

||

Voltas Limited |

0.98 |

||

Consumer Services |

4.13 |

||

Zomato Limited |

2.84 |

||

The Indian Hotels Company Limited |

1.29 |

||

Fast Moving Consumer Goods |

5.08 |

||

ITC Limited |

1.42 |

||

Bikaji Foods International Limited |

1.01 |

||

Hindustan Unilever Limited |

0.91 |

||

Gopal Snacks Limited |

0.67 |

||

Jyothy Labs Limited |

0.56 |

||

Allied Blenders And Distillers Limited |

0.51 |

||

Financial Services |

15.14 |

||

HDFC Bank Limited |

4.55 |

||

ICICI Bank Limited |

2.78 |

||

State Bank of India |

2.16 |

||

Bajaj Finance Limited |

1.66 |

||

PB Fintech Limited |

1.60 |

||

Indian Bank |

1.12 |

||

JM Financial Limited |

0.94 |

||

The Karnataka Bank Limited |

0.34 |

||

Forest Materials |

2.18 |

||

Aditya Birla Real Estate Limited |

2.18 |

||

Healthcare |

7.12 |

||

Supriya Lifescience Limited |

1.93 |

||

Divi's Laboratories Limited |

1.34 |

||

Sun Pharmaceutical Industries Limited |

1.23 |

||

Max Healthcare Institute Limited |

1.13 |

||

Lupin Limited |

0.55 |

||

Onesource Specialty Pharma Limited |

0.53 |

||

Strides Pharma Science Limited |

0.42 |

||

Information Technology |

11.22 |

||

Tata Consultancy Services Limited |

2.42 |

||

Infosys Limited |

2.42 |

||

Zaggle Prepaid Ocean Services Limited |

1.80 |

||

Coforge Limited |

1.47 |

||

Persistent Systems Limited |

1.02 |

||

Zensar Technologies Limited |

0.79 |

||

LTIMindtree Limited |

0.73 |

||

KPIT Technologies Limited |

0.58 |

||

Metals & Mining |

2.78 |

0.85 |

|

National Aluminium Company Limited |

1.34 |

||

NMDC Limited |

1.02 |

0.85 |

|

Jindal Stainless Limited |

0.43 |

||

Oil Gas & Consumable Fuels |

3.25 |

||

Reliance Industries Limited |

2.17 |

||

Hindustan Petroleum Corporation Limited |

1.07 |

||

Others |

3.71 |

||

Nifty Midcap |

3.71 |

||

Power |

4.73 |

||

NLC India Limited |

2.53 |

||

NTPC Limited |

1.23 |

||

Tata Power Company Limited |

0.97 |

||

Realty |

3.00 |

||

Oberoi Realty Limited |

1.48 |

||

The Phoenix Mills Limited |

1.00 |

||

Godrej Properties Limited |

0.52 |

||

Services |

3.57 |

||

InterGlobe Aviation Limited |

2.06 |

||

JSW Infrastructure Ltd |

1.03 |

||

eClerx Services Limited |

0.48 |

||

Telecommunication |

1.52 |

||

Bharti Hexacom Limited |

1.52 |

||

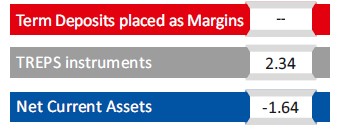

Short Term Debt & Net Current Assets |

0.71 |

Top Ten Holdings

THIS PRODUCT IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

- Capital appreciation over long term

- Investments in equity and equity related instruments of large cap and mid cap companies

^Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

LARGE - MIDCAP 250 Index (TRI)]

Face Value per Unit: Rs. 10 unless other wise specified; Data is as of December 31, 2024 unless other wise specified.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully