Debt Market Update

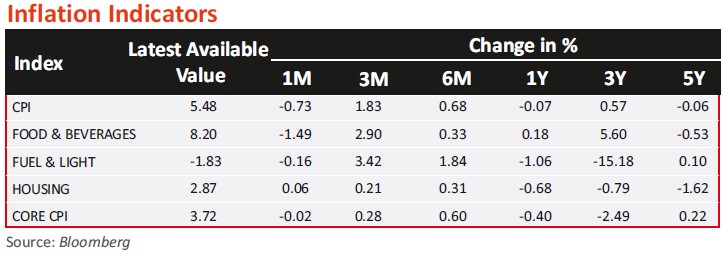

- Retail inflation (CPI), eased to 5.48% in November 2024, marking a three-month low after reaching a 14-month peak of 6.21% in October. This decline was primarily driven by improved vegetable supplies, which led to lower prices. In its December 2024 meeting, the RBI opted to maintain the repo rate at 6.5% for the eleventh straight time, extending the period of unchanged interest rates to 22 months.

- Wholesale price index (WPI) inflation eased to a three-month low of 1.89% in November 2024, down from 2.36% in October 2024, driven by cooling food prices, particularly vegetables.

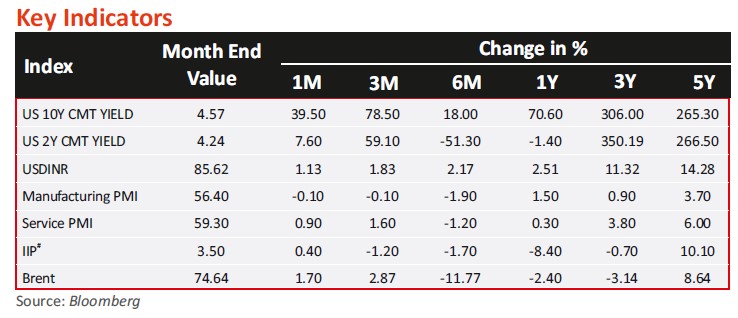

- Industrial production growth slowed to 3.45% in October 2024 - a marginal increase from 3.1% in the previous month, but a significant drop from 11.9% in October 2023. The April-October IIP growth stood at 4%, down from 7% in the same period last year. Mining output grew by 0.9%, manufacturing by 4.1%, and power generation by 2%, all reflecting slower growth compared to the previous year. The capital goods segment expanded by 3.1%, consumer non-durables by 2.7%, and infrastructure goods by 4%. Primary goods and intermediate goods saw reduced growth rates of 2.6% and 3.7%, respectively.

- Core sectors experienced a notable 4.3% growth in November 2024, up from 3.71% in October 2024, marking the highest increase in four months. This improvement was by strong performances in cement (13%), and steel (4.8%). However, production of crude oil and natural gas recorded a decline.

- In December 2024, gross GST revenue amounted to Rs 1.77 lakh crore, slightly down from Rs 1.82 lakh crore in November 2024, but still reflecting a 7.3% year-on-year increase. This marks the tenth straight month where collections surpassed Rs 1.7 lakh crore. GST revenue during the same month last year stood at Rs 1.65 lakh crore.

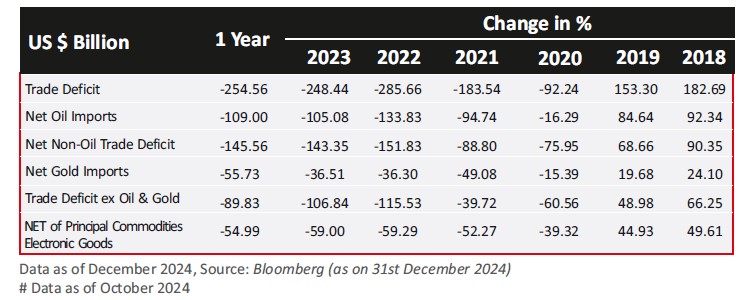

- India's trade deficit expanded to USD37.8 billion in November 2024 (USD27.14bn in October 2024), driven by record USD70 billion imports, with gold imports surging 4.3 times to USD14.9bn. Exports fell 4.8% to USD32.1bn, impacted by lower petroleum prices. However, non-petroleum exports grew 8%, with strong demand for engineering, electronic goods, and pharmaceuticals. Weak global demand, geopolitical tensions, and rising input costs persist in challenging India's trade environment.

Source: RBI, Bloomberg, CCIL, MOSPI

*BE - Budget Estimates

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. Index performance does not signify scheme performance Investors should consult their financial advisers if in doubt about whether the product is suitable for them.