Debt Market Update

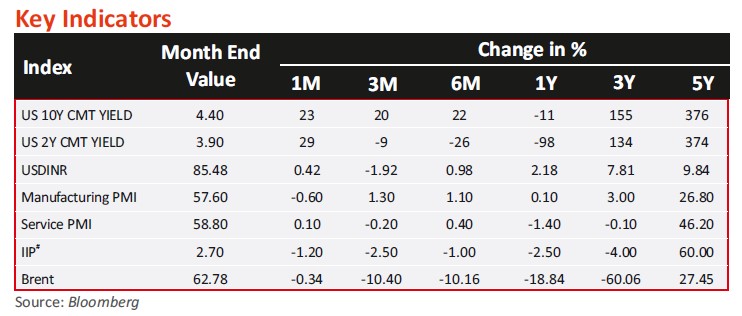

- India's GDP grew 7.4% year-on-year in Q4FY25, accelerating from the revised 6.4% in Q3 and exceeding market expectations significantly. This marked the fiscal year's strongest growth rate. The recovery reflected improved economic momentum as lower food and energy prices, benign interest rates, and increased investment drove growth. India's limited export dependence provided resilience against global tariff threats. Gross fixed capital formation surged 9.4% (highest in nearly two years) while private consumption rose 6%. Net foreign demand contributed positively, with exports up 3.9% and imports down 12.7%. For full FY25, GDP grew 6.5% - the slowest pace in four years.

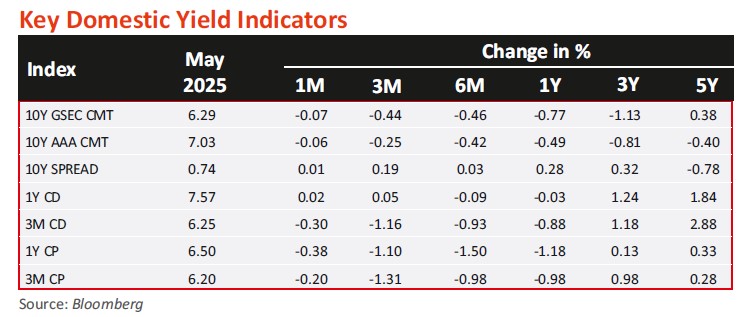

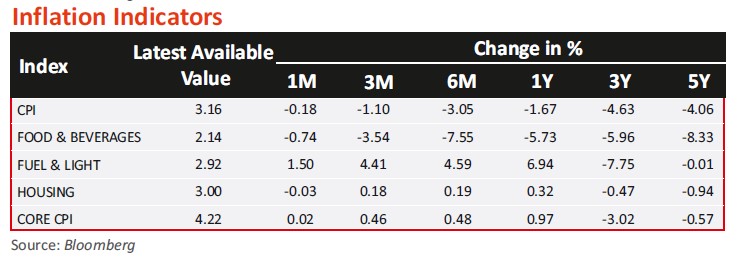

- April 2025 CPI fell to 3.16% (vs. 3.34% in March), driven by a food inflation dip to 1.78%, owing to 11% YoY fall in vegetable prices. Core inflation held at ~4%, while cereals and pulses showed mixed trends. With CPI below target and the RBI now in an accommodative stance, a 25 bps rate cut in June 2025 is widely expected.

- WPI (wholesale inflation) eased to 0.85% in April 2025 from 2.05% in March 2025. WPI saw sharp declines in crude petroleum and natural gas (−5.31%) and non-food articles (−1.78%), while minerals rose 7.81%. The WPI Food Index increased slightly to 189.3 from 188.8, but annual food inflation slowed to 2.55% from 4.66%. Manufacturing, the largest WPI component at 64.23%, rose 0.35% month-on-month, while yearly inflation eased to 2.62%, reflecting price increases in metals, chemicals, and machinery, and declines in textiles, pharmaceuticals, and paper products.

- India's Industrial Production Index rose 2.7% year-on-year in April 2025, though growth moderated from 3.94% in March 2025. Manufacturing led with 3.4% growth, while mining contracted 0.2%. Capital goods surged 20.3%, driven by machinery, motor vehicles, and basic metals. Consumer non-durables declined 1.7%.

- GST collections crossed Rs 2 lakh crore for the second month in May 2025, signaling steady demand. Net receipts surged 20.4%. GDP growth scaled 7.4% in Q4, but consumption remains uneven, although May 2025 GST collections signal a robust start to FY26.

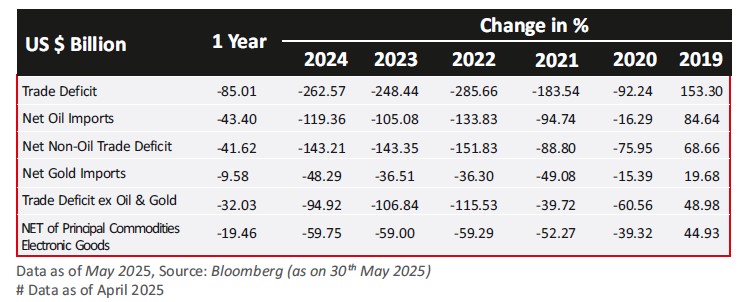

- India's trade deficit widened to USD26.4bn in April 2025, up from USD21.5bn in March 2025 and USD19.2bn in April 2024. Merchandise exports grew 9% to USD38.5bn, driven by electronics (+40%), engineering goods (+11.3%), and gems/jewelry (+11%). However, imports surged 19% to USD64.9bn, led by higher petroleum imports (USD20.7bn). Services exports reached USD35.3bn. Overall trade deficit stood at USD8.7bn.

Source: RBI, Bloomberg, CCIL, MOSPI

*BE - Budget Estimates

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. Index performance does not signify scheme performance Investors should consult their financial advisers if in doubt about whether the product is suitable for them.