Debt Market Update

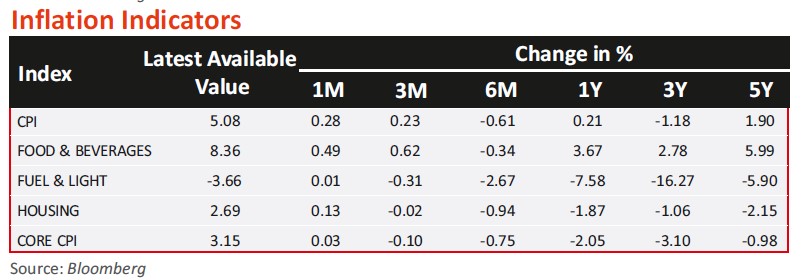

- Retail inflation (CPI) hit a four-month high of 5.08% in June 2024, up from 4.80% in May 2024, driven by a surge in food inflation to 9.4% owing to heatwaves. Food inflation rose to a 6-month high of 9.36%, with vegetable and pulse prices recording double-digit increase.

- Wholesale inflation (WPI) rose to a 16-month high of 3.4% in June 2024, up from 2.6% in May 2024, driven by increases in food and manufactured products prices. Food inflation hit a 20-month high at 8.7%. Manufactured products saw 1.43% price inflation, up from 0.8% in May 2024. The fuel and power index, after 12 months of deflation, recorded 1.03% inflation in June 2024. There was a broad-based rise in prices of food articles, particularly vegetables

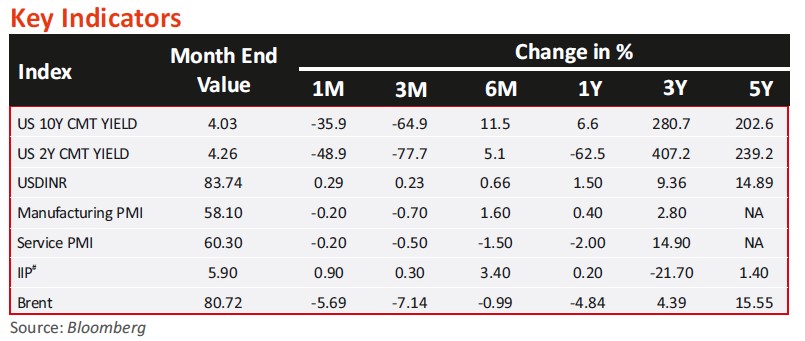

- Industrial output (IIP) expanded 5.9% YoY in May 2024 vis-à-vis 5% growth in previous month. Mining rose 6.6%, electricity 13.7%, and manufacturing 4.6%.

- India's core sector growth fell to a 20-month low of 4% in June 2024 from 6.4% in May 2024, due to a slowdown in five of eight industries and an unfavourable base. First quarter growth was 5.7%, down from 6% the previous year.

- GST collection in July 2024 surged by 10.3% to over Rs 1.82tn, powered by domestic transactions, marking the third-highest monthly collection since July 2017.

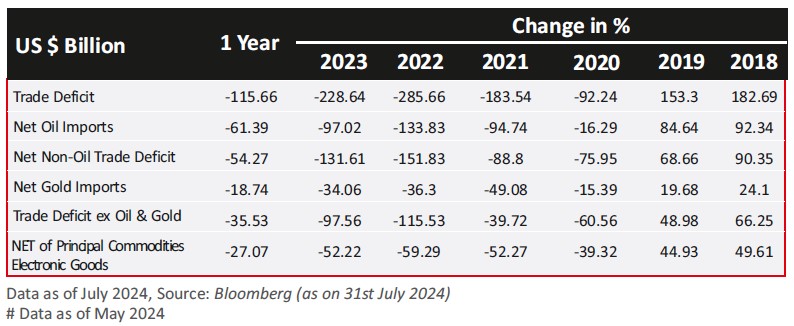

- India's merchandise trade deficit narrowed to USD20.98bn in June 2024 from USD23.78bn in May 2024, due to a larger fall in imports. June 2024 exports dropped 7.7% to USD35.20 bn, while imports fell 9.25% to USD56.18bn. Exports rose 2.6% YoY and imports increased 5% YoY. Major export growth drivers were engineering goods, electronic goods, and pharmaceuticals. India's total June 2024 exports (merchandise and services) were USD65.47 bn, up 5.40% from June 2023, while total imports were USD73.47bn, up 6.29%.

- The central government’s fiscal deficit in 1QFY25 remained low at ~8.4% of FY2025BE*. Total receipts were at ~26% of FY2025BE, 39% higher than 1QFY24, led by direct taxes and RBI surplus transfer. Gross tax revenue was ~22% of FY2025BE (24% higher than 1QY24), Centre’s expenditure in 1QFY25 was ~20% of FY2025BE (7.7% lower than 1QFY24). Revenue expenditure was ~21% of FY2025BE (2.2% higher than 1QFY24) while capital expenditure in 1QFY25 was at ~16% of FY2025BE (35% lower than in 1QFY24).

Source: RBI, Bloomberg, CCIL, MOSPI

*BE - Budget Estimates

Past performance may or may not be sustained in future and is not a guarantee of any future returns, and should not be used as a basis of comparison with other investments. Index performance does not signify scheme performance